TLDR

- Charles Hoskinson predicts ADA could rally 100x to 1000x, reaching $80-$800 if it becomes Bitcoin’s DeFi yield layer

- Two major airdrops (Midnight and Glacier) will distribute NIGHT tokens to ADA and XRP holders starting in August

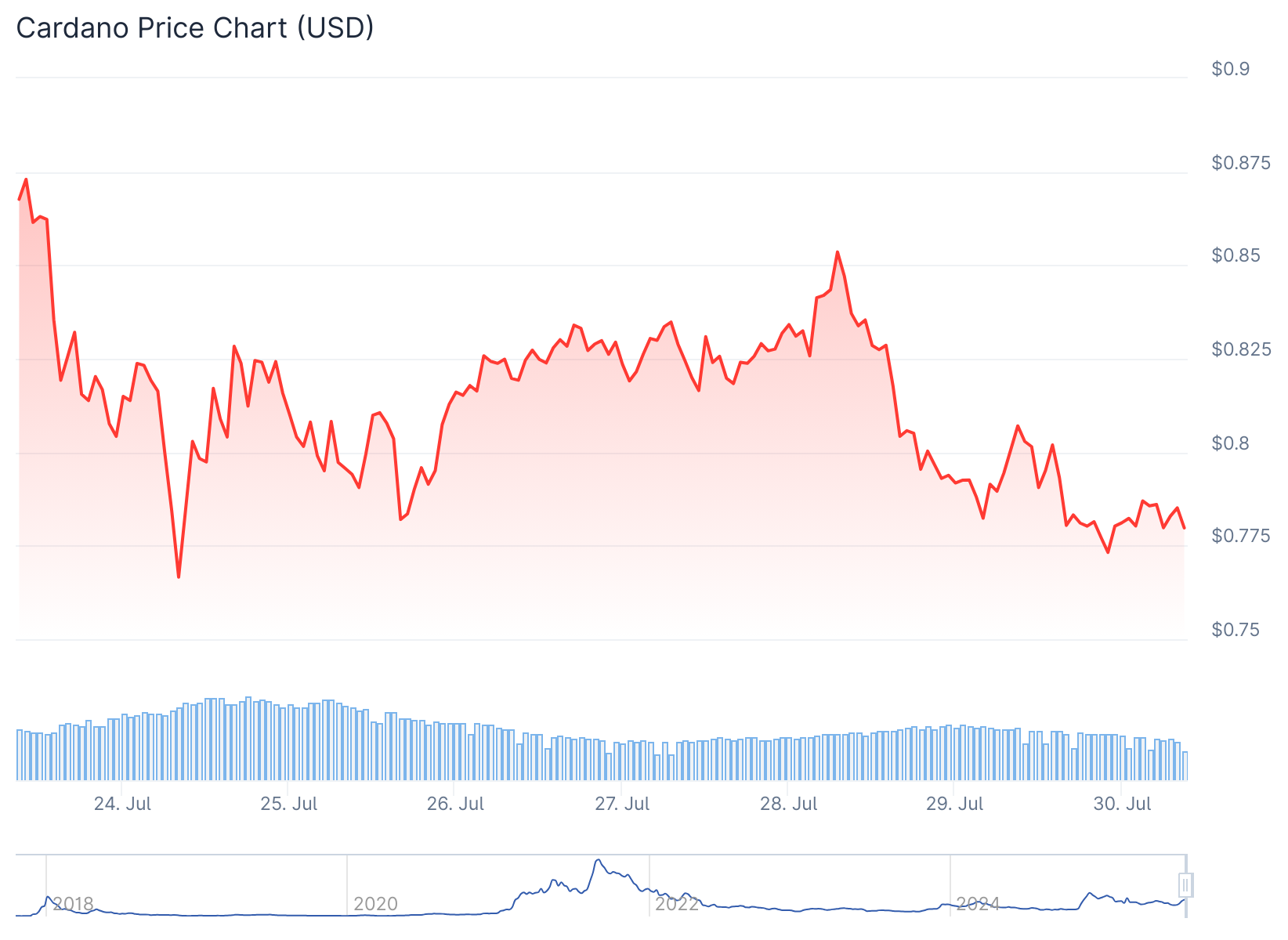

- ADA trades near $0.80 support level with over 2,000 projects now building on the Cardano ecosystem

