TLDR

- BNB is trading at $899.23, down 1.44% in 24 hours but trading volume jumped 61.62% to $3.75 billion

- BlackRock’s BUIDL Fund launched on BNB Chain and is now approved as collateral by Binance

- Technical analysis shows BNB holding a demand zone between $900-$925 with potential bullish divergence on RSI

- A breakout above the current trendline could signal bullish momentum, while a drop below $880 may trigger further downside

- Binance faced scrutiny after founder Changpeng Zhao received a pardon from President Trump following his four-month prison term

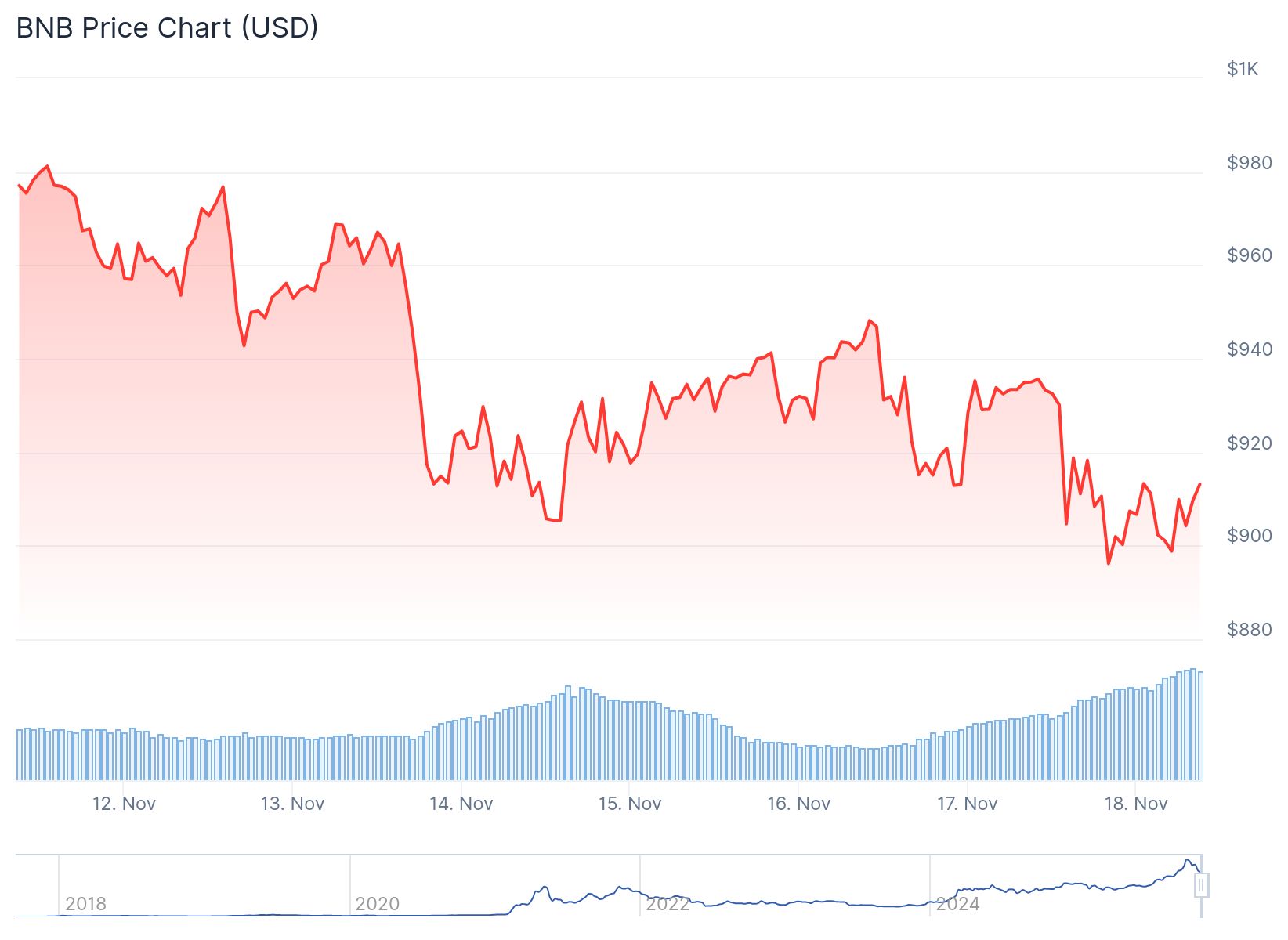

BNB is currently trading at $899.23 after declining 1.44% over the past 24 hours. Despite the price drop, trading volume surged to $3.75 billion, marking a 61.62% increase.

The cryptocurrency has retreated 8.6% over the past seven days. Market participants are closely monitoring both technical indicators and institutional developments.

BlackRock Enters BNB Chain

BlackRock launched its BUIDL Fund on BNB Chain in a major development for the ecosystem. The fund has been approved as collateral by Binance.

BNB Street just got a new resident.@BlackRock’s BUIDL Fund, the world’s largest tokenized real-world asset, has officially landed on BNB Chain, powered by @Securitize and @wormhole.

The world’s biggest asset manager just brought tokenized U.S. dollar yields to one of the… pic.twitter.com/AfOeMqAdBe

— BNB Chain (@BNBCHAIN) November 14, 2025

The BUIDL Fund uses Securitize and Wormhole protocols to facilitate institutional trading. The integration aims to connect traditional financial assets with decentralized finance.

Sarah Song, Head of Business Development at BNB Chain, stated that BNB Chain is designed for scalable, low-cost, and secure financial applications. She noted that BUIDL is turning real-world assets into programmable financial instruments.

The fund allows institutional participants to access liquidity and exposure to U.S. Treasury yields through on-chain instruments. This approval could enhance capital efficiency for institutional clients.

The development may boost on-chain activity and increase total value locked within BNB’s ecosystem. Analysts suggest similar initiatives historically lead to heightened engagement and liquidity expansion.

