TLDR

- Cardano price holds near $0.80 following a 6.22% daily gain as trader interest increases

- Network activity shows rising demand with 30.9K unique active addresses, up from 29.6K

- Open Interest jumped 12% to $1.43 billion, indicating greater confidence among traders

- On-chain transaction volume in profit to loss ratio surged to 4.808 from 1.790

- Technical analysis shows channel breakout with bulls targeting $0.86 resistance level

Cardano price continues its upward momentum, trading near $0.80 as of Friday following a 6.22% gain from Thursday. The cryptocurrency has broken out of a falling channel pattern on technical charts.

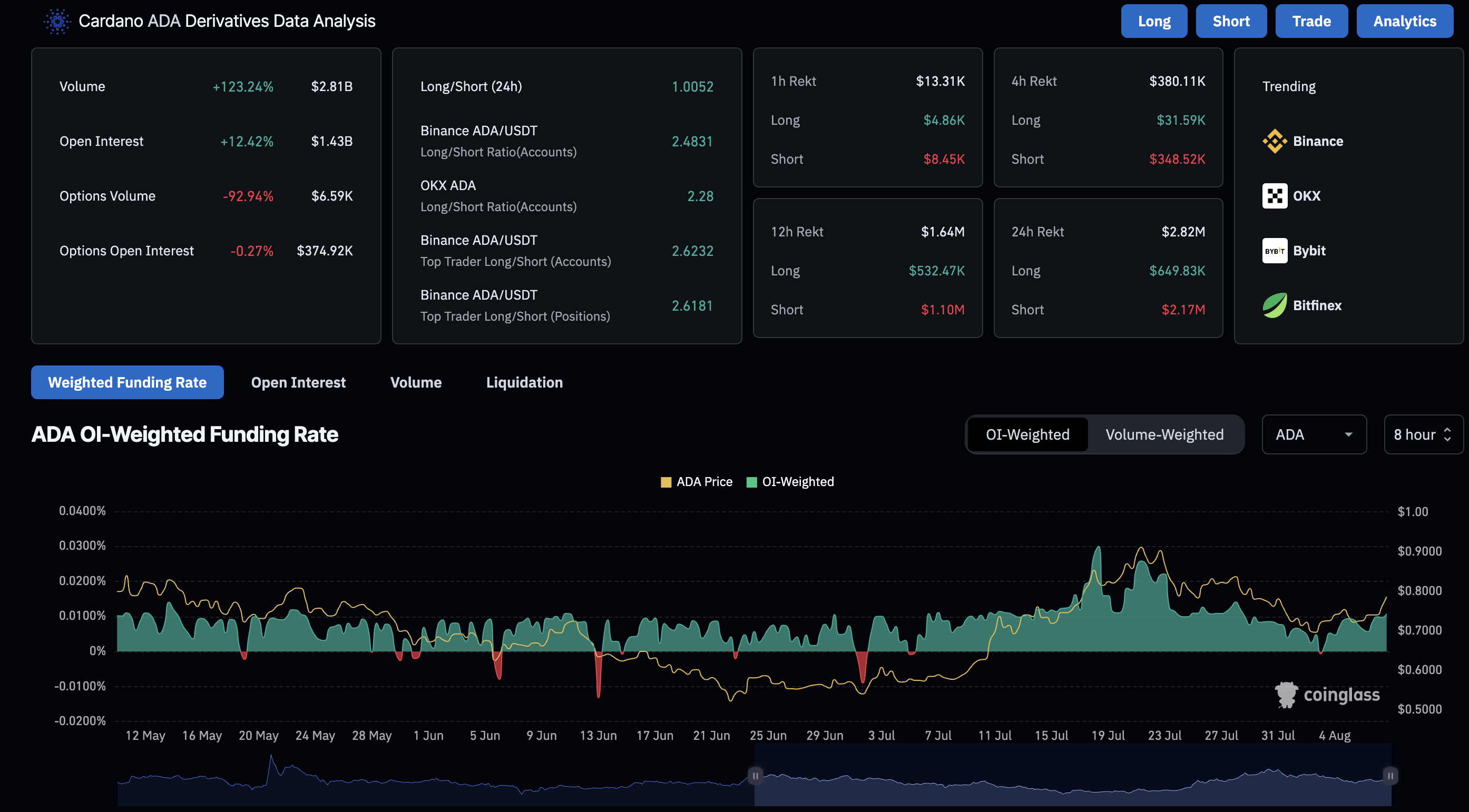

Open Interest in ADA derivatives increased by 12% over the last 24 hours, reaching $1.43 billion according to CoinGlass data. This rise in Open Interest often signals increased capital inflow from traders and investors.

The OI-weighted funding rate stands at 0.0107%, up from 0.0085% on Thursday. This increase indicates buy-side dominance in the derivatives market.

Network activity data from Santiment shows growing user engagement on the Cardano blockchain. The 24-hour Unique Active Addresses count rose to 30.9K on Friday, compared to 29.6K addresses recorded on Thursday.

The ratio of on-chain transaction volume in profit to loss jumped to 4.808 from 1.790 on Thursday. This metric indicates more transactions are occurring at prices higher than when tokens were last moved.

Technical Analysis Points to Further Gains

The Moving Average Convergence Divergence indicator shows rising bullish momentum with uptrending average lines and green histogram bars. However, the Relative Strength Index has flattened at 69, approaching overbought territory.

Cardano price trades at $0.7953 at press time after reaching a peak of $0.8012. The breakout rally maintains support above $0.7854, a former resistance level that has now turned into support.

Bulls are targeting the $0.8599 level, which was last tested on July 23. This level represents the next key resistance point for the cryptocurrency.

Institutional Interest Grows Following Plomin Hard Fork

The recent Plomin Hard Fork introduced full decentralized governance to the Cardano network. This upgrade has attracted institutional attention, with Grayscale allocating 20% of one diversified crypto fund to ADA.

EMURGO partnered with Ctrl Wallet on July 2, 2025, enhancing Cardano’s interoperability with over 2,300 blockchains. This partnership expands the network’s connectivity and potential use cases.

Bloomberg analysts have increased the likelihood of approval for a spot ADA ETF. This development could open the door for larger institutional investment flows.

The Midnight chain, a privacy-focused sidechain, continues gaining traction. Bitcoin DeFi protocol integrations are creating new use cases for ADA token holders.

Cardano experienced an 80% rise in July, climbing from $0.55 to $0.92 during the month. This represented the coin’s best performance in months, coinciding with Bitcoin reaching new highs.

However, selling pressure emerged by month-end, with ADA falling to $0.69 on August 2. This represented a 25% decline from July’s monthly high.

The cryptocurrency has stabilized around its 20-day and 50-day exponential moving averages. A convincing close above $0.75 could set up a test of the $0.92 level.

A decline below the $0.70-$0.69 support area could trigger further losses toward $0.65 or $0.55. The channel breakout rally currently holds above $0.7854 support.