Bitcoin ETFs just hit the largest inflow this year. SoSoValue data indicates that the ETFs attracted over $843.6 million in net inflows on Wednesday. Meanwhile, DeepSnitch AI has hit a new milestone, raising over $1.2M in revenue.

The latest rush comes as investors go all in on DeepSnitch AI as its presale enters the 11th hour. This project might be the headline-making gem that could give investors over 100X ROI, overshadowing Bitcoin Hyper price prediction forecasts.

Right now, DeepSnitch AI has raised over $1.20M and is currently priced at $0.03538. Investors who join the ongoing presale have a higher chance of getting huge returns if it launches this January, and that would be a great way to start the year.

Bitcoin ETFs record the highest inflow in 2026

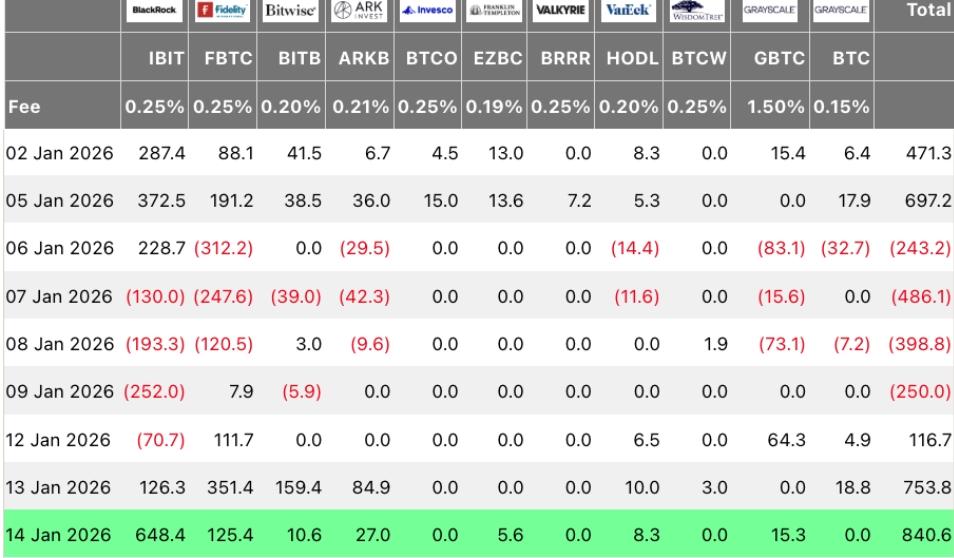

Spot Bitcoin exchange-traded funds (ETFs) have recorded their biggest inflows of 2026 so far as Bitcoin rallied above $97,000 and sentiment turned bullish. Data from SoSoValue shows spot Bitcoin ETFs attracted $843.6 million in net inflows on Wednesday, the strongest single-day total this year.

The surge capped a three-day streak that brought more than $1.7 billion into the funds, reversing earlier January weakness. Those inflows helped offset roughly $1.4 billion in outflows recorded between January 6 and January 9.

Bitcoin’s move back to two-month highs also lifted market mood, pushing the Crypto Fear & Greed Index into “greed” territory for the first time since October.

Bitcoin Hyper price prediction January 2026 & 2 top competitors

1. DeepSnitch AI: The best ICO for 100X ROI this year?

DeepSnitch AI is getting more spotlight attention, thanks to rumors of a January launch. Traders are currently positioning early for what could be a major breakout moment.

With momentum already building in the presale, many investors believe the project is entering its most important phase, where hype, utility, and timing start to align. DeepSnitch AI is an AI-powered intelligence platform that helps you trade smarter.

It has five specialized AI agents that can track whale movements, scan smart contracts for bugs and scams, and interpret market sentiment in real time. Instead of relying on paid signal groups or delayed analysis, DeepSnitch turns raw on-chain activity into clear insights you can act on quickly.

Furthermore, the platform’s live dashboard makes these signals easy to monitor, helping users stay ahead of market shifts before trends go mainstream. Apart from the tools, DeepSnitch AI has a dynamic staking feature.

The APR has no limit and increases as more users stake. Right now, DeepSnitch AI is priced at $0.03538. Investors are watching closely for a potential 100X rally this quarter.

2. Bitcoin Hyper price prediction for 2026

Bitcoin Hyper is a Bitcoin-focused Layer-2 project trying to bring faster, cheaper transactions and DeFi-style utility to the BTC ecosystem. HYPER is expected to soar by 10X this year, per the latest Bitcoin Hyper price prediction.

Meanwhile, launch uncertainty is now part of the story. It began last but did not launch before the end of last year.

Presently, there is no news about a potential launch. With no confirmed rollout yet, the Bitcoin Hyper growth outlook will likely depend on clear updates, delivery, and whether momentum holds until listing.

3. Digitap: The world’s first omni-bank

Digitap is a platform that aims to connect the world of DeFi and CeFi and provide users with access to cross-border payment options at a low cost and in a short time. Among the features, the real-time crypto-to-fiat conversion tool of Digitap is worth mentioning.

Customers are able to exchange various fiat currencies into over 100 cryptocurrencies in real-time. Digitap is at the presale stage, and it has raised more than $4.13 million. However, a launch date has not yet been announced.

The bottom line

DeepSnitch AI is outshining Bitcoin Hyper price prediction discussions with its 100X ROI potential and AI narrative. The January launch talk is adding fuel, and the FOMO is rising across crypto communities.

For investors searching for the next crypto launchpad for 100X ROI, DeepSnitch AI is currently priced at $0.03538 and could skyrocket anytime soon. So, acting fast could be a wise decision.

Visit the official website for more information, and join X and Telegram for community updates.

FAQs

1. What is the Bitcoin Hyper price prediction for 2030?

A recent Bitcoin Hyper price forecast says HYPER could reach $1 by 2030 if it achieves sustained adoption and usage in the Bitcoin ecosystem. Meanwhile, DeepSnitch AI could reach this $1 mark faster, tapping into the billion-dollar AI market, which is already witnessing explosive growth.

2. Is Bitcoin Hyper ever going to launch?

The Bitcoin Hyper project was planned to be released in Q4 2025. However, no official announcement of a new launch date has been made. This is one of the uncertainties that could affect the Bitcoin Hyper growth outlook in 2026. In the meantime, speculations indicate that DeepSnitch AI may roll out this January, and the narrative is fueling a 100X rally.

3. Is Bitcoin hyper on Binance?

Hyper token analysis shows HYPER is trading at $0.013585 but is not available for purchase on Binance. Interestingly, rumours circulating online indicate that DeepSnitch AI might be listed on Binance very soon. Given that such listings could spark a 100X rally, smart investors are accumulating DeepSnitch AI.