BitConnect: Is It Legit or a Ponzi Scheme?

BitConnect is a Bitcoin investment platform and a cryptocurrency released in 2016. Originally, the BitConnect platform promoted Bitcoin investment and touted special investment software that helped generate returns. A few months after creation, however, BitConnect implemented an ICO for its own currency to be used within the platform for investing purposes.

The platform has been the subject of much controversy over the past few months. Many of its users claim they’ve seen significant returns investing in BitConnect, and they evangelize heavily for the platform on forums, YouTube, and blog comments. On the other hand, detractors warn that BitConnect’s business model does not seem entirely honest, and it could be a long scam or a variation of a ponzi scheme.

The detractors haven’t stopped BitConnect from gaining a significant following. Likely due to the strong referral bonuses for existing members when they convince others to join the platform, BitConnect’s user base is growing. As it grows, so does the value of the Bitconnect coin (BCC). Over the past several months the BCC token has consistently remained in the top 20 cryptocurrencies by market cap, with its total capitalization reaching over $1 billion according to CoinMarketCap.

Most Ponzi schemes seem successful until the very end when they dry up spectacularly.

In the case of BitConnect, it’s worth carefully considering how the platform works, where it generates returns, and who is behind the company before making an investment decision. In this article, I’ll do my best to present both sides of the contentious debate over BitConnect’s legitimacy, and ultimately it will be up to you to do more research and decide how you feel about BitConnect.

How BitConnect Works

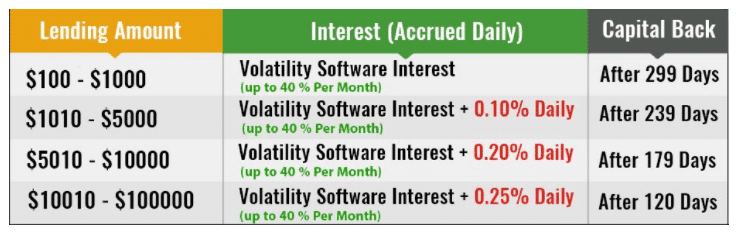

BitConnect’s core offering is a piece of Bitcoin price volatility software that makes Bitcoin investment decisions on behalf of the BitConnect community. The basic idea behind BitConnect is everyone lends their funds to the BitConnect investment pool, and the software manages those funds, generating a guaranteed return using its volatility predictions. In exchange, the lenders (users) receive daily interest on their investments.

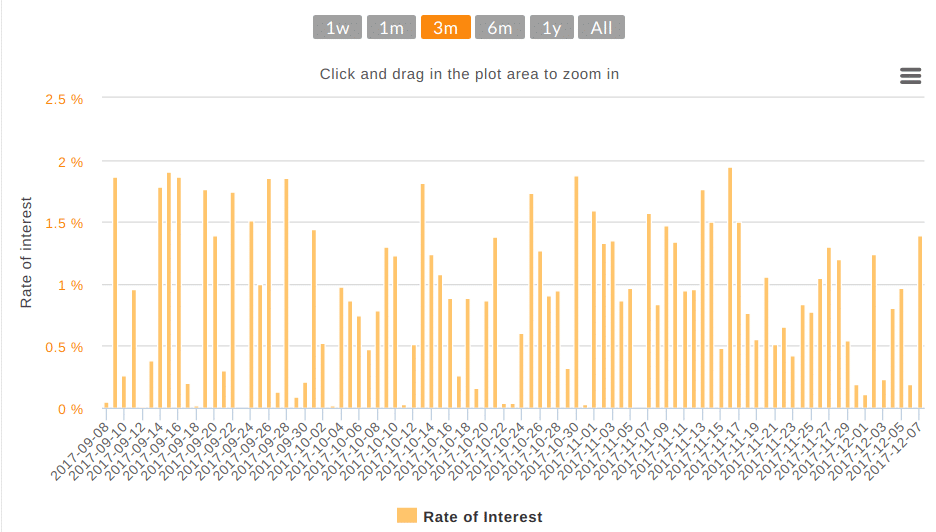

The daily interest rate for BitConnect investments varies between 0.25% and 5.0% daily, with BitConnect guaranteeing an average of 1%/day. Over time, if users reinvest the interest, this daily interest can add up to significant returns due to daily compounding. For instance, a $100 investment compounded at 1% daily interest would be worth $107.21 after a week, $134.78 after a month, and $599.58 after 6 months! After a year, you’d have over $3700 thanks to compound interest off an initial $100 investment.

