TLDR

- ADA surged over 30% in the past week, leading top 10 cryptocurrencies in performance

- Cardano broke free from a long-standing falling channel pattern with key $0.86 resistance ahead

- Weekly Stochastic RSI signals emerged from oversold levels, indicating potential trend reversal

- Cup-and-handle pattern suggests $2.65 breakout target based on Fibonacci extension analysis

- Cardano Foundation disclosed $695 million in holdings with 76.7% allocated to ADA tokens

Cardano has emerged as the top performer among leading cryptocurrencies over the past seven days. The layer-1 blockchain token delivered explosive gains exceeding 30% during this period.

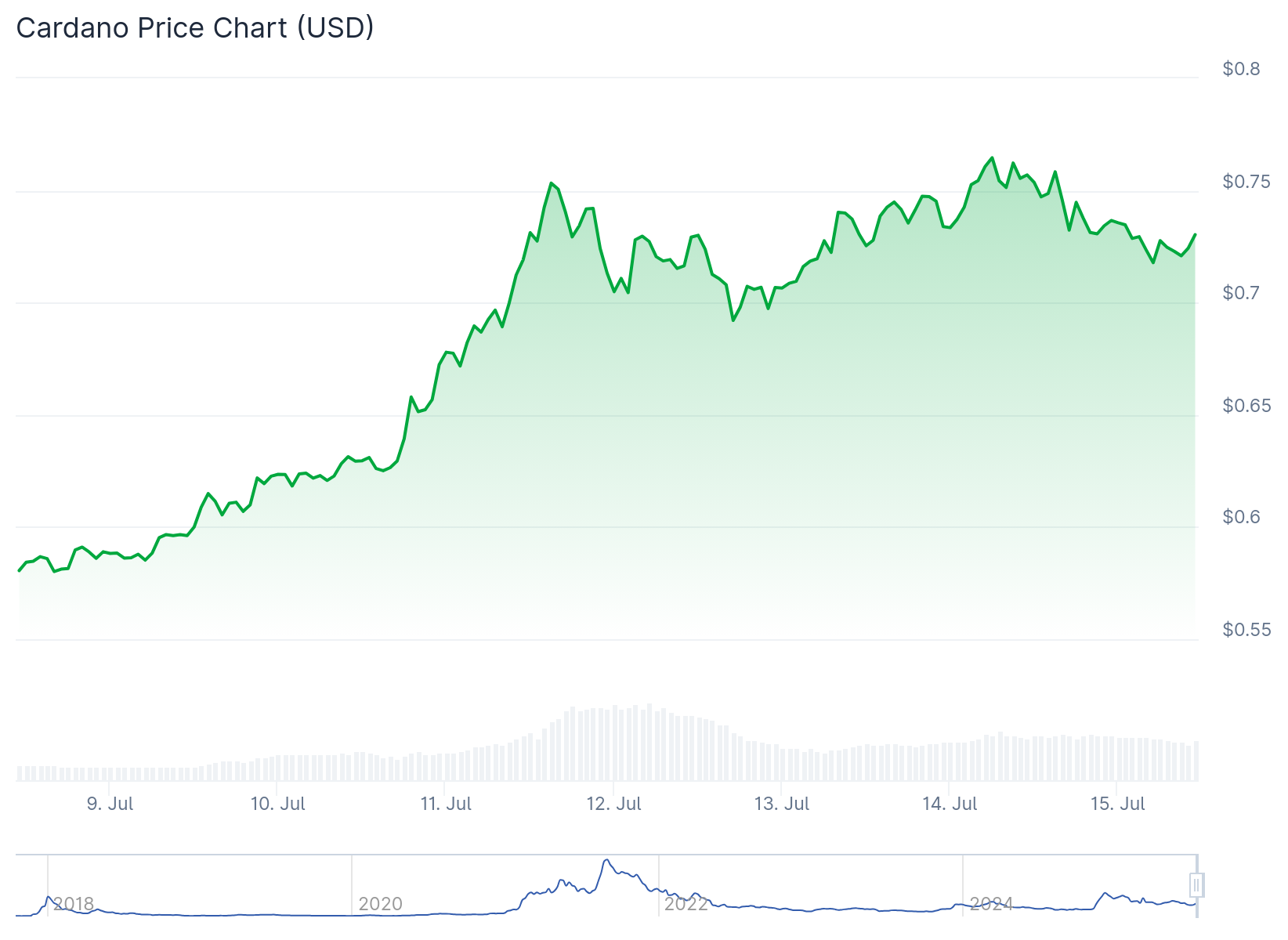

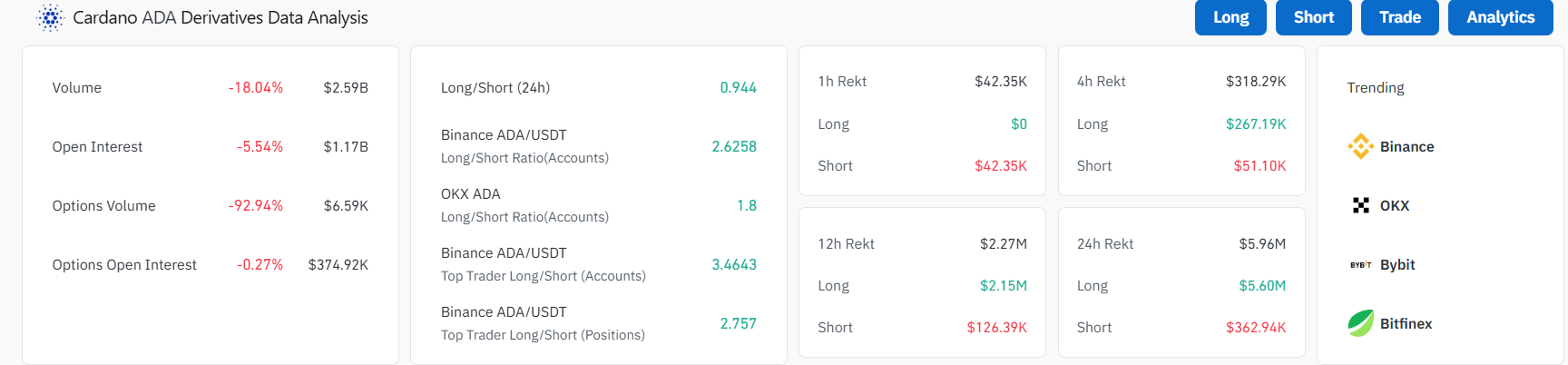

ADA currently trades at $0.7363 with a market capitalization of $26.01 billion. The 24-hour trading volume reached $1.82 billion, representing a 23.85% increase from the previous day.

The recent surge matches XRP’s performance while outpacing Dogecoin’s 21% rally and Ethereum’s 19.6% advance. This momentum has positioned Cardano within $2 billion of Tron’s market position.

Daily trading volumes have consistently approached $2 billion. Multiple analysts suggest ADA possesses fundamental strength to reach $10 per token in the foreseeable future.

The broader crypto market turned bullish following Bitcoin’s movement above previous all-time highs. Bitcoin established its former $118,000 peak as key support and reached a new all-time high at $123,000.

Technical Analysis Points to Continued Upward Movement

Technical analysis reveals ADA successfully broke free from a long-standing falling channel pattern. This bearish structure had constrained price action for months through gradual decline.

Weekly Cardano $ADA chart update 📊

Price action is starting to shift in a meaningful way.

We’re seeing early signs of a potential trend reversal. ADA has broken out of the descending channel it’s been stuck in for months, and short-term momentum is turning bullish.

The weekly… https://t.co/Ao0ltdvp3D pic.twitter.com/fVBawVhTRy

