TLDR

- Crypto market liquidations exceeded $1 billion in 24 hours as market cap dropped to $3.98 trillion

- Bitcoin fell 3.59% to $119,098 after hitting new all-time high above $123,700, Ethereum dropped 2.4% to $4,643

- Dogecoin saw the biggest loss among top ten coins with 10.3% decline

- US Treasury Secretary Scott Bessent said government won’t buy Bitcoin for Strategic Reserve, only use seized assets

- July PPI report showed 0.9% jump, exceeding economist expectations and signaling inflation concerns

The cryptocurrency market suffered major losses over the past 24 hours following disappointing economic data and policy announcements. Total market capitalization fell to $3.98 trillion, down $133 billion from the previous day.

Bitcoin dropped 3.59% to $119,098 after setting a new all-time high above $123,700 just yesterday. The world’s largest cryptocurrency faced sharp selling pressure following multiple bearish factors.

Ethereum also declined 2.4% to $4,643 after dropping to a low of $4,452 during the session. The second-largest cryptocurrency by market cap joined the broader market selloff.

Dogecoin experienced the steepest losses among the top ten cryptocurrencies. The meme coin fell 10.3% as investors pulled back from riskier altcoin positions.

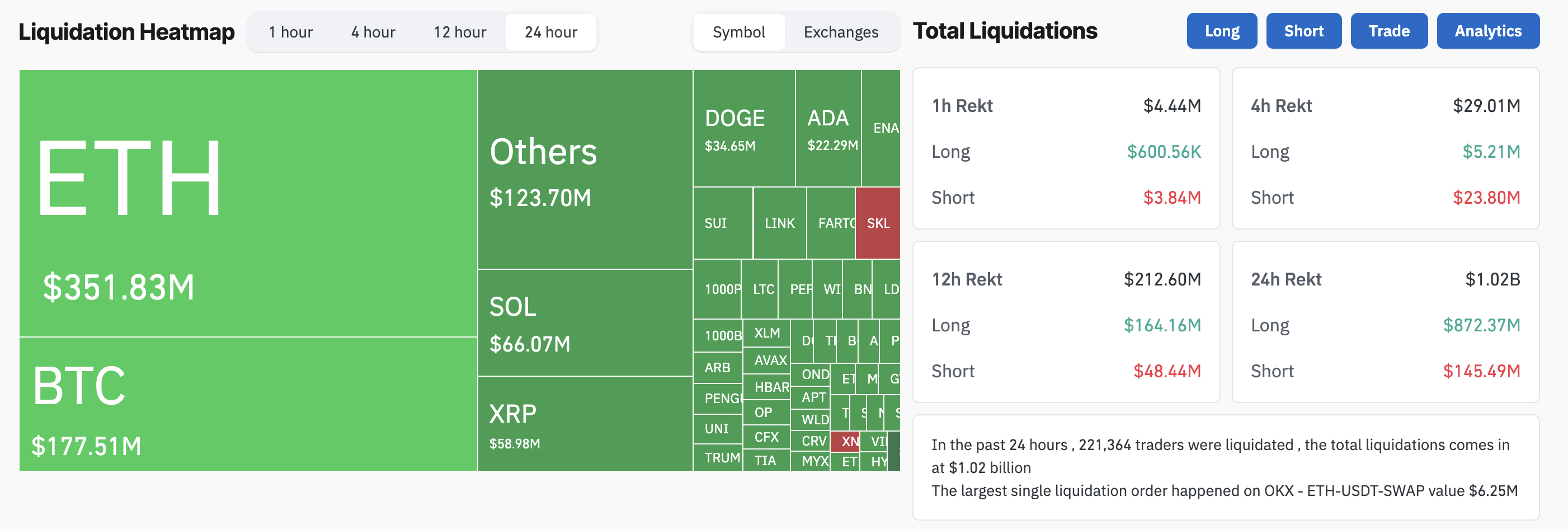

The market downturn triggered massive liquidations across cryptocurrency derivatives markets. According to Coinglass data, $1.02 billion in crypto positions were liquidated within 24 hours, affecting 221,364 traders.

Long positions bore the brunt of the liquidation wave. Traders betting on price increases saw $872.37 million in positions forcibly closed, while short positions faced $145.49 million in liquidations.

Treasury Secretary Rules Out Bitcoin Purchases

US Treasury Secretary Scott Bessent delivered a blow to Bitcoin supporters during a Fox Business interview. Bessent confirmed the government will not purchase Bitcoin for the proposed Strategic Bitcoin Reserve.

Instead, the Treasury Secretary said the US will build the reserve using only confiscated cryptocurrency assets. These seized assets are currently worth between $15 to $20 billion at current market prices.

Bessent also revealed the government plans to stop selling its existing Bitcoin holdings. This policy shift comes as the Trump administration positions the US as the “crypto capital of the world.”

The announcement added to selling pressure already building from disappointing economic data. Bitcoin’s price volatility increased following Bessent’s comments about the strategic reserve funding.

Economic Data Fuels Market Concerns

The Bureau of Labor Statistics released July Producer Price Index data that exceeded expectations. The PPI jumped 0.9%, well above economist forecasts of a 0.2% increase.

🇺🇸 U.S. PPI Comes in hotter than expected…

PPI (MoM) +0.9% vs +0.2% forecast

Core PPI (MoM) +0.9% vs +0.2% forecast

(YoY) +3.7% vs +2.9% forecastInflation from tariffs starting to hit producers? pic.twitter.com/cAh0hd93yi

— Trader Edge (@Pro_Trader_Edge) August 14, 2025

Year-over-year PPI climbed 3.3%, marking the largest 12-month increase since February 2025. The hotter-than-expected inflation data raised concerns about Federal Reserve policy.

Crypto expert Michaël van de Poppe attributed the market decline directly to the PPI report. He noted the correction was “vital and steep” due to excessive leverage in altcoin markets.

Ethereum led liquidations with $351.8 million in positions closed. Long positions accounted for $272.47 million of Ethereum liquidations, while shorts saw $79.36 million wiped out.

Bitcoin liquidations totaled $214 million during the 24-hour period. Solana and XRP also faced major liquidations of $66 million and $56 million respectively.

Market analysis firm Glassnode previously warned about elevated risk levels. Open interest in altcoins had reached all-time highs, making the market vulnerable to sharp corrections.

The combination of high inflation data and policy uncertainty created perfect conditions for the liquidation cascade. Federal agencies continue working on cryptocurrency regulations under the Trump administration’s digital asset initiatives.