BitMEX (Bitcoin Mercantile Exchange) Review

BitMEX (Bitcoin Mercantile Exchange) has recently gained some popularity as an exchange for advanced cryptocurrency traders. Offering up to 100x leverage contracts and shorting, you can up your potential gains (or losses) on the platform by taking on additional risk for each trade.

Unlike other exchanges, BitMEX only offers leveraged contracts that you buy and sell in Bitcoin. This means that, even if you’re trading altcoins, your profit and loss will be in Bitcoin. This platform is meant for traders, not investors who are looking to actually own the coins.

Note: BitMEX is currently unavailable for U.S. residents.

In the BitMEX review, we’ll cover:

- Key Information

- How It Works

- Trading Fees

- Available Cryptocurrencies

- Transfer Limits

- Company Trust

- Fund Security

- Customer Support

- Conclusion

BitMEX Key Information

| Key Information |  |

|---|---|

| Site Type | Cryptocurrency Futures Exchange |

| Beginner Friendly | |

| Mobile App | |

| Company Location | Hong Kong |

| Company Launch | 2014 |

| Deposit Methods | Bitcoin |

| Withdrawal Methods | Bitcoin |

| Available Cryptocurrencies | Contracts for Bitcoin, Bitcoin Cash, Cardano, Ethereum, Litecoin, Ripple |

| Community Trust | Great |

| Security | Great |

| Fees | Varies |

| Customer Support | Good |

| Site | Visit BitMEX |

How It Works

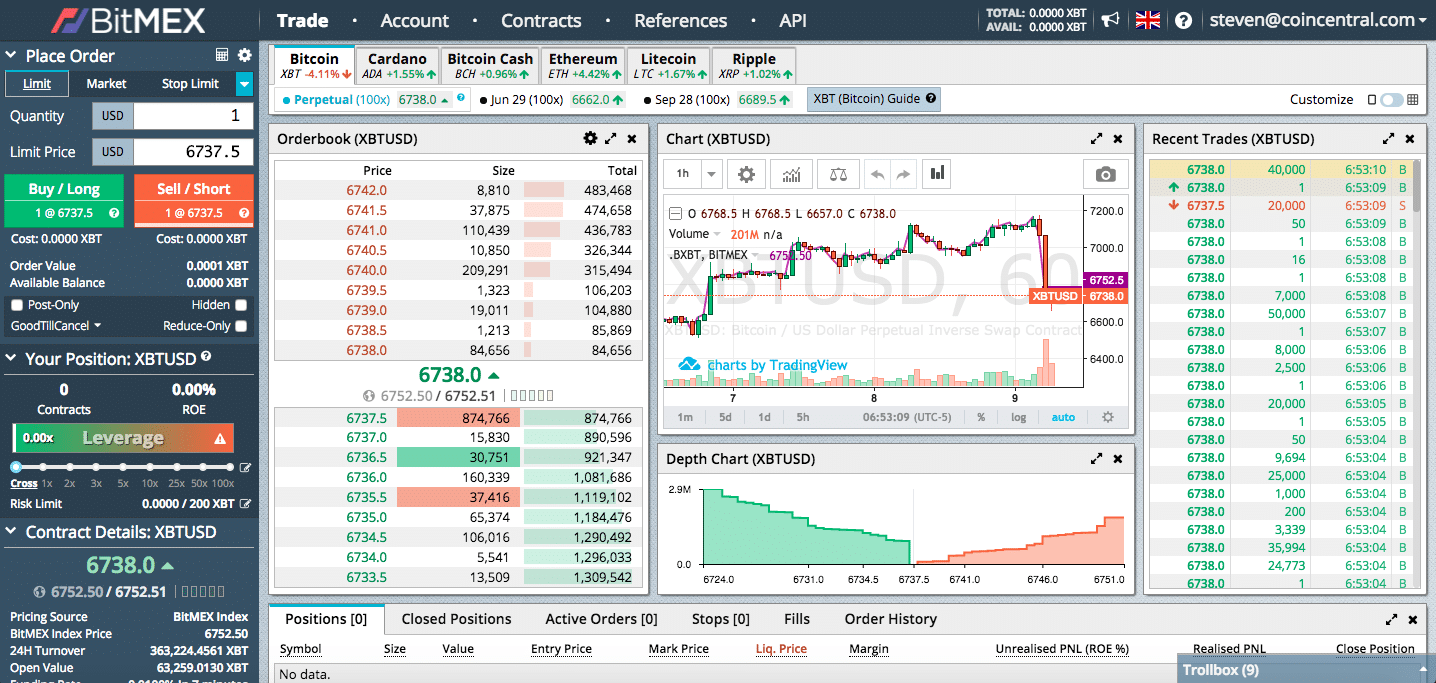

At first glance, the BitMEX interface can be overwhelming. The platform constantly keeps the order books as well as executed trades up to date. You’ll notice right away that the platform has all the standard analysis data: candlestick and depth charts, technical indicators, and trading volume.

