Rollblock has quickly separated itself from speculative projects, raising more than $11.8 million while proving strong adoption through active gaming use. Its growth contrasts sharply with Cardano price movements, which recently slipped under pressure after a strong summer run.

With Rollblock tipped for outperformance thanks to steady adoption and a deflationary model, and Cardano navigating a pullback despite holding key levels, both tokens are drawing attention for very different reasons in today’s shifting crypto market.

From Gaming Adoption to Token Burns: Rollblock’s Winning Mix

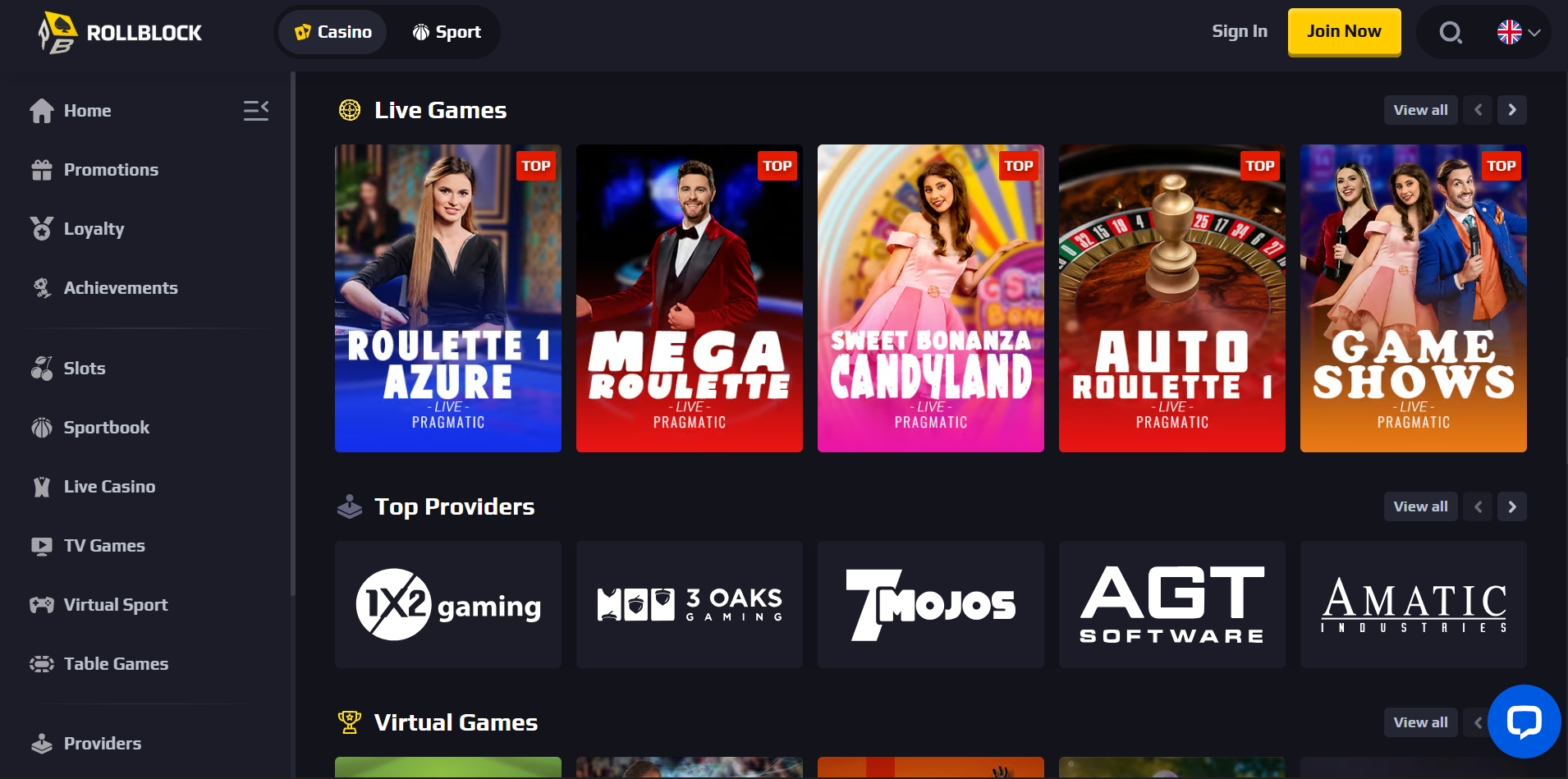

Rollblock (RBLK) has carved out a different path from most new tokens. Instead of hype-driven promises, it built momentum by getting people to use its platform early. More than $15 million in wagers have already been processed before its first listing, giving it real traction, while others are still trying to find users.

The Rollblock ecosystem is significant and growing. Over 12,000 titles are live, ranging from poker and blackjack to live dealer games and sports predictions. The project holds an Anjouan Gaming license and has been fully audited by SolidProof, which adds a layer of credibility that many GameFi platforms lack.

RBLK’s tokenomics are also built with staying power. Weekly revenue is directed into token buybacks and burns to reduce supply, while staking rewards give holders an extra reason to stay invested. This blend of adoption and deflation has attracted over 55,000 active users and continues to expand its community.

Four factors now stand out as drivers of Rollblock’s rise:

- Over $11.8 million raised with 85% of tokens sold at $0.068.

- A capped one billion supply supporting long-term scarcity.

- Access to fiat payments through Visa, Mastercard, Apple Pay, and Google Pay.

- Staking pools with rewards reaching up to 30% APY.

With early buyers already seeing gains of 580%, many now tip Rollblock as the altcoin primed to outperform once it lands on major exchanges.

Cardano Price Pulls Back After Strong Summer Gains

Cardano’s recent trading session showed a clear sign of stress as the token slipped to $0.8164, shedding nearly 7.7% in a single day. The chart highlights a sharp red candle that cut through support levels after weeks of gradual gains.

The Cardano price had climbed steadily from its mid-June low of $0.51 to touch above $1.01 in late August, but momentum has cooled since then. Moving averages show mixed signals. The short-term MA5 has crossed below the MA10, a sign of fading strength, while the MA30 continues to hover just under current levels, hinting at consolidation.

Volume spiked to 179 million during the drop, indicating heavier selling pressure compared to the quiet trade seen earlier this month. Cardano has managed to hold above $0.80 for much of September, but today’s slip raises questions about whether that range can hold.

Despite the setback, the token remains far above its summer lows, proving that recent buyers are still holding ground. For now, the Cardano price reflects a market testing its conviction, with traders watching closely how support zones respond in the coming days.

Rollblock Outpaces Old Rivals

Rollblock’s presale has pulled in over $11.8 million with 85% of tokens snapped up, a clear sign of demand. Its growing ecosystem and deflationary design set it apart from tokens now battling resistance. With Cardano price under pressure after recent highs, Rollblock looks positioned to step ahead, offering a story built on adoption and steady growth rather than stalling momentum.

Discover the Opportunities of the RBLK Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.