TLDR

- Whales holding 1-10 million ADA sold over 140 million tokens in two weeks

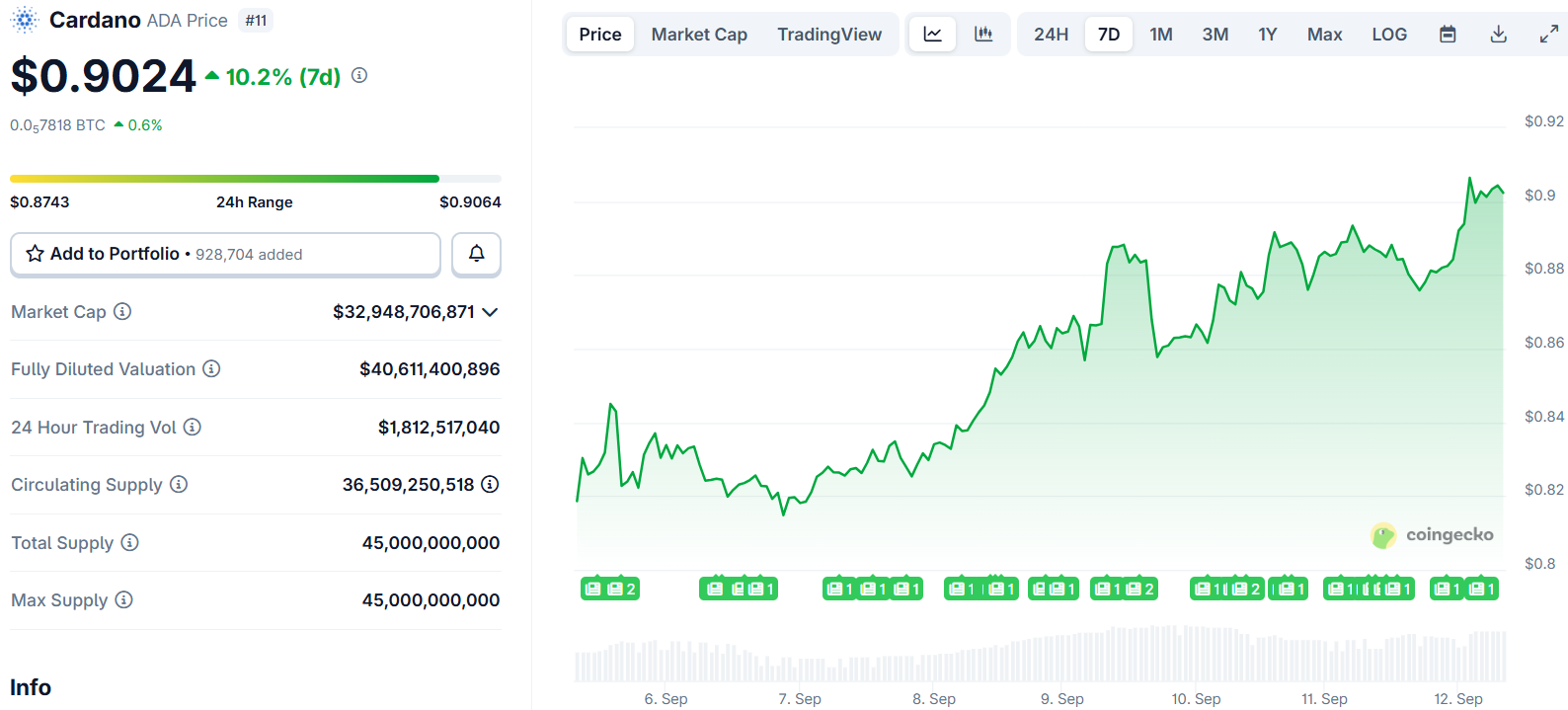

- ADA price holds steady at $0.87 despite heavy whale selling pressure

- Technical analysis shows ADA regained $0.85 support and tests $0.90 resistance

- Fractal patterns suggest potential target of $1.86 if historical cycles repeat

- Exchange flows show $644K outflows indicating cautious accumulation

Cardano (ADA) faces a critical juncture as large investors offload substantial holdings while technical indicators suggest potential for upward movement. The cryptocurrency trades around $0.87, maintaining stability despite pressure from whale selling.

On-chain data reveals that whales holding between 1 million and 10 million ADA tokens have sold more than 140 million coins over the past two weeks. This selling represents clear profit-taking behavior among large investors who accumulated during earlier price levels.

Whales are booking profits, selling over 140 million Cardano $ADA in the last two weeks! pic.twitter.com/tpeGHmWb0O

— Ali (@ali_charts) September 11, 2025

The heavy selling from whales creates downward pressure on ADA’s price. Crypto analyst Ali highlighted this trend, noting that whale exits often create short-term price ceilings that limit upward momentum.

Despite the substantial selling pressure, ADA has maintained relative stability around current levels. The price action suggests smaller buyers and new market participants are absorbing the supply being offloaded by larger holders.

Several factors drive the current wave of profit-taking among whales. ADA’s rally since mid-August provided an attractive exit opportunity for large investors. Cautious sentiment across cryptocurrency markets encourages defensive positioning strategies.

Whales may also be reallocating capital into other digital assets with stronger short-term momentum prospects. This reallocation strategy is common during periods of market uncertainty.

Technical Analysis Shows Bullish Potential

From a technical perspective, ADA has shown encouraging signs despite the selling pressure. The cryptocurrency regained the $0.85 support zone, which aligns with the 20-day exponential moving average.

ADA broke out of a descending channel pattern, with buyers defending higher lows. The Parabolic SAR indicator has flipped to bullish, while short-term moving averages have started sloping upward.

The broader structure shows ADA respecting its longer-term ascending channel. This pattern suggests downside risks remain limited above the $0.80 level.

A decisive break above $0.90 could invite momentum toward $0.95 and the psychological $1.00 level. The cryptocurrency currently tests short-term resistance in the $0.90 to $0.95 range.

Fractal Analysis Points to Higher Targets

Market analysts have identified fractal patterns that could signal larger upward moves. Bitconsensus noted that previous ADA cycle bottoms triggered gains of 260% and 360% respectively.

If historical patterns repeat, ADA could target $1.86 in coming months. This projection builds on price structures where prolonged consolidations preceded steep breakouts.

The fractal analysis suggests ADA’s current setup resembles the 2023 and 2024 cycles. During these periods, consolidation phases eventually gave way to parabolic rallies.

A sustained close above $1.00 would provide the first technical confirmation that this fractal pattern is developing. Such a move would validate the bullish fractal case.

Exchange flow data shows mixed signals for ADA. Net outflows of $644,000 occurred on September 11, continuing a trend of weaker accumulation after August’s inflows.

While outflows typically align with upward price pressure, the modest scale suggests trader hesitation. Open interest has stabilized after recent volatility, indicating reduced leverage exposure.

Bollinger Bands have tightened around $0.88, suggesting potential for increased volatility. If ADA clears $0.95, the upper band near $1.00 becomes the key resistance test.

Upside targets include $1.00 and $1.08 if momentum builds above $0.95. Extended targets reach $1.20 if acceleration occurs, with the fractal target at $1.86.

Downside risks center on the $0.85 support level. Losing this level would expose $0.80 and the 200-day moving average near $0.75.

The cryptocurrency maintains its position within the ascending channel structure. This technical framework supports the constructive outlook as long as support levels hold.

Current price action around $0.886 reflects the balance between whale selling and smaller investor accumulation.