Read our Advertising Guidelines Here

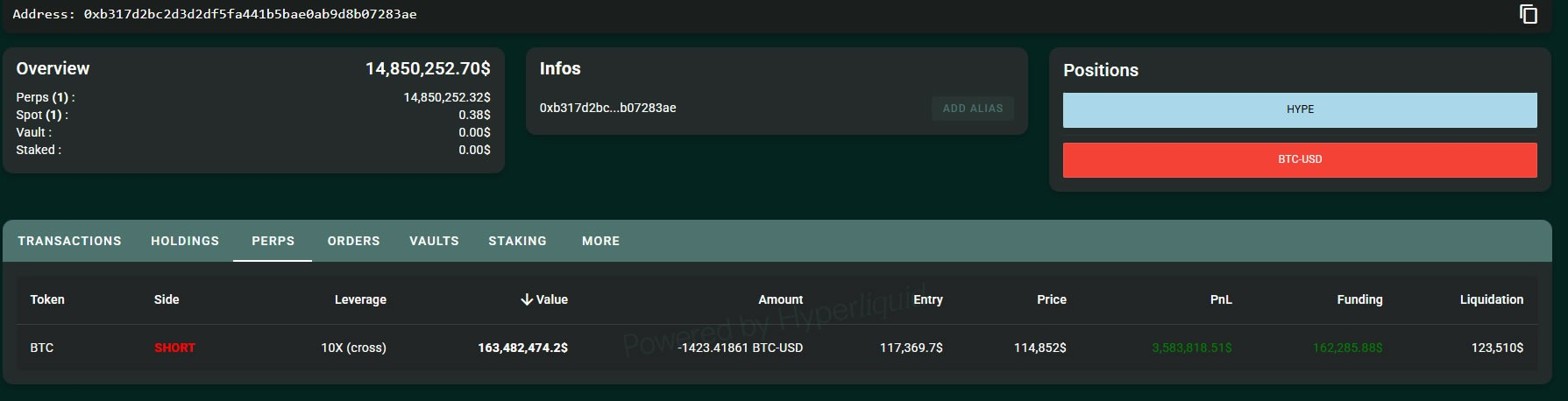

A crypto whale who famously made $192 million shorting Bitcoin minutes before Trump’s tariff announcement is back with a new $163 million leveraged bet against BTC.

The trade, opened on Hyperliquid, has already netted over $3.5 million in profit and is once again sparking speculation about insider manipulation during one of 2025’s most volatile weeks.

But seasoned traders know this wasn’t market weakness, as the Bitcoin price prediction still flies strong. Diamond hands are still buying BTC, ETH, and top-performing presales like DeepSnitch AI, which is now up 24% with over $400K raised, now in Stage 2.

The whale that made $192M shorting the Bitcoin crash opens a new $163M bet

A trader who raked in $192 million shorting the crypto market just minutes before Donald Trump’s tariff announcement is back with another massive position, sparking fresh speculation about insider trading in crypto’s most volatile week of 2025.

The wallet address 0xb317, active on the decentralized derivatives exchange Hyperliquid, opened a $163 million 10x leveraged short on Bitcoin late Sunday. The position is already in profit, but will be liquidated if BTC rallies above $125,500.

The timing is once again drawing attention. Just like Friday’s flash crash, the new short was opened minutes before another heavy sell-off, leading traders and analysts to label the entity an “insider whale.”

Some suggest the whale’s aggressive leverage even triggered the weekend’s liquidation cascade, contributing to the $20 billion wiped from crypto markets.

“This guy shorted nine figures right before the dump,” one user observed. “And that’s just what’s public. Who knows what he did on centralized exchanges.”

Meanwhile, Binance denied involvement in the market chaos, attributing reported issues to a display error, despite offering $283 million in compensation to users affected by failed liquidations on assets like USDE and WBETH.

As volatility spikes, tools like DeepSnitch AI are becoming critical for traders trying to stay ahead of the curve.