Of course, the interest rate varies day to day, and the BitConnect site only promises a return of 120% annually, not the 3700% we just calculated. Still, promising those kind of results should make you skeptical. If the 120% annual interest is true, then BitConnect is one of the best places you could possibly invest your money. However, promises of large returns like these are usually the sign of a pyramid scheme, and you’d be wise to exercise caution any time you see a program that advertises “guaranteed returns.” Investing is inherently risky and volatile, and any legitimate investment should expect to see losses and gains over time, not just gains.

It’s not clear how BitConnect’s price volatility software functions, or if it even exists. BitConnect claims that the price software is intellectual property owned by the company, and they, therefore, prefer to keep its workings secret. It’s worth asking why BitConnect has chosen to deploy its software publicly if it can gain such returns. Wouldn’t BitConnect’s founders be better served using the software to game the market with their own private investments or institutional backers? In many cases, companies claiming to have omniscient software are telling stories that are too good to be true.

The BitConnect Coin

In order to facilitate the BitConnect trading platform, the BitConnect developers created the BCC token. You can purchase BCC with Bitcoin, and the token is useful within the BitConnect platform for lending on investments or staking in the coin’s proof of stake system. The BCC token uses a combined proof of work and proof of stake system, with a mining and staking reward for verifiers. In total, there are over 3.1 million circulating BCC tokens, each with a value of over $400 USD as of writing.

The BCC token is not useful outside the BitConnect ecosystem. Few vendors accept BCC and you can’t easily exchange it for other tokens. Generally, you purchase BCC directly from BitConnect using Bitcoin, meaning the company behind BitConnect is, paradoxically, collecting Bitcoin in exchange for the token they created so that users could invest in their platform that invests in Bitcoin. Due to BitConnect’s popularity, however, the value of the BitConnect token continues to rise.

When you buy into BitConnect, you pay in Bitcoin, but you don’t receive your earnings in Bitcoin. Instead, they’re deposited in BCC that you then have to convert if you’d like to withdraw your earnings from the system. While this is fairly standard practice for most ICOs, it does call into question how easily you’d be able to withdraw your money in the event that BitConnect shuts down. It seems unlikely that you’d be returned the Bitcoin you invested initially, and the BCC token would be worthless in the event of a shutdown.

Referral Rewards & Other Bonuses

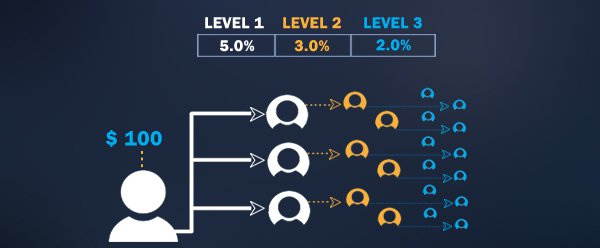

Aside from the questionable price volatility software, BitConnect’s main economic driver is affiliate marketing. Current users are highly incentivized to get new users to join BitConnect. BitConnect’s affiliate marketing program offers three tiers of rewards for recruitment. The first tier applies directly to the friend you’ve recruited, and you receive 5% of whatever your friend invests with BitConnect. If your friend recruits someone, you’ll receive 3% of whatever that person invests. And if that person recruits someone, you’ll receive 2% of the third person’s investments.

This pyramidal marketing scheme funnels rewards up to the top, and it encourages a culture of heavy recruitment and evangelism. It also ensures that new funds continue to be injected into the ecosystem, and drives demand for the BCC token, increasing its value on the market. BitConnect even provides bonuses for investing larger sums in the platform initially. The nature of BitConnect’s affiliate marketing is what leads many critics to label it a ponzi scheme, as we’ll see in the “Criticisms” section of this article.

Who Runs BitConnect?

BitConnect’s website does not list information about the team behind the platform, and it’s unclear who is running the company or developing the software. Bitconnect does list a group of partner organizations on their website, and they have representatives that attend industry conferences. Supporters claim that BitConnect is a private company and has the right to maintain privacy about its leadership. Critics argue that the lack of transparency in leadership is another indication of questionable business practices.

