TLDR

- Cardano (ADA) approved a $71 million treasury allocation through its first major on-chain governance vote with 74% community support

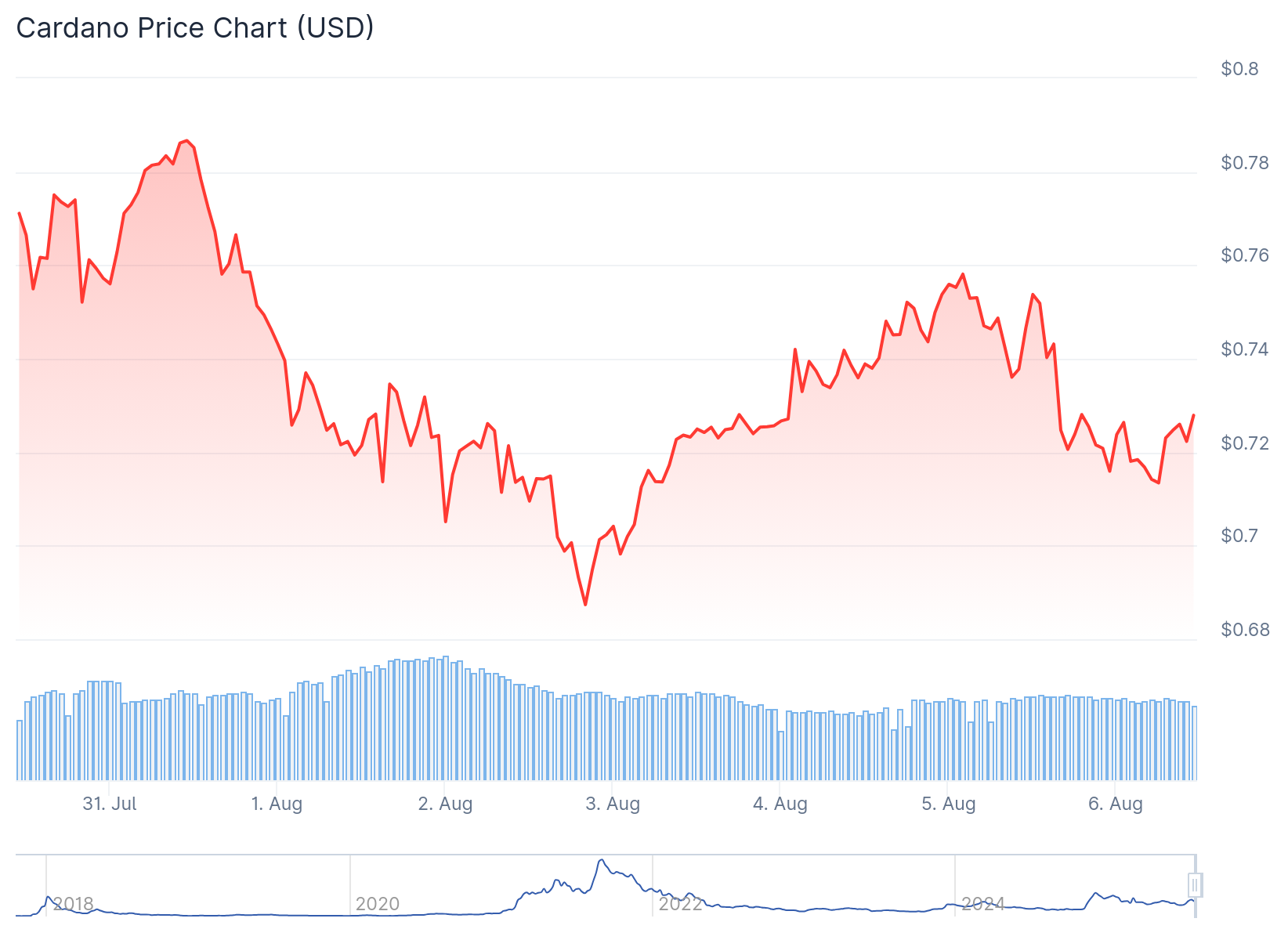

- ADA price declined nearly 2% on Wednesday, continuing a three-week downward trend within a falling channel pattern

- Large whale investors holding 1-100 million ADA tokens reduced their positions by 390 million ADA since July 24

- Network transaction volume dropped to $744 million from $1.69 billion following profit-taking activity on July 25

- Funds will support blockchain development including scaling solutions, node redesign, and interoperability improvements over 12 months

Cardano has made history by approving a $71 million treasury allocation through its first major on-chain governance vote. The proposal received 74% community support, marking the network’s transition to fully decentralized decision-making.

This milestone makes Cardano the first top-10 cryptocurrency by market cap to conduct such a governance vote. The funds will be distributed over 12 months with oversight from Intersect, a member-driven governing body.

The treasury allocation will focus on key development areas including scaling solutions like Hydra. Project Acropolis, a complete node redesign, also received funding approval. Developer tools and interoperability features with Bitcoin and Ethereum networks are included in the plan.

Despite this governance achievement, ADA price action tells a different story. The token declined nearly 2% on Wednesday, extending losses for the third consecutive week.

Technical analysis shows ADA trading within a falling channel pattern on the 4-hour chart. The price faces resistance from the channel’s overhead trendline while the 50-period EMA approaches the 200-period EMA.

On-Chain Activity Reflects Mixed Signals

Network data reveals declining activity following a profit-taking surge on July 25. Transaction volume dropped from $1.69 billion to $744 million by Tuesday, indicating reduced on-chain activity.

The Network Realized Profit/Loss recorded a spike of 143.63 million ADA during the July 25 session. This massive profit-booking event preceded the current price weakness.

Daily active addresses have recovered to nearly 31,000, exceeding the 28,248 addresses active during the profit-taking period. This suggests retail participation remains steady despite reduced transaction volumes.

Large wallet investors show mixed behavior in their ADA holdings. Whales holding 1 million to 100 million ADA reduced their positions by 390 million tokens since July 24.

Their holdings declined from 18.9 billion ADA to 18.51 billion ADA. This selling pressure contributes to the current price decline within the falling channel.

Whale Activity Creates Supply Pressure

Investors with over 100 million ADA tokens increased their holdings by 450 million ADA. Their total position now stands at 5.36 billion ADA, showing institutional accumulation continues.

The net effect still favors selling pressure from the 1-100 million ADA holder group. Their 390 million token reduction outweighs the ultra-whale accumulation by 450 million tokens.

Technical indicators support the bearish outlook with RSI reading 40 on the 4-hour chart. This level indicates declining buying pressure with room for further downside movement.

The MACD line crossed below its signal line, confirming bearish momentum. The pattern targets the $0.6884 support level tested on Sunday.

For bullish reversal, ADA needs to break above the 200-day EMA at $0.7417. This level coincides with the falling channel’s overhead resistance trendline.

The ecosystem continues developing with the Midnight sidechain launch focusing on privacy features. A major NIGHT token airdrop reached over 37 million users across multiple blockchain networks.

Smart contracts and an independent committee will provide additional oversight for the $71 million treasury spending. The funds target enhanced interoperability and scaling solutions over the next 12 months.