TLDR

- Canary’s Trump Coin ETF Sparks Meme Token Mania in Crypto Markets

- Trump Coin Soars as Canary Capital Eyes First Meme ETF Approval

- Meme Mania Goes Mainstream: Trump Coin ETF Inches Closer to Reality

- Canary Capital Pushes Boundaries With Trump Coin ETF Registration

- Institutions Eye Trump Coin as Canary Files ETF Registration in Delaware

Canary Capital has formally registered the “Canary Trump Coin ETF” entity in Delaware, indicating plans to launch a spot crypto fund. The move focuses on tracking the Trump Coin, a Solana-based meme token with rapidly increasing market activity. This registration has triggered a notable rise in the token’s trading volume and valuation across the crypto space.

🚨 JUST IN: A CANARY $TRUMP COIN ETF HAS BEEN REGISTERED IN DELAWARE pic.twitter.com/Zh2nof6Ujf

— Satoshi Club (@esatoshiclub) August 13, 2025

Trump Coin ETF Registration Spurs Institutional Entry

Canary Capital completed the entity registration on August 13, paving the way for a potential ETF linked to the Trump Coin. This development serves as the first step toward a formal filing with the U.S. Securities and Exchange Commission (SEC). The company is expected to proceed with an S-1 form and a 19b-4 filing via an exchange.

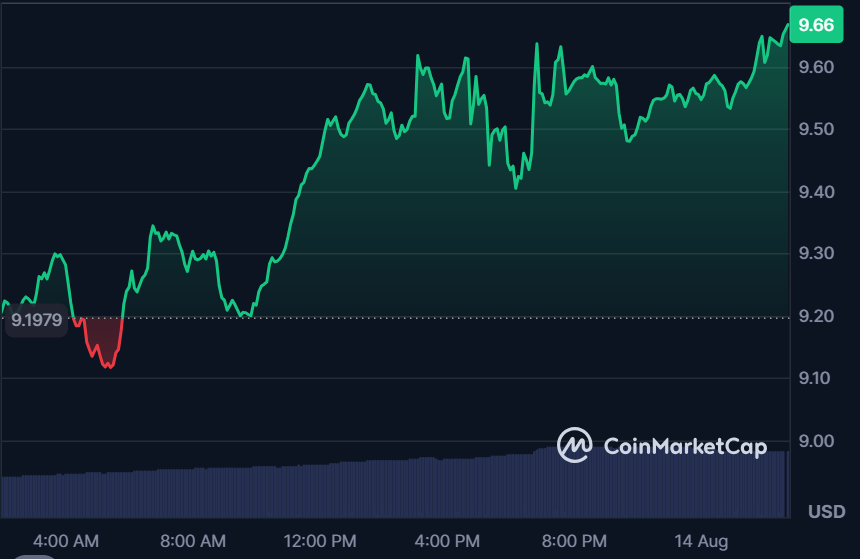

The fund would offer institutional exposure to the Trump Coin, opening up regulated access to an otherwise volatile meme token. As a result, the news has sparked enthusiasm in the market, causing the token’s value and liquidity to surge. Data shows daily gains of 4.64% and trading volume soaring by over 58% within 24 hours.

With a current price of $9.63, the TRUMP token now holds a $1.9 billion market cap, making it the fifth-largest meme coin. It ranks 49th overall among all cryptocurrencies, surpassing several altcoins in terms of momentum. The ETF aims to bring legitimacy and broader access to this highly active crypto asset.

Canary Capital’s Unconventional ETF Strategy Gains Traction

The Trump Coin ETF is part of Canary Capital’s wider strategy to bring lesser-known tokens into the mainstream financial ecosystem. Alongside the Trump Coin product, the firm has also filed for a PENGU ETF, targeting another meme coin. This makes Canary one of the few U.S. asset managers actively developing multiple altcoin-based ETFs.

The move breaks from the industry norm, where most firms focus on Bitcoin, Ethereum, and major layer-1 tokens like Solana. Instead, Canary is targeting speculative high-volatility assets, betting on their popularity and untapped market potential. This aligns with the CEO’s earlier comments about seeking value in undervalued digital assets.

This filing follows earlier attempts by firms like Osprey Funds and REX Shares to create Trump Coin-related ETFs. Those filings, submitted in January, came shortly after the token’s launch and reflected early market interest. Canary Capital’s registration marks a more advanced and structured step toward potential approval.