TLDR

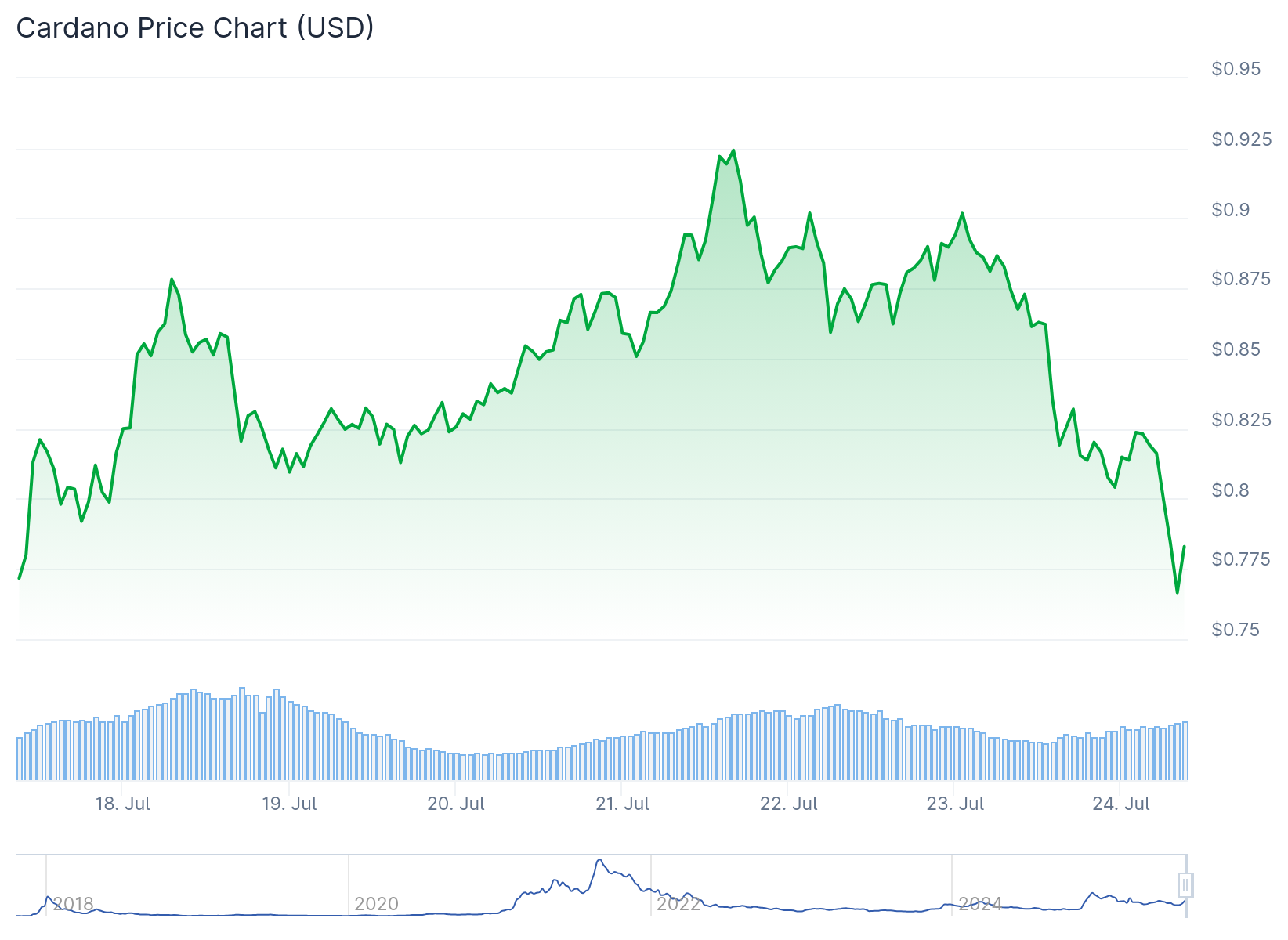

- Cardano price dropped over 15% in 24 hours to $0.77, breaking key support levels

- SEC paused Bitwise’s multi-asset ETF which included 4.97% ADA allocation

- Daily active users fell to 39.6K from earlier highs above 60K this year

- Total value locked in ADA’s DeFi ecosystem decreased to $382 million

- Technical indicators show bearish momentum with MACD turning negative

Cardano price has experienced a sharp decline, falling over 15% in the past 24 hours to trade around $0.77. The drop has broken a key support level, raising concerns about further downside movement.

The cryptocurrency market lost approximately $103.37 billion in the last 24 hours. Bitcoin dominance climbed to 61.29%, pulling capital away from altcoins like ADA.

The Altcoin Season Index dropped to 36 from 43 overnight. This shift indicates investors are moving toward Bitcoin and away from speculative altcoins.

The SEC abruptly paused Bitwise’s multi-asset ETF, which included a 4.97% allocation to ADA. While the allocation was relatively small, the sudden freeze has reignited investor fears about regulatory outlook for altcoins.

This pause mirrors delays in previous Grayscale filings. The move suggests a chilling effect on market sentiment toward altcoin-focused investment products.

On-chain data reveals declining network activity. Cardano’s daily active users dropped to 39.6K, down from highs above 60K earlier this year.

The total value locked in ADA’s DeFi ecosystem has decreased to $382 million. This represents nearly a 3% decline over the past 24 hours.

Technical Indicators Show Bearish Momentum

Cardano Price fell below its 7-day simple moving average at $0.848. The price also breached the 24-hour pivot point of $0.837, triggering stop-losses near $0.772.

The MACD histogram has turned negative at -0.0145. This confirms growing bearish momentum in the price action.

The RSI sits around 55.76, showing ADA isn’t yet oversold. This leaves room for further downside movement toward lower support levels.

$ADA hits our target.

This bounce is still not very convincing, might be more downside🫡 https://t.co/zJqhiJjkIe pic.twitter.com/ZaOMmDpgC1

— Sssebi🦁 (@Av_Sebastian) July 24, 2025

Traders are watching the 38.2% Fibonacci retracement level at $0.780. If that level fails, the next support target sits near $0.73.

Short-term charts show weak bounces despite high volume. These patterns are classic signs of a bear-controlled market.

Development Progress Continues

Despite price pressure, Cardano’s ecosystem development remains active. The network has implemented preparations for the Chang upgrade, which introduces governance and technical structure changes.

Over 2,000 active projects are now building on Cardano. The Plutus smart contracts platform continues evolving with PlutusV4 release development.

The Hydra Layer-2 scaling solution teams are advancing their 2025-2026 roadmaps. The Cardano Foundation has implemented inter-blockchain communication capabilities.

Institutional interest persists with Cardano maintaining a position in Grayscale’s Smart Contract Fund. The Cardano Foundation secured $19.22 million in funding to support operational resilience and global adoption.

Looking ahead, traders are eyeing $0.73 and $0.68 as potential next targets if current support fails to hold.