Criticisms

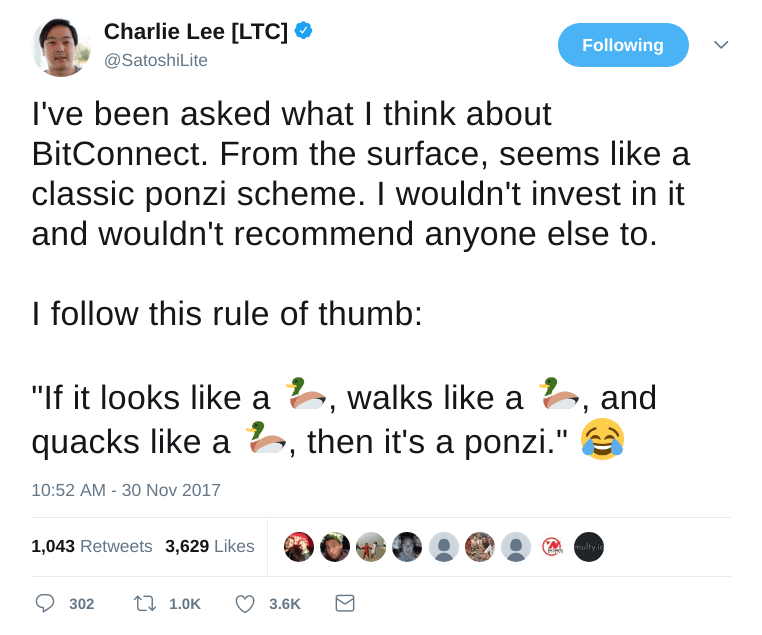

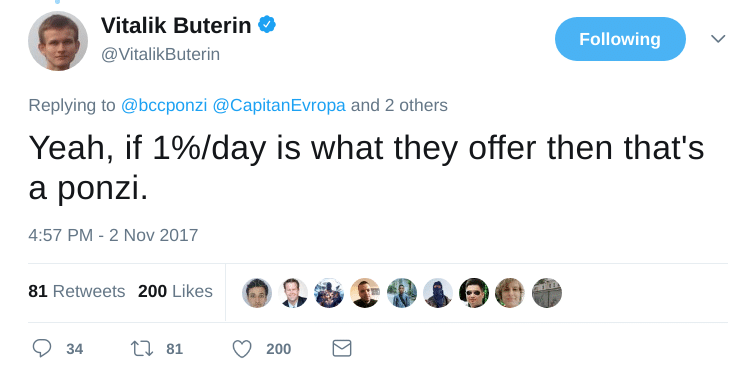

Respected figures in cryptocurrency like Ethereum’s Vitalik Buterin and Litecoin’s Charlie Lee have denounced BitConnect as a ponzi scheme. Ponzi schemes rely on the influx of new members through recruitment to pay the dividends to existing members. This form of pyramid scheme will continue to grow as long as its user base does. However, if the user base stops growing, there will no longer be enough incoming cash to pay dividends and the scheme will shut down permanently.

This was the case with BitPetite, a similar investment platform that closed abruptly earlier this year, locking users out of their accounts while the leadership disappeared. Reddit threads, Steem articles, and Twitter hashtags are full of similar warnings against BitConnect. More experts are coming forward with concerns about the platform. 99Bitcoins recently did an excellent, in-depth review of where BitConnect gets its funds and why people think it’s a scam.

Even if BitConnect’s intentions are pure, it’s still improbable to run a company that consistently generates a 120% return. BitConnect will likely run into trouble meeting those targets sooner rather than later. It could also face regulatory challenges. The British Government recently threatened to shut down and dissolve a BitConnect company on its registry, and since the BCC token is clearly an investment vehicle, BitConnect should expect intervention from the U.S. Securities and Exchange Commission.

Conclusion

BitConnect has many ardent supporters who are ready to defend the platform and show off their earnings statements in YouTube videos and tweets. However, the criticisms are difficult to ignore, especially when they come from the most respected experts in crypto. I, personally, will not be investing in BitConnect. If you’re considering it, it’s worth thinking twice about the experts’ concerns before you make your decision.