BitMEX offers two types of contracts: Futures Contracts and Perpetual Contracts. A Futures Contract is an agreement to buy or sell the underlying asset for an agreed price at a specific time in the future. It allows you to trade coins without having to ever actually own them.

A Perpetual Contract is similar but doesn’t have an expiration date. Trading these is similar to normal spot trading.

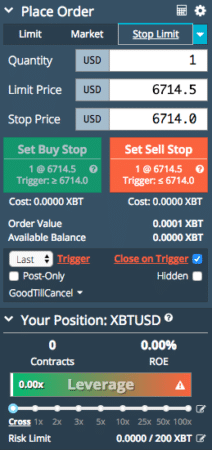

On BitMEX, you can make simple market and limit orders as well as set stop limits using Perpetual Contracts. If those terms confuse you, we recommend using an exchange more geared towards beginners, like Coinbase.

What makes BitMEX unique, though, are the advanced trading options it provides. Most notably, it supports leverage trading from as low as 2x all the way up to 100x your position. The amount of leverage varies from contract to contract, but the Daily Bitcoin / JPY Futures and Perpetual Bitcoin / USD have the highest leverage options available.

Trading Fees

BitMEX trading fees range from -0.05% (a rebate) to 0.075% depending on whether you’re a maker or taker and which contracts you’re trading. There’s been some confusion in the community about these fees; however, it appears that trading on leverage increases these fees substantially.

The BitMEX settlement fees are free for all futures trades except for Bitcoin. Additionally, you won’t have to pay any fees to deposit or withdraw your funds. When withdrawing Bitcoin, though, BitMEX automatically sets a minimum network fee that may be higher than what you’re used to.

Available Cryptocurrencies

As mentioned earlier, BitMEX is a futures trading platform, not a cryptocurrency exchange. Therefore, you’ll only ever deal in Bitcoin. However, you can trade contracts for:

If you’re interested in owning the different coins that you trade, you may be interested in Binance.

Transfer Limits

There’s no limit to the amount of Bitcoin you can deposit to and withdraw from your account.

The minimum deposit for trading varies from contract to contract depending on the Initial Margin but is usually fairly low.

[thrive_leads id=’5219′]

Company Trust

The team running BitMEX is incredibly transparent, showcasing their names, LinkedIn bios, and pictures directly on the official website. The team founded the exchange in 2014 and currently operates it out of Hong Kong.

Community members mostly have positive things to say about the platform, although some do state the fees are significantly higher than other leverage trading options. Recently, BitMEX has seen some notoriety among active traders on Twitter due to the company’s affiliate program. Even though popular traders are likely promoting the platform to gain additional income, it’s unlikely they’d ruin their reputation by promoting something untrustworthy.

Fund Security

The BitMEX team takes fund security seriously. They store all funds in multisignature wallets that can only be accessed if a majority of partners allow it. The wallets are offline (cold storage) out of reach of potential hackers.

Additionally, all withdrawals are manually checked by at least two BitMEX employees before they’re sent out. Because of this, you need to submit your withdrawal request by 13:00 UTC in order to get your funds the same day.

Customer Support

BitMEX handles support issues through an email ticketing system. The community sentiment around the customer support seems to be fairly good. The team also actively communicates on Reddit and other forums working out issues that arise.

On top of that, The BitMEX website has ample information not only about the trading platform but about confusing terminology as well. It includes a list of FAQs, margin trading information, and contract guides.

Conclusion

BitMEX is a solid choice for experienced cryptocurrency traders. Although the fees are on the higher, the platform’s leverage options are unmatched. The community has primarily positive things to say about BitMEX, and the team keeps your funds safely in cold storage.

However, if you’re an investor looking to own coins, or you’re a beginner, we recommend using another platform.

[wp-review id=”7902″]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.