Technical Analysis Shows Mixed Signals

Crypto analyst Cryptorphic indicates that BNB remains supported within a demand zone between $900 and $925. The Relative Strength Index is forming a higher-low structure.

$BNB is holding above a key demand zone at $900–$925, forming a higher-low structure on the RSI while price remains flat, a classic bullish divergence.

A breakout above the trendline would confirm bullish momentum and open the way toward.

Invalidation A breakdown below $880… pic.twitter.com/3JHNeJw1S7

— Cryptorphic (@Cryptorphic1) November 17, 2025

This pattern suggests potential bullish divergence despite relatively flat prices. A confirmed breakout above the prevailing trendline could signal renewed bullish momentum.

However, a decline below $880 may undermine the current technical structure. This could potentially invite further downside pressure.

The chart shows a sequence of lower highs and lower lows over recent weeks. BNB is down 18% for the month.

Price action has struggled to reclaim a key resistance zone that was once a support level. The RSI shows weakening bullish momentum but hasn’t entered oversold territory.

The RSI failed to break above mid-range levels throughout the week. This signals that buyers have been unable to regain control.

Controversy Surrounding Binance

Binance founder Changpeng Zhao received a pardon from President Trump after serving a four-month prison term. The pardon has sparked scrutiny and raised questions about potential pay-to-play allegations.

An investigation from the International Consortium of Investigative Journalists revealed that Binance has been linked to the flow of at least $28 billion tied to illicit activity over the past two years. The report highlights how criminal organizations have used crypto exchanges to launder funds.

In May, Binance completed a $2 billion deal with an Emirati fund using digital currency from the Trump family’s World Liberty Financial firm. Zhao applied for a pardon around that time.

BlackRock’s BUIDL Fund launch on BNB Chain represents a strategic deployment bridging traditional finance with blockchain infrastructure.