TLDR

- ADA has gained 26% over the past week, breaking out of a long-term descending channel pattern

- Daily active users reached 27,000, marking a fresh high since late May with transaction count above 38,000

- Technical indicators show strong directional momentum with ADX at 27.64 and Money Flow Index at 73.64

- Analysts predict price targets between $0.90-$1.20 if ADA can hold above $0.7468 resistance level

- Grayscale has appealed SEC’s suspension of its GDLC ETF which includes 0.8% allocation to Cardano

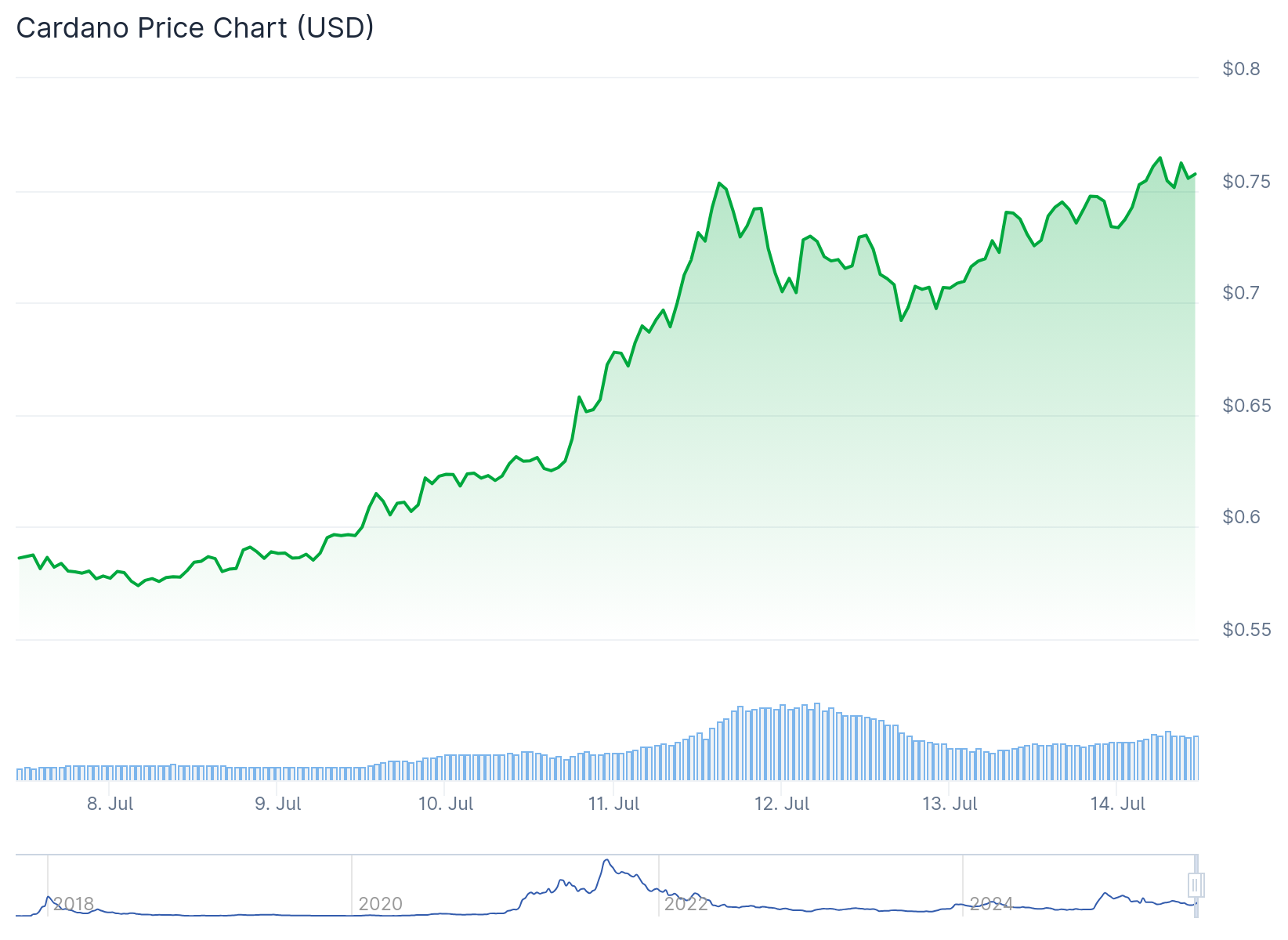

Cardano has emerged from a prolonged bearish phase with a strong 26% weekly gain, currently trading at $0.7373. The cryptocurrency added another 4.81% in the past 24 hours, showing renewed investor interest after months of downward pressure.

The recent price action represents a breakout from a descending channel pattern that had confined ADA’s price movement for months. This technical formation saw the cryptocurrency drop from a high of $1.32 to $0.74 before the recent recovery began.

Market analysts are now watching closely as ADA attempts to establish itself above key resistance levels. The immediate hurdle lies at $0.7468, which analysts identify as the gatekeeper level that must be overcome for sustained upward momentum.

Technical Analysis Points to Higher Targets

Trading volume data shows mixed signals with 24-hour volume declining 12.8% to $1.46 billion despite the price gains. This suggests some caution among traders even as the breakout develops.

Technical indicators are providing bullish confirmation for the current move. The Average Directional Index has reached 27.64, indicating a strong directional trend is forming. Values above 25 historically confirm reliable momentum in either direction.

The Money Flow Index sits at 73.64, placing ADA in the upper range of the 50-80 zone typically associated with strong capital inflows. This metric suggests increasing buyer conviction and liquidity supporting the current price level.

Crypto analyst Ali has identified what appears to be a bullish crossover between the 50-day and 200-day moving averages. This technical pattern is often considered a precursor to sustained price increases.

Cardano $ADA is breaking through a key resistance level, opening the door for a rally to $0.90–$1.20! pic.twitter.com/4dj8jQfJFN

— Ali (@ali_charts) July 13, 2025

On-Chain Activity Supports Price Recovery

Network activity has strengthened alongside the price recovery. Daily active users have climbed to 27,000, representing a fresh high since late May according to Artemis data.

Transaction count has also jumped above 38,000, marking another multi-month peak. These increases signal growing utility and suggest more users are actively transacting with ADA.

The uptick in network usage provides fundamental support for the price recovery. Higher user activity typically correlates with increased demand for the underlying cryptocurrency.

If current momentum holds, analysts project ADA could climb toward the $0.95-$1.12 range. Some technical projections extend the target to $1.22 based on Fibonacci retracement levels.

Price predictions for 2025 vary across different platforms. DigitalCoinPrice maintains an optimistic outlook, estimating ADA may reach $1.62 this year. Changelly takes a more conservative approach, predicting an average price of $0.775 for July 2025.

Institutional Developments Add Context

Grayscale has formally appealed the SEC’s decision to suspend its Digital Large Cap Fund ETF. The fund includes a 0.8% allocation to Cardano alongside Bitcoin and Ethereum holdings.

The ETF was initially approved on July 1 before being suspended for further review. Grayscale argues the delay is detrimental to existing investors in the fund.

While Bitcoin and Ethereum comprise 80% of the fund, Cardano’s inclusion represents institutional recognition of its position in the digital currency space.

The outcome of Grayscale’s appeal could influence broader sentiment toward alternative cryptocurrencies like ADA. Institutional products often serve as catalysts for increased mainstream adoption.

Current trading shows ADA holding above the breakout level with technical indicators supporting continued upward momentum through the $0.7468 resistance zone.