TLDR

- Q3 2025 adjusted EPS was $11.55, above the expected $11.31 per share.

- Revenue rose 25.2% year-over-year to $6.5 billion.

- Assets under management hit a record $13.5 trillion.

- Net inflows totaled $205 billion, led by ETF and private asset growth.

- Completed $12 billion acquisition of HPS Investment Partners to expand in alternatives.

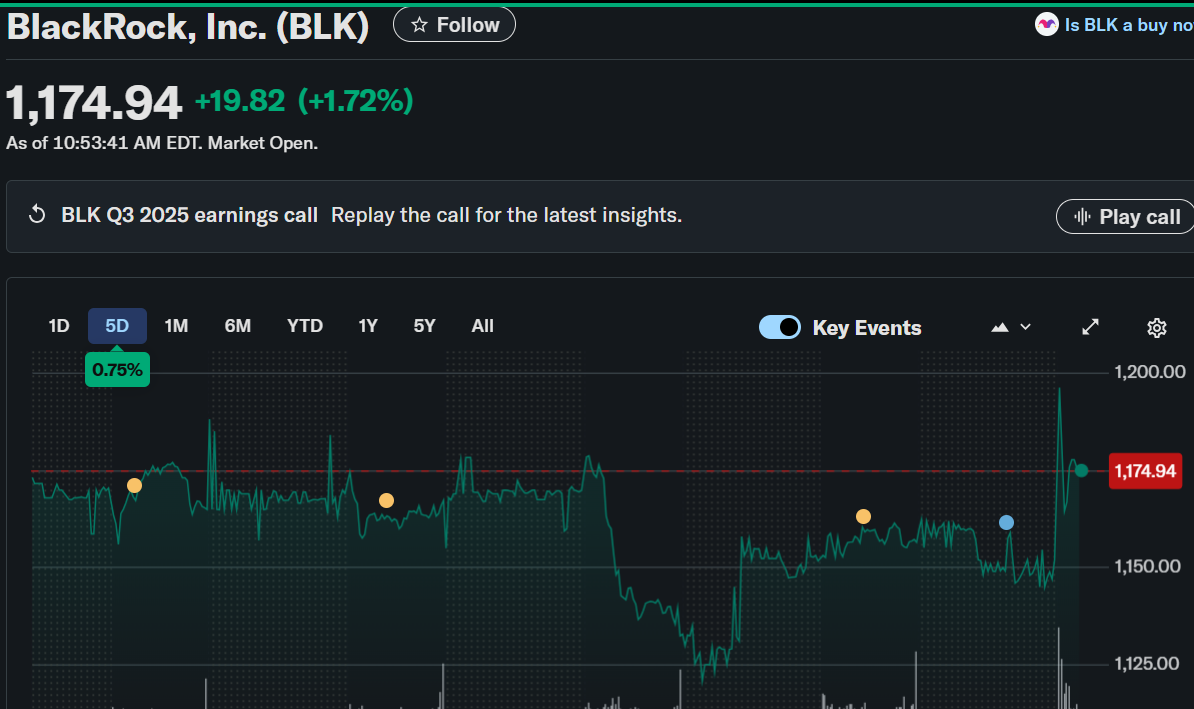

BlackRock Inc. (NYSE: BLK) stock closed at $1,155.12, up 2.01% on October 13, before dipping 0.56% to $1,150.00 in pre-market trading.

Today, October 14th, the company reported its third-quarter 2025 earnings, showing lower profit than last year but exceeding Wall Street expectations, supported by record inflows and surging assets under management.

Solid Q3 Performance Amid Lower Profit

BlackRock posted net earnings of $1.323 billion, or $8.43 per share, compared with $1.631 billion or $10.90 per share in Q3 2024. On an adjusted basis, profit rose to $1.907 billion, translating to $11.55 per share, surpassing analyst estimates of $11.31.

BlackRock, $BLK, Q3-25. Results:

📊 Adj. EPS: $11.55 🟢

💰 Revenue: $6.51B 🟢

📈 Net Income: $1.32B

🔎 AUM reached a record $13.5T, with $205B in net inflows driven by iShares ETFs, private markets, and cash. pic.twitter.com/oG63ex1BVq— EarningsTime (@Earnings_Time) October 14, 2025

Revenue grew 25.2% to $6.509 billion, up from $5.197 billion a year earlier, driven by higher management and performance fees. CEO Larry Fink said, “We’re entering our seasonally strongest fourth quarter with building momentum,” highlighting growing investor confidence in the firm’s expanding private markets strategy.

Record Inflows and AUM Growth

BlackRock reported $205 billion in total net inflows during the quarter, reflecting robust demand across ETFs, private assets, and money-market funds. Long-term investment fund inflows reached $171 billion, beating Bloomberg’s analyst estimate of $161.6 billion.

#BlackRock is eating the world! The world's largest asset manager recorded net inflows of $205bn in Q3 2025 as the company expanded its footprint in private credit and alternative assets. BlackRock’s total assets under management hit a record of $13.5 TRILLION as markets surged. pic.twitter.com/QFkR5G8aqw

— Holger Zschaepitz (@Schuldensuehner) October 14, 2025

The company’s exchange-traded funds (ETFs) exceeded $5 trillion in assets for the first time, underscoring their dominance in the passive investment space. Meanwhile, cash management and money-market funds added $34 billion, pushing total assets in that segment to $1 trillion.

BlackRock’s assets under management (AUM) climbed to a record $13.5 trillion, fueled by rising markets and solid client demand. Fink expressed optimism about the future, stating that the scale of opportunity ahead “far exceeds what we’ve ever seen before.”

Expansion in Alternatives and Private Credit

During the quarter, BlackRock finalized its $12 billion acquisition of HPS Investment Partners, adding $165 billion in client assets and strengthening its footprint in private credit. The firm’s alternatives business now manages $663 billion, and it aims to raise an additional $400 billion by 2030.

Performance fees rose 33% to $516 million, driven by robust performance in private markets. This growth follows previous acquisitions of Global Infrastructure Partners and Preqin, positioning BlackRock as a leader in alternative asset management.

Market Performance and Outlook

BlackRock shares have gained 14.44% year-to-date and 19.05% over the past year, outperforming the S&P 500’s 13% and 14.4% respective returns. The company’s three-year return stands at 119.82%, well above the benchmark’s 81.33%.

Despite a decline in quarterly GAAP profit, BlackRock’s expanding AUM, growing fee base, and strategic acquisitions highlight its long-term strength. As it enters the fourth quarter with strong inflows and momentum across key business lines, the firm appears well-positioned to maintain its global leadership in asset management.