TLDR

- BNB reached $1,300 and overtook XRP to become the third-largest cryptocurrency by market cap at $182 billion

- The token gained 28% in seven days while Bitcoin only rose 5% during the same period

- CEA Industries now holds 480,000 BNB tokens worth $585 million with plans to reach 1% of total supply

- BNB Chain reported 60 million monthly active addresses and received a government-backed fund in Kazakhstan

- Some community members raised questions about price manipulation behind the rapid price increase

Binance Coin broke through the $1,300 level for the first time on Tuesday. The token now trades at $1,326 after a 30% increase over seven days.

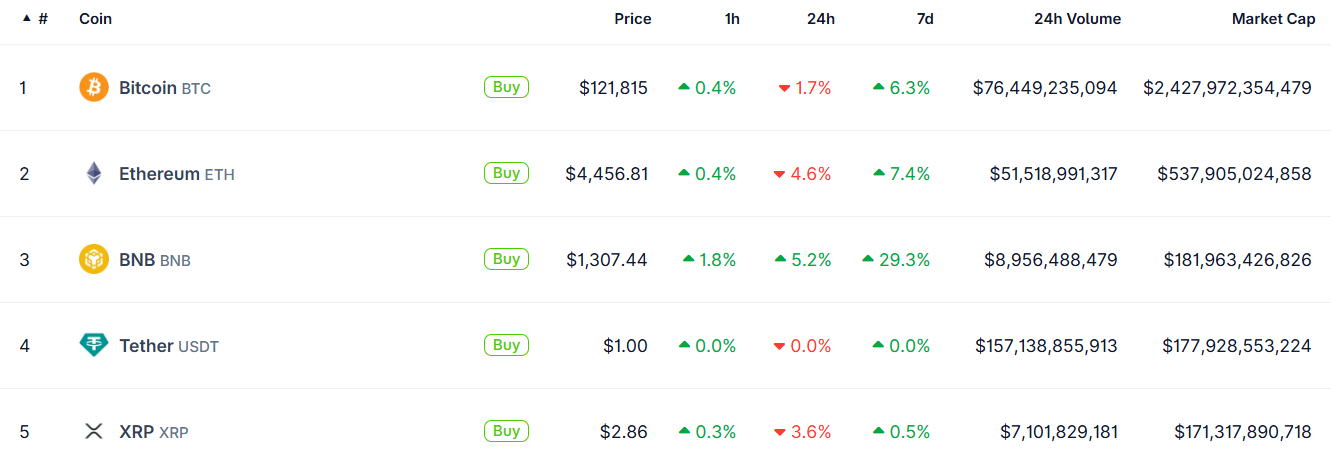

BNB overtook XRP to become the third-largest cryptocurrency by market capitalization. The token’s market cap reached $182 billion according to CoinGecko data.

The price first crossed $1,100 on Friday. Within days it climbed past XRP’s total value to claim the number three spot behind Bitcoin and Ethereum.

BNB is the native token of BNB Chain. Binance developed this layer-1 blockchain network.

The token added $40 billion to its market cap in just one week. This growth stands out compared to other major cryptocurrencies during the same timeframe.

Bitcoin’s market cap grew about 5% since October 1. Ethereum increased 8.4% during the same period with a market cap of $568 billion.

The total cryptocurrency market cap rose only 5.5% since the start of October. BNB’s 28% weekly gain outpaced the broader market by a large margin.

CEA Industries Expands Corporate Holdings

CEA Industries announced it now holds 480,000 BNB tokens. The company’s holdings are worth roughly $585.5 million at current prices.

$BNB BUYS: CEA Industries has acquired 61,112 BNB, bringing their total holdings to 480,000 BNB.

View company profile 👉 https://t.co/jKkt7GfUtT pic.twitter.com/4mFowURgaz

— CoinGecko (@coingecko) October 8, 2025

The firm invested a total of $412.8 million with an average purchase price of $860 per token. CEA Industries trades on Nasdaq under the ticker BNC.

The company aims to hold 1% of BNB’s total supply by the end of the year. It also holds $77.5 million in cash and other assets.

CEO David Namdar described BNB as “a fulcrum of a massively integrated ecosystem.” He said the price surge validates the token’s expanding utility.

CEA Industries follows a single-asset strategy focused on BNB. This approach mirrors companies like Strategy Inc with Bitcoin and BitMine Technologies with Ethereum.

Growing Adoption and Community Questions

BNB Chain reported 60 million monthly active addresses. Kazakhstan launched a government-backed BNB fund as adoption grows in various regions.

Binance recently announced a partnership with Franklin Templeton. This news came shortly before BNB’s latest price surge.

Binance founder Changpeng “CZ” Zhao posted “Keep building on BNB Chain” on social media. He also wrote “#BNB meme szn!” and said he “didn’t expect this at all.”

Some community members questioned the drivers behind BNB’s rapid growth. Social media users discussed whether the gains resulted from genuine adoption or other factors.

Crypto analyst Ali called the milestone “a huge achievement.” He pointed to BNB’s 31.6% seven-day gain and its climb past XRP in market rankings.

Previous reports from June 2024 suggested CZ held 64% of BNB’s circulating supply. At the current $182 billion market cap, this would equal roughly $116 billion in personal holdings.

BNB took more than two months earlier this year to add a similar amount to its market cap. The token stood at around $100 billion in mid-July, the same level it held at the start of 2025.

The token traded around $1,294 on Monday according to TradingView data. This marked a 122% increase over six months and a 25% gain in one week.