TLDR

- Cardano price is trading near $0.70-$0.80 support levels that analysts consider critical for determining the next move

- eToro launched Cardano staking in the US, giving over 40 million users access to earn rewards on their ADA holdings

- Whale wallets added about 200 million ADA (worth $140 million) in 48 hours after recent market weakness

- Overall selling activity dropped 51% as fewer ADA coins moved across wallets, showing reduced selling pressure

- Technical analysts identify $0.86 as the next key resistance level, with potential targets at $1.01 and $1.12 if broken

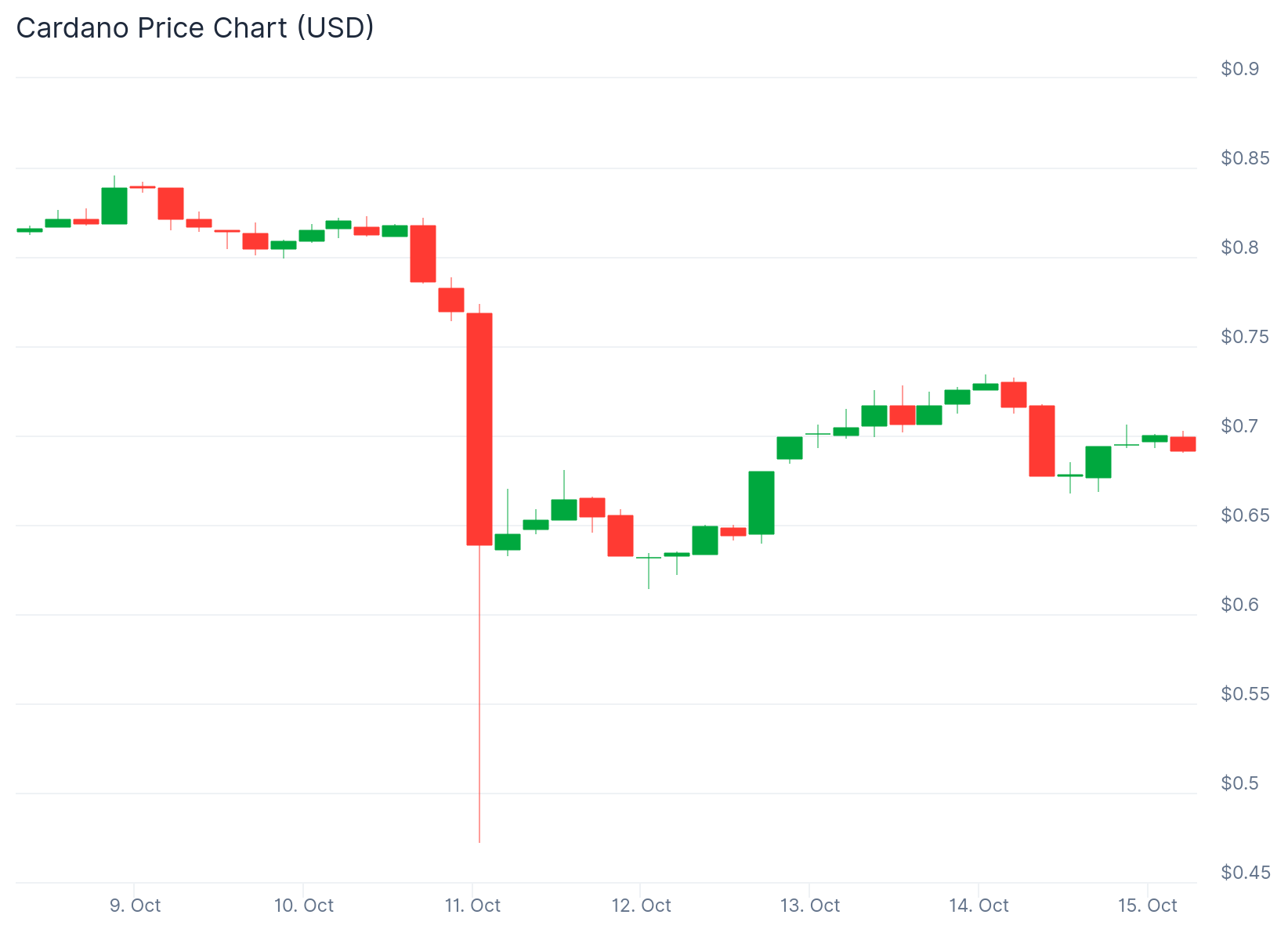

Cardano price held near important support zones in October 2025 as traders watched whether the token would confirm a recovery or face additional pressure. The asset traded around $0.70 to $0.80 during this period.

Multiple technical and on-chain signals emerged that could influence the token’s direction. At the same time, new staking options became available to millions of retail investors.

Whale wallets increased their positions following recent market weakness. Data from Santiment showed that wallets holding over 1 billion ADA increased their balances from 1.50 billion to 1.59 billion tokens between October 12 and October 14.

Wallets containing 10 million to 100 million ADA also grew from 13.18 billion to 13.29 billion tokens during the same timeframe. At an average price of $0.70, these groups added roughly 200 million ADA.

The combined value of this accumulation totaled approximately $140 million. The buying came from both large whale addresses and mid-tier holders.

On-chain activity showed a drop in selling pressure. The Spent Coins Age Band metric, which tracks ADA movement across all wallet age groups, fell from 179.06 million tokens to 87.33 million tokens since October 12.

This represented a 51% decline. The metric indicates that fewer coins were being transferred or sold across the network.

Platform Access Expands

eToro launched Cardano staking for US customers during this period. The platform serves more than 40 million retail clients.

JUST IN: eToro is launching Cardano $ADA staking in the U.S — reaching over 40 million users. pic.twitter.com/8GaEKfGczj

— TapTools (@TapTools) September 29, 2025

The staking feature allows users to earn rewards on their ADA holdings. Market observers noted that staking typically reduces the amount of tokens available for trading.

Some commentators described Cardano price as undervalued relative to the network’s development activity. The blockchain continues to see new decentralized applications and maintains an active developer community.

Technical charts displayed an ascending channel pattern on higher timeframes. After finding support near $0.61, the price bounced back toward $0.73.

This level aligned with the 0.236 Fibonacci retracement. Analyst Jesse Peralta identified $0.82 to $0.85 as logical next targets if momentum continued.

The Ichimoku Cloud indicator showed ADA pressing against short-term resistance. The Tenkan-Sen and Kijun-Sen lines were converging, pointing to an upcoming test of price levels.

The relative strength index was neutral at the time after cooling from earlier elevated readings. This suggested potential room for accumulation if demand increased.

Analysts highlighted $0.86 as the next major resistance zone. Multiple previous rallies had been rejected at this level.

A breakout above $0.73 could open the path toward $0.86. If that resistance breaks, the next targets would be $1.01 and $1.12.

The $1.12 level corresponds to the upper trend line of the ascending channel. However, analysts noted that the bullish structure depends on ADA holding above $0.61 support.

Losing that level could trigger deeper declines. The token’s interaction with channel boundaries provided structure for traders.

At press time, Cardano was trading around $0.80. It had risen 0.39% in the past 24 hours.

The token declined 1.29% over the previous week. It was down 0.05% for the month.

Analyst Jordan observed that ADA had been climbing gradually since early 2025 while bouncing from the bull market support band on weekly charts. He noted this pattern suggested underlying strength.

The $0.75 to $0.80 zone formed a key reference point for market participants. If the price continued to hold this area, Jordan projected the possibility of higher levels later in the year.

eToro’s staking launch arrived as whale wallets increased holdings and selling pressure declined across the network.