Top 3 breakout tokens in 2025: DeepSnitch AI rivals Bitcoin and Ethereum

DeepSnitch AI: The presale that can outperform the most bullish Bitcoin price prediction

The weekend crash, where Bitcoin plunged from $124K to $114K, was a brutal reminder that trading in downtrends matters just as much as catching the pumps.

While retail investors panicked and sold at a loss, whales took advantage of the fear-fueled dip and accumulated millions. This is exactly where most traders lose, not because of poor entries, but because of emotional exits.

DeepSnitch AI is building tools to help traders stay focused, avoid panic selling, and make smarter decisions even in the worst market conditions. Because in every cycle, one truth remains: trading in bear markets is much harder. DeepSnitch AI helps traders secure the profits they made in bull markets.

One of its most powerful tools is SnitchGPT, an AI agent that acts like a personal trading companion. It’s like having a Wall Street-level trader right in your Telegram. This way, DeepSnitch is building a fully bear-proof ecosystem. One that will remain essential in both bull and bear markets.

And the numbers prove the interest: now priced at $0.01877, the DeepSnitch AI presale has officially entered Stage 2, raising over $400,000 so far.

Bitcoin price prediction: Analysts believe $200k is still in sight

Bitcoin has reclaimed a key level, snapping back above the short-term holder cost basis at $114,000 after last week’s $20 billion liquidation flush. The move signals renewed bullish momentum and suggests that the broader uptrend remains intact despite the Bitcoin crash.

This recovery above the STH realized price is historically seen as a strong indicator of market strength, often marking the start of new legs higher as fresh capital returns. Quant analyst Frank Fetter put it simply: “The show goes on.”

Traders are now closely watching the 20-week moving average at $113,300. Holding this line could open the door to accelerated gains, with technical and macro Bitcoin price predictions pointing to upside targets of $120K, $150K, and even $200K.

Ethereum shows signs of strength as whales start accumulating again

Ethereum is beginning to show signs of a bullish reversal, rebounding to $4,130 after bottoming near $3,430 just last week. But while the bounce looks promising, on-chain signals suggest the road ahead may still be choppy.

Whales appear to be accumulating again, quietly adding around 80,000 ETH since October 11, worth approximately $330 million. However, short- and mid-term holders are still reducing exposure, reflecting a cautious mindset after the recent crash.

On the chart, ETH is forming a classic cup pattern, with $4,390 emerging as the neckline. A breakout above that level could open the path toward $4,550 or even $4,750. However, if the pattern plays out with a handle forming first, a pullback to $4,070 or even $3,950 may come into play.

Final thoughts

Bitcoin and Ethereum have been the market’s profit engines for years, but that changed once BTC crossed $100K and ETH broke $4K. They’re no longer the tokens that turn $100 into $10,000.

DeepSnitch AI is. Now in Stage 2 and priced at just $0.01877, DeepSnitch is quickly becoming the presale everyone’s watching. Over $400K has already been raised, and the next leg up could move fast.

Check out the website for more information.

FAQs

What triggered the recent Bitcoin crash?

The Bitcoin crash was triggered by the renewed tension between the US and China, while the liquidation rush aggravated the situation.

Where can I buy DeepSnitch AI?

Only through the official website. Don’t trust DEX listings or Telegram links. Always verify the source.

What does the latest Bitcoin market analysis say?

Bitcoin market analysis shows BTC has bounced back above $114K, a key level tied to short-term holder cost basis. Holding this zone could signal continued upside as most Bitcoin price predictions aim for $200k.

Can DeepSnitch AI really 100x?

Yes. DeepSnitch AI is still at just $0.01877, and its Telegram-native AI tools are attracting growing attention.

What’s the BTC forecast for the next bull run?

The forecast for the next bull run includes upside targets between $120K and $200K, depending on how long BTC holds above the 20-week moving average.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above. Read our Advertising Guidelines Here.