TLDR

- Bitmine launches options trading, eyes deeper crypto market integration

- BMNR dips as options debut; firm targets 5% of global Ethereum supply

- Bitmine grows Bitcoin mining, ETH holdings amid options market entry

- BMNR now optionable; Bitmine doubles down on crypto asset strategies

- Despite stock dip, Bitmine advances ETH stake and mining expansion plans

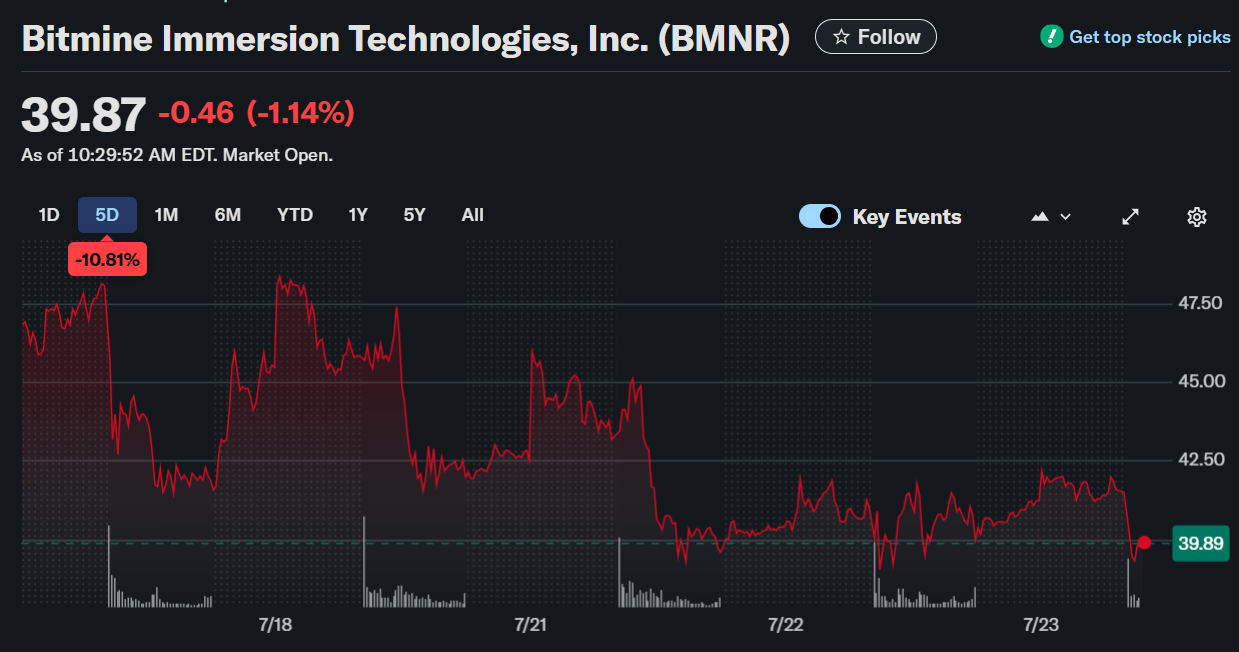

Bitmine Immersion Technologies, Inc. (NYSE American: BMNR) shares decline 1.51% to $39.72 during early trading on July 23, 2025.

Bitmine Immersion Technologies, Inc. (BMNR)

The drop occurred as the company’s options began trading on the New York Stock Exchange under the symbol “BMNR.” Despite the decline, the company remains focused on expanding its presence in the crypto and capital markets.

The listing introduces a full range of expiration dates and strike prices, enhancing trading accessibility and liquidity. Bitmine expects this move to allow better risk management and position strategies for market participants. With the stock now optionable, the company is stepping into broader financial engagement.

The company’s leadership believes this development underscores market recognition of its long-term Ethereum acquisition goals. By offering options, Bitmine aims to deepen market participation and improve stock performance visibility. The trading is supported through the Options Clearing Corporation and follows standard NYSE and OCC regulations.

Bitcoin-Focused Mining Business Maintains Strategic Position

Bitmine operates diversified mining facilities focused on Bitcoin generation and revenue-building through crypto-based services. Its sites in Pecos and Silverton, Texas, and Trinidad use cost-efficient energy for optimized mining yields. The company also engages in synthetic mining and advisory services to increase crypto-denominated income.

This strategic setup helps Bitmine balance capital expenditure with consistent Bitcoin output in changing crypto market conditions. It leverages financial products tied to hashrate operations to expand business lines without relying only on physical infrastructure. Bitmine diversifies its revenue while staying anchored in the Bitcoin network.

The company continues to build partnerships with public firms seeking crypto exposure through advisory and operational support. These services allow other firms to navigate Bitcoin-based revenue streams efficiently. As a result, Bitmine strengthens its presence while securing a recurring business model alongside direct mining.

Ethereum Strategy Advances With 5% Supply Target

Bitmine is pursuing a goal of acquiring 5% of the global Ethereum supply through staking and treasury accumulation. This ETH-focused strategy complements its mining business and is designed for long-term value creation. The company combines direct acquisitions with staking rewards to grow holdings.

The treasury strategy signals an aggressive approach to institutional-level ETH participation. Bitmine intends to use capital-raising proceeds and market opportunities to increase its Ethereum reserves. This approach positions the company as a potential leader in ETH ownership among public entities.

Market performance may fluctuate short-term, but Bitmine continues to align its operations with digital asset accumulation. The company outlines its progress in SEC filings and emphasizes regulatory compliance in its Ethereum roadmap. While the stock dipped, the overall business strategy remains unchanged and focused on digital asset growth.