TLDR

- Bitcoin ETFs recorded five straight days of inflows totaling over $1.3 billion.

- The inflow streak began on June 9 and continued through June 14.

- Bitcoin’s price dropped briefly by 3 percent after geopolitical tensions escalated.

- Despite the drop, Bitcoin recovered and traded around $105,000 by the end of the week.

- The cryptocurrency remains less than 6 percent below its all-time high of $112,000.

Bitcoin exchange-traded funds (ETFs) posted five consecutive days of capital inflows despite the escalating conflict between Israel and Iran. Investor interest remained strong, as over $1.3 billion flowed into Bitcoin ETFs from June 9 through June 14. Market resilience appeared firm, even as global tensions threatened broader financial stability.

Bitcoin ETFs Surge Despite Rising Global Tensions

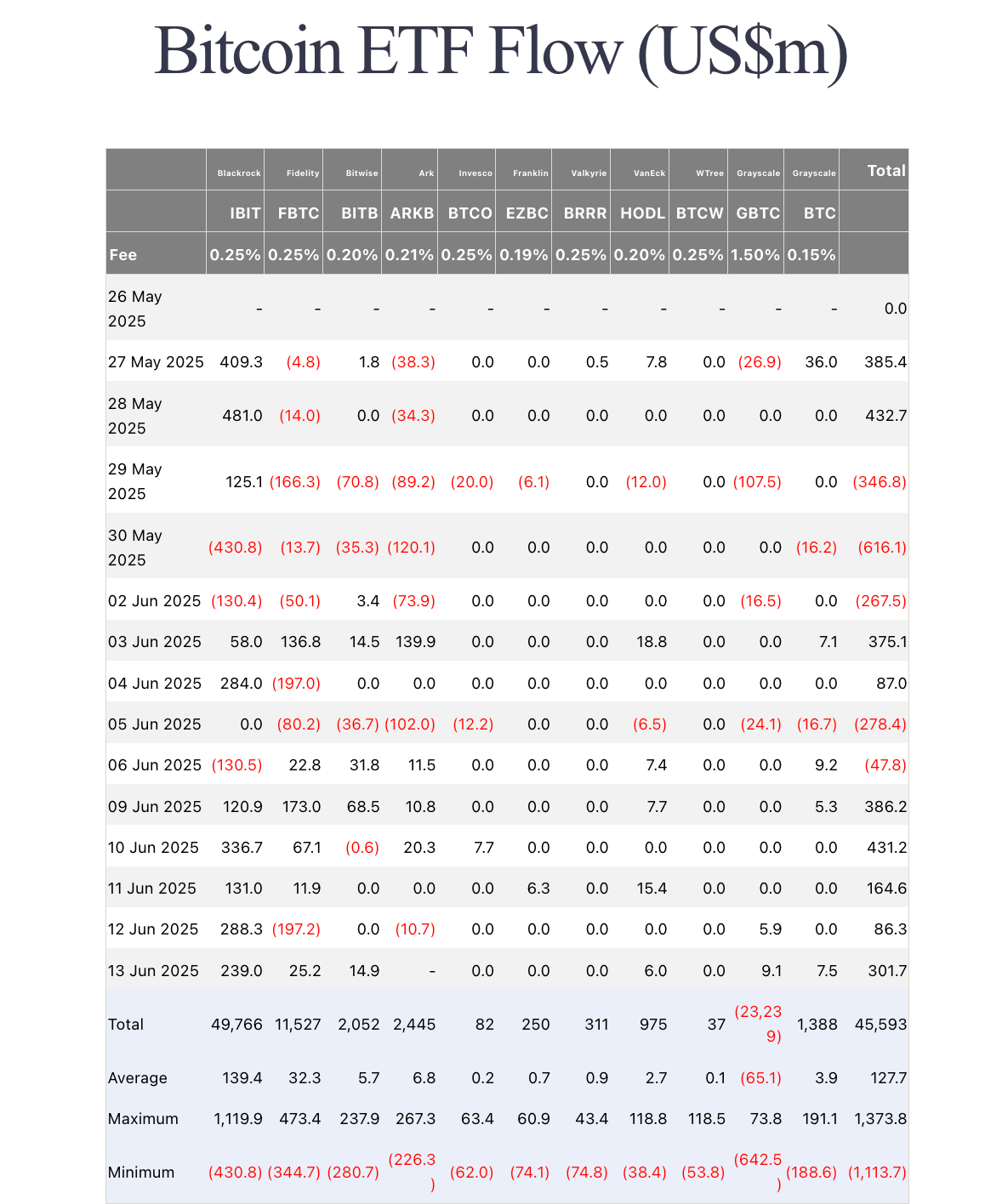

Bitcoin ETFs saw daily inflows starting June 9, with the highest single-day intake reaching $386 million. By June 14, investors had added another $301 million, bringing the five-day total above $1.3 billion. Farside Investors confirmed the streak as one of the strongest since Bitcoin ETFs launched.

- Bitcoin ETF inflow data from May 26 to June 13. Source- Farside Investors

The consistent inflows signaled sustained institutional confidence, even with geopolitical instability in the Middle East. Although tensions spiked after Israel’s strikes on Iranian military targets, Bitcoin’s market position remained steady. Risk appetite appeared intact, encouraging further capital rotation into crypto-based assets.

Price Recovers After Short-Term Drop, Holds Near Record Highs

Bitcoin dropped roughly 3% following the escalation but quickly regained strength by week’s end. Long liquidations totaled $422 million, briefly pushing BTC below $103,000. Despite this, the cryptocurrency bounced back and hovered around $105,000 on Friday.

The recovery kept Bitcoin within 6% of its May 22 all-time high of $112,000. Short-term volatility remains possible, especially if Iran disrupts oil supply by closing the Strait of Hormuz. A sudden energy shock could rattle global markets and affect crypto pricing.

Macro Trends and Dollar Weakness Support Bullish Outlook

Analysts continue to monitor macroeconomic conditions that influence Bitcoin performance more than regional conflicts. The US Dollar Index recently dropped below 100, its weakest level in three years. Historically, Bitcoin tends to move inversely with the dollar, reinforcing upward price pressure.

Persistent concerns over national debt, inflation, and global instability support ongoing adoption of Bitcoin as a hedge. Many investors view the supply-limited asset as a safeguard against fiat erosion. As a result, current market dynamics suggest growing interest in digital assets amid weakening confidence in traditional systems.