- Technical analysis shows bullish potential above $0.85, bearish risk below $0.80 support

- Recent capital inflows suggest continued investor interest despite short-term selling pressure

Cardano founder Charles Hoskinson has made a striking price prediction for ADA. He believes the token could rally 100x to 1000x, potentially reaching $80 to $800.

Hoskinson shared this outlook during a recent Blockworks interview. He stated that ADA could achieve these gains if Cardano becomes the “yield layer of Bitcoin DeFi.”

The founder argued that ADA offers better investment potential than Bitcoin. He noted that ADA holders receive yield plus additional tokens from the broader Cardano ecosystem.

Hoskinson pointed to past performance data to support his thesis. He mentioned that Cardano once held 108,000 BTC worth about $15 billion at current values.

During the same period, ADA’s market cap reached $30 billion. This represented a 2x outperformance compared to Bitcoin, according to Hoskinson.

However, recent performance tells a different story. ADA has lagged behind Bitcoin during the first half of 2025.

The altcoin did outperform Bitcoin by 160% last November. Since June, ADA has rallied nearly 30% more than Bitcoin.

Technical Analysis Shows Mixed Signals

ADA currently trades around $0.80, which represents a key resistance level from Q2. Defending this level as support could allow bulls to target $1.00 or $1.15.

Technical indicators show mixed signals for the short term. The spot taker CVD has turned negative, indicating strong selling pressure over the past week.

If this selling trend continues, ADA’s recovery could face limitations. The 200-day Simple Moving Average presents another potential hurdle for bulls.

Despite short-term challenges, some metrics remain positive. The realized cap has increased slightly from $23.4 billion to $23.6 billion.

This increase suggests that investors continue putting money into ADA. The metric indicates maintained conviction despite recent price struggles.

#Cardano Swing Trade Idea 🚀

If you're bullish on $ADA, $0.73 is a solid level to start building a position 📊

🟢 Entry: $0.73

🟢 TP1: $0.935 | TP2: $1.18

🟢 SL: $0.57

🟢 Risk:Reward – 1:3 pic.twitter.com/05WouNybnQ— Trader Edge (@Pro_Trader_Edge) July 28, 2025

Major Airdrops Expected in August

Two major airdrops are planned for ADA holders this August. The Midnight and Glacier projects will distribute NIGHT tokens to eligible wallet holders.

ADA holders will receive 50% of the total NIGHT token allocation. XRP holders will get 5% of the distribution.

To qualify for the XRP portion, holders needed at least $100 in eligible XRP wallets during the July 11, 2025 snapshot. The claiming period begins in August.

These airdrops represent part of Cardano’s expanding privacy-focused chain development. The distributions could provide additional value to existing ADA holders.

The Cardano ecosystem has shown strong growth metrics recently. Over 2,000 projects are now building on the Cardano blockchain.

Recent improvements include mempool optimizations and expanded smart contract capabilities. The foundation has also launched new financial reporting tools.

Intersect has introduced an on-chain smart contract framework for treasury management. This system uses multi-signature permissions and oversight committees for accountability.

The derivatives market currently shows more short positions than long ones. This indicates cautious optimism among professional traders.

Market participants generally view full Bitcoin displacement as unlikely. This skepticism stems from Bitcoin’s established institutional adoption rates.

The Cardano Foundation continues investing in ecosystem resilience and education initiatives. Recent developments include the launch of “Reeve,” a new on-chain financial reporting tool.

ADA’s performance since 2021 shows an 88% decline against Bitcoin when viewed over the longer term. This raises questions about the feasibility of Hoskinson’s price targets.

Current price action suggests ADA faces a critical juncture at the $0.80 level, with capital inflows showing slight increases despite recent selling pressure.