— The DApp ₳nalyst (@TheDAppAnalyst) July 14, 2025

The weekly Stochastic RSI is emerging from oversold levels for the first time in months. This indicator has historically served as a reliable precursor for larger breakout movements in Cardano.

ADA has reclaimed a critical demand zone and transformed it into a support level. The price maintains position above the neckline with support in the $0.68-$0.72 range.

A cup-and-handle pattern has formed on the technical charts. This formation suggests potential for continued upward trajectory if momentum persists.

Fibonacci extension analysis projects multiple bullish price targets. The 0.618 level sits at $1.01, the 0.786 level at $1.15, and the 1.618 level at $1.83.

The 2.618 Fibonacci extension indicates a potential rally toward $2.65. This target represents the primary breakout objective based on current technical patterns.

Foundation Holdings Reinforce Long-Term Commitment

The Cardano Foundation recently disclosed financial holdings totaling $659 million in assets. The allocation breakdown shows 76.7% in ADA tokens, 14.9% in Bitcoin, and 8.3% in cash equivalents.

These holdings have generated positive market sentiment among investors. The disclosure demonstrates substantial long-term commitment to the cryptocurrency ecosystem.

The foundation’s ADA position reinforces confidence in the asset’s long-term prospects. This holding pattern aligns with the technical breakout signals currently developing.

Market analysts view the foundation’s disclosure as supportive of higher price targets. The combination of technical patterns and institutional commitment creates a bullish setup.

The $0.86 resistance level remains the critical threshold for confirming buyer control. A clean break above this zone with rising volume would signal a shift from consolidation to expansion phase.

Current price action shows ADA trading 1.79% higher over the past 24 hours. The weekly performance of 27.25% has captured significant market attention across trading platforms.