TLDR

- Dan Gambardello shared that Cardano was rejected from a key lower trendline.

- Cardano failed to reclaim the $0.90 support level after a 6.7 percent drop on September 22.

- The analyst noted that Cardano has not followed its 2020 breakout pattern after a similar consolidation period.

- Gambardello predicted that Cardano could fall to the $0.62 to $0.66 range from its current price of $0.823.

- He believes ongoing price suppression is delaying a major altcoin breakout in this bull cycle.

Cardano has faced another strong rejection, according to top market analyst Dan Gambardello. He revealed that ADA failed to reclaim a vital trendline. The prominent analyst now predicts deeper dip targets, warning of continued suppression in Cardano’s price action.

Cardano Faces Fresh Rejection From Lower Trendline

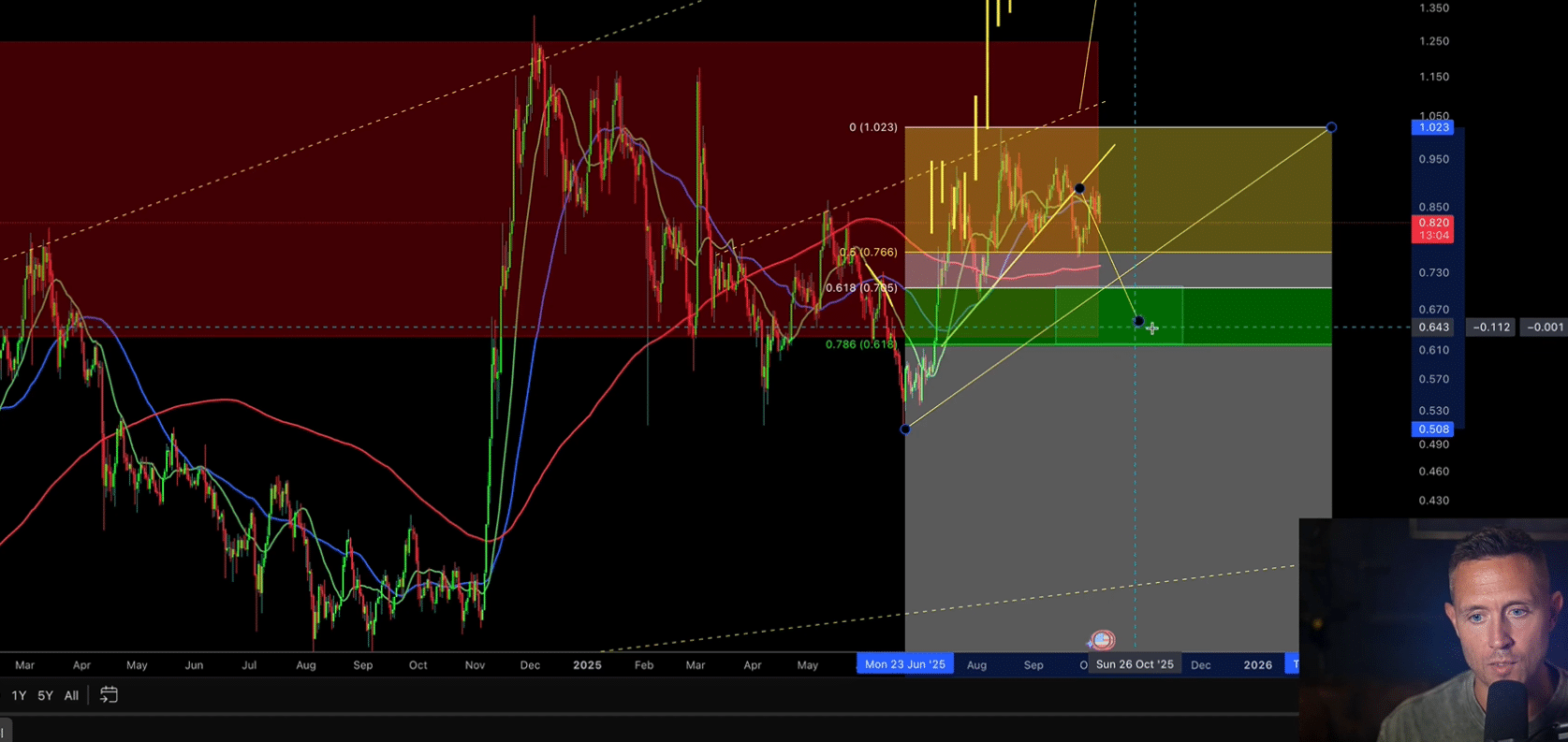

Dan Gambardello shared that Cardano recently failed to hold above a key trendline on the daily chart. ADA briefly attempted to recover on October 3 but got rejected near $0.89. This follows a sharp 6.7% drop on September 22, which pushed it below the $0.90 support.

Altcoins REJECTED Again! CRYPTO Tension Reaching A BREAKING POINT…

Intro 00:00

Altcoin coiling 2:00

itrustcapital 4:50

Cardano macro setup 5:45

ADA dip target 8:15 pic.twitter.com/N115FmQrKX— Dan Gambardello (@cryptorecruitr) October 8, 2025

He explained that this rejection places Cardano within a bearish zone, weakening hopes for a sustained recovery. “ADA’s failure to reclaim key support could signal more downside,” Gambardello stated. The current ADA price hovers near $0.823, reflecting low market momentum.

Gambardello also noted that Cardano’s movement resembles its 2020 pattern from the previous cycle. Back then, ADA broke out after 714 days of consolidation from its 2018 lows. A similar setup formed in May after another 714 days, but the breakout has not occurred.

Lower Targets Emerge as Suppression Theory Builds

Gambardello believes that external forces may be suppressing Cardano’s growth. He cited that institutional and nation-state adoption should have triggered a rally by now. However, ADA continues to lag in this phase of the market cycle.

He warned that Cardano could dip further toward $0.62, marking a potential 24% drop from its current level. The mid-range support target remains around $0.66, reflecting a cautious short-term outlook. He emphasized that Cardano’s bearish price action may not reflect its long-term fundamentals.

Gambardello added, “Price manipulation is stalling the altcoin breakout, delaying ADA’s expected breakout pattern.” He stressed that this situation deviates from historical cycle behavior. Although the setup remains valid, the price has not been implemented yet.

Technical Levels Could Offer Support For Cardano

Despite the bearish rejection, Gambardello highlighted key Fibonacci levels as potential support zones. The 0.618 and 0.786 levels at $0.808 and $0.785, respectively, may slow the downward trend. These areas have historically acted as strong retracement zones for Cardano.

Additionally, Cardano continues to trade above both the 20-week and 50-week moving averages. The 20-week MA sits around $0.770, while the 50-week MA is near $0.794. These levels could serve as dynamic support if prices slide further.

Gambardello acknowledged that the downside targets might not fully materialize if support holds. However, Cardano needs strong momentum to confirm a new uptrend. Until then, traders should monitor how ADA behaves near these crucial support zones.