China’s decision to allow banks to pay interest on digital yuan wallets from January 1 has reignited debates around stablecoin competitiveness, regulation, and where capital may flow next.

While policymakers in the United States continue to restrict yield-bearing digital dollars under the GENIUS Act, traders are exploring altcoins, presales, and utility-driven projects like Deepsnitch AI. Here’s the latest Blockdag news and why an AI token could be the next 100x token of 2026.

China’s yield-bearing digital Yuan changes the game

China allows commercial banks to pay interest on balances held in eCNY wallets. Officials describe the policy as a way to integrate the digital yuan into traditional bank balance sheets. In contrast, the United States has taken a stricter route. The GENIUS Act, signed into law in July 2025, bans stablecoin issuers from offering “any form of interest or yield.”

Coinbase CEO Brian Armstrong warned that China’s decision gives its digital currency a competitive edge. He noted the policy could affect whether US dollar stablecoins remain attractive globally. Industry leaders argue that banning yields pushes innovation offshore, while banks claim yield-bearing tokens could drain deposits from the traditional system.

This policy tension matters for crypto markets because capital tends to follow efficiency, yield, and clarity. That reality is influencing Blockdag news and investor sentiment for long-running presales.

DeepSnitch AI brings live utility into focus

While many projects remain in planning mode, DeepSnitch AI already runs live utilities during its presale phase. The platform is currently in stage 4 and operates four active agents designed to reduce common retail trading mistakes.

SnitchFeed works as a real-time radar, flagging tokens with unusual volume, alerts, or whale activity. Traders can immediately open the Token Explorer to review holder concentration, liquidity behavior, and contextual risk. The latest upgrade introduced AuditSnitch, which simplifies contract analysis into CLEAN, CAUTION, or SKETCHY outcomes.

Instead of reading smart contract code, traders receive a plain verdict that helps avoid honeypots, hidden taxes, and locked liquidity traps. SnitchGPT then converts dashboards into simple explanations, answering direct questions about risk and sentiment.

DeepSnitch AI is trading at $0.03334 and has raised over $1 million, with more than 28 million tokens locked in a staking vault offering daily rewards. Analyst suggests that the token could do between 50x to 100x after launch. This prediction is why traders are moving away from uncertain Blockdag news toward immediate utility.

Blockdag ecosystem news and opportunity cost

The Blockdag ecosystem news narrative of locking funds for years without live products is a huge concern. Projects that provide tools now tend to attract attention during uncertain macro conditions.

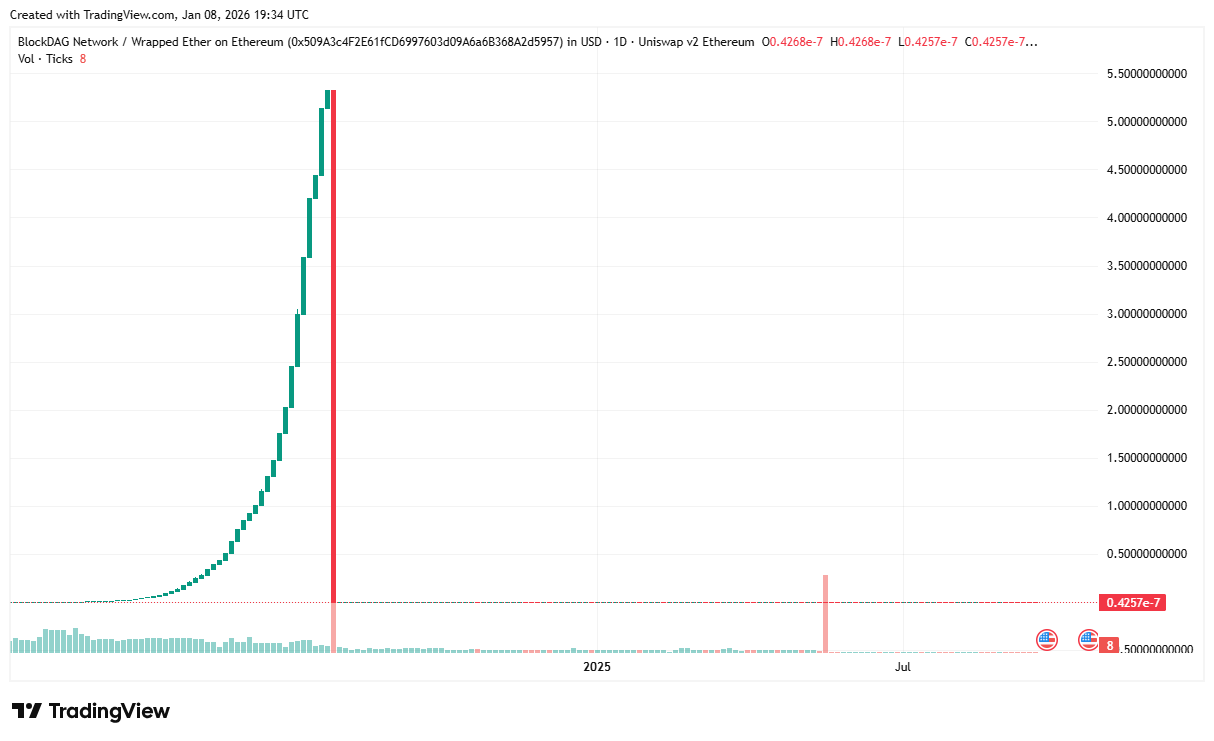

BlockDAG’s presale has been running since December 2023, with a projected launch now set for February 2026. Early investors have waited more than two years for liquidity, raising concerns about opportunity cost and supply overhang.

The high $650 million hard cap adds pressure. If the launch happens, early investors may look to exit quickly after a long lock-up.

As per the latest Blockdag news, while BDAG development progresses, delays amplify selling pressure once liquidity arrives, especially when Deepsnitch AI shows traction before launch.

Maxi Doge vs utility-driven tokens

Maxi Doge (MAXI) is built on Ethereum, but MAXI leans into degen trader culture with contests, ROI competitions, and gamified trading tournaments. The project has raised over $5 million and offers audited contracts with a clear reward structure.

However, Maxi Doge is a meme-focused token. Although it appeals to high-risk traders, it lacks the analytical depth offered by platforms like DeepSnitch AI. This contrast further shapes Blockdag news, as investors weigh entertainment-driven speculation against data-backed decision tools.

Final thought

The clash between China’s interest-bearing digital yuan and US stablecoin restrictions is reshaping crypto incentives. Yield, speed, and clarity are now decisive factors. As Blockdag news regarding its launch is delayed, long presales and delayed liquidity are facing tough competition from utilities like Deepsnitch AI.

Projects like DeepSnitch AI show that actionable data and transparent execution matter in today’s market. Traders appear less willing to wait years for promises when working tools already exist.

Visit the official DeepSnitch AI website, join Telegram, and follow on X for the latest updates.

FAQs

What is the current status of the BlockDAG presale compared to that of Deepsnitch AI?

The BlockDAG presale has been active since December 2023, with a high hard cap of $600 million and a February 2026 launch date, while Deepsnitch AI started its presale in Q1 of 2025 and will launch in January 2026.

How does DeepSnitch AI help traders compared to BlockDAG?

DeepSnitch AI provides live market intelligence, contract risk analysis, and simplified dashboards, reducing risk during presale and launch phases.

Why are investors concerned about BlockDAG’s launch?

Early investors face potential liquidity issues and a large supply overhang, making timing and market insights a key factor before launch. This is unlike what we see with Deepsnitch AI, where over 28 million supplies are staked, showing investors’ confidence before launch.