TLDR

- Blockchain.com secures MiCA license in Malta for EU market expansion.

- Malta provides regulatory transparency and access to the European Economic Area.

- Fiorentina D’Amore to lead Blockchain.com’s EU strategy from Malta.

- EU regulators express concerns over Malta’s crypto regulatory approach.

- European Banking Authority warns against regulatory arbitrage in crypto sector.

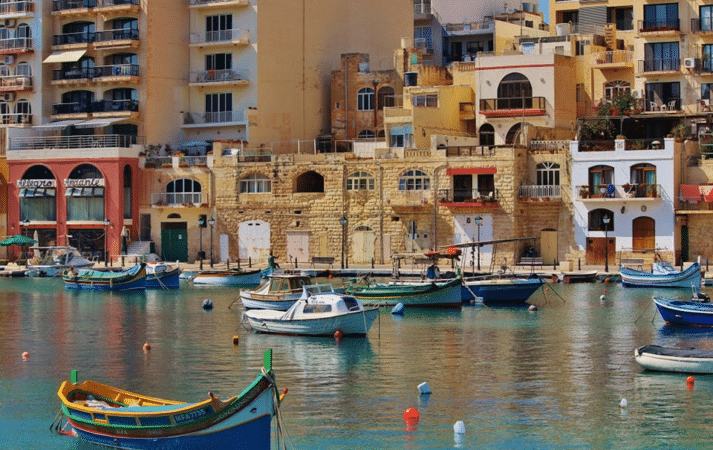

Blockchain.com has recently obtained a MiCA license in Malta, a significant step for the company’s expansion into Europe. This move enables Blockchain.com to offer services across the entire EU market. The company joins a growing list of crypto firms, including Kraken, Gate, and Gemini, that are seeking access to the European market through Malta.

Blockchain.com Chooses Malta for EU Expansion

A spokesperson for Blockchain.com stated that Malta’s regulatory environment provided the “right combination of transparency, institutional expertise, and strategic access.” The MiCA license will now serve as the foundation for Blockchain.com’s European operations. Fiorentina D’Amore will lead the company’s EU strategy from Malta, positioning it for growth across the region.

The MiCA regulation came into full effect in late 2024. This framework allows crypto companies to apply for authorization in one EU member state and operate across the 27-country bloc. Blockchain.com sees this as an opportunity to expand its services, shifting from centralized exchanges to focus on brokerage, institutional infrastructure, and self-custody wallet services.

Blockchain.com’s spokesperson also highlighted that the company is monitoring regulatory developments in the UK, Singapore, Latin America, and the Middle East. The firm has not yet addressed rumors of a potential U.S. public listing, but it remains open to such a move in the future.

EU Regulators Call for Stronger Crypto Oversight

Malta’s relatively light approach to crypto regulation has raised concerns among some European regulators. In mid-September, markets authorities from France, Austria, and Italy pushed for stronger EU oversight. They called for a more centralized role for the European Securities and Markets Authority (ESMA) in supervising the crypto market across member states.

A recent ESMA review of Malta’s licensing practices highlighted that some risks were not fully assessed during the authorization process. While the Malta Financial Services Authority (MFSA) demonstrated strong cooperation, certain areas were flagged as potential concerns. Critics argue that Malta’s regulatory approach, including its history of offering “golden passports” and a lenient stance on gambling, may attract companies seeking more relaxed conditions.

The European Banking Authority (EBA) also expressed concerns about “forum shopping.” This practice occurs when crypto companies seek licenses in jurisdictions with more lenient regulations, such as Malta. The EBA warned that such actions could compromise the integrity of the EU’s financial system, making it more difficult to ensure investor protection.

Despite the concerns, some legal experts argue that regulatory diversity is inevitable in a single market. Dr. Hendrik Müller-Lankow, a lawyer at Kronsteyn, noted that different national approaches reflect the balance between EU integration and national discretion. While some view regulatory arbitrage as a byproduct of adapting national laws to EU regulations, others see it as a form of regulatory arbitrage.