TLDR

- Ark Invest sold nearly $45 million worth of Circle shares on Tuesday after selling $52 million worth on Monday

- The sales happened as the U.S. Senate passed the GENIUS Act, which regulates stablecoin issuers like Circle

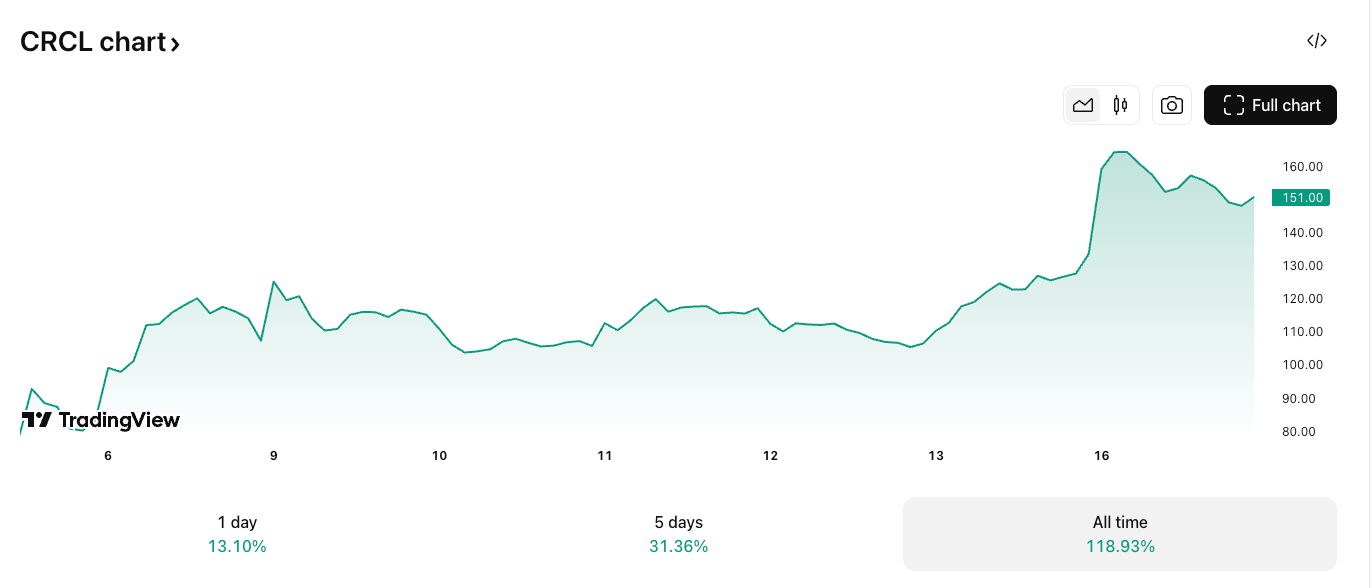

- Circle stock has surged 118% since its NYSE debut on June 5, closing at $149-151 per share

- Ark still holds Circle as a top position across three ETFs, representing up to 6.7% of fund assets

- As Ark reduced Circle holdings, it increased positions in AMD and Taiwan Semiconductor

Cathie Wood’s Ark Invest sold a total of $96.7 million worth of Circle Internet Group shares over two consecutive days this week. The asset management firm offloaded the stablecoin issuer’s stock as Circle continues its strong performance following its public market debut.

⚡️ NEW: Cathie Wood’s Ark Invest offloads an additional $44.8M in Circle shares, following a prior $51.7M sell-off. pic.twitter.com/ASm2Y33x1Z

— Investors Collective (@InvestorsCollec) June 18, 2025

On Monday, Ark sold 342,658 Circle shares worth $51.7 million across its three exchange-traded funds. The firm followed up on Tuesday with another sale of 300,108 shares totaling $44.7 million.

The Tuesday sale came on the same day the U.S. Senate passed the GENIUS Act in a bipartisan vote. The legislation establishes regulatory framework for stablecoin issuers like Circle.

Circle CEO Jeremy Allaire welcomed the Senate’s action. He called the GENIUS Act a “genius” piece of legislation in a post on X.

Circle Stock Maintains Strong Performance

Circle shares closed at $149.15 in New York on Tuesday. The stock has maintained investor interest since its NYSE debut on June 5 at $69 per share.

The company’s shares peaked at over $164 on June 16 according to TradingView data. This represents a 118% gain from the initial trading price.

Ark was among early investors who showed interest in purchasing up to $150 million in Circle shares before the NYSE launch. The firm increased its purchase volume after the initial public offering was upsized due to high investor demand.

On the first day of trading, Ark acquired 4.49 million Circle shares valued at $373.4 million at closing prices. The purchases were spread across three funds managed by the firm.

Circle Remains Top Holding Despite Sales

Even after the recent sales, Circle remains one of Ark’s largest holdings across its three ETFs. The position spans the ARK Innovation ETF, ARK Next Generation Internet ETF, and ARK Fintech Innovation ETF.

The ARK Innovation ETF holds the largest Circle position at $387.7 million. This represents roughly 6.6% of the fund’s total assets under management of $5.6 billion.

The ARK Next Generation Internet ETF holds $124 million in Circle shares, accounting for 6.7% of total assets. The ARK Fintech Innovation ETF, the smallest of the three funds, holds $72 million in Circle shares representing 6.7% of its assets.

Circle ranks as the fifth-largest holding in the Innovation ETF by weight. In the Next Generation Internet ETF, Circle trails only Coinbase, which has a 6.8% weight.

As Ark reduced its Circle stake, the firm increased investments in other technology companies. Trade notifications show increased positions in chip designer AMD and Taiwan Semiconductor Manufacturing Company.

Ark researchers have noted that Circle’s successful public offering reflects changing perceptions of the cryptocurrency industry. They said stablecoins are advancing property rights innovations that Bitcoin first introduced.

The GENIUS Act passage represents a regulatory milestone for the stablecoin sector and cryptocurrency industry broadly.