TLDR

- Cardano (ADA) fell to $0.281 after reaching $0.30 during a weekend rally driven by cooler U.S. inflation data showing 2.4% year-over-year growth in January’s CPI.

- Charles Hoskinson announced USDCx stablecoin will launch on Cardano by end of February, while LayerZero integration will connect the network to over 160 blockchains.

- Analysts identify $0.244 as the most critical support level for ADA as markets face uncertainty ahead of Fed minutes and core PCE inflation report releases.

- Cardano’s total value locked in DeFi dropped 26% in 30 days to $134 million, while stablecoin supply remains at just $37 million compared to the industry’s $300 billion.

- Technical analysis points to potential decline toward year-to-date low of $0.2255, with ADA down nearly 80% from November 2024 highs.

Cardano experienced profit-taking on Monday following a three-day rally that pushed the price to $0.301 on February 15. The cryptocurrency retreated to $0.281, down 1.02% in the last 24 hours.

The weekend rally followed broader crypto market gains as investors responded to January’s Consumer Price Index data. The CPI rose 2.4% year-over-year, coming in below the forecast of 2.5%.

The price movement occurred during a week of important announcements for the Cardano ecosystem. Founder Charles Hoskinson revealed at the recent Consensus event that USDCx stablecoin will launch on Cardano by the end of February.

LayerZero, a multichain messaging protocol connecting over 160 blockchains with $200 billion in cross-chain volume, will be integrated with Cardano. The integration represents the largest cross-chain connectivity expansion in Cardano’s history. The partnership is expected to provide access to stablecoin liquidity, Bitcoin-backed assets, tokenized real-world assets and shared DeFi infrastructure.

Ecosystem Metrics Show Decline

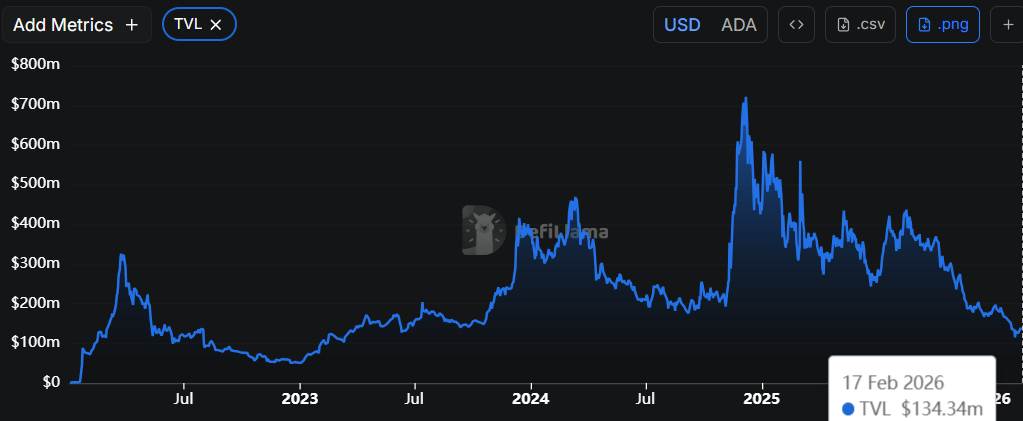

Data from DeFi Llama reveals Cardano’s decentralized finance ecosystem has weakened in recent weeks. The total value locked fell 26% in the last 30 days to $134 million. Cardano has not added new developers this year despite securing a partnership with Pyth Network, a leading oracle provider in the crypto industry.

The network’s stablecoin supply stands at $37 million, a small fraction of the industry’s total $300 billion in stablecoin assets. The top stablecoins in the ecosystem include Moneta, Anzens, Djed, and iUSD.

CME data shows the initial reception of recently launched ADA futures has been weak. Open interest remains much lower than other tokens like Bitcoin and XRP.

Key Support Level Identified

According to market analyst Alicharts, $0.244 represents the most important support level for Cardano as the market faces uncertainty. The cryptocurrency is trading below the $0.3040 level, which marked its lowest point in July and September 2024.

$0.244.

That’s the most important support level for Cardano $ADA. pic.twitter.com/PsAHaVACRL

— Ali Charts (@alicharts) February 15, 2026

ADA remains below all moving averages, while the Percentage Price Oscillator stays below the zero line. Technical indicators suggest potential downside toward the year-to-date low of $0.2255.

Traders are preparing for a busy week of macroeconomic events. The Federal Reserve will release minutes from the January meeting and the core personal consumption expenditures price index, the Fed’s preferred inflation gauge.

Liquidations across the crypto market reached $280 million in the last 24 hours, according to CoinGlass data. Markets fell on Monday ahead of the packed week of economic data releases.

Cardano is focusing on the upcoming Midnight mainnet launch, scheduled for the final week of March. Midnight will be a privacy-focused sidechain on Cardano designed to attract more developers to the ecosystem.