TLDR

- Ark Invest bought 161,183 shares of Bullish crypto exchange worth $8.3 million on September 16

- The purchase was split between ARKK fund (120,609 shares) and ARKW fund (40,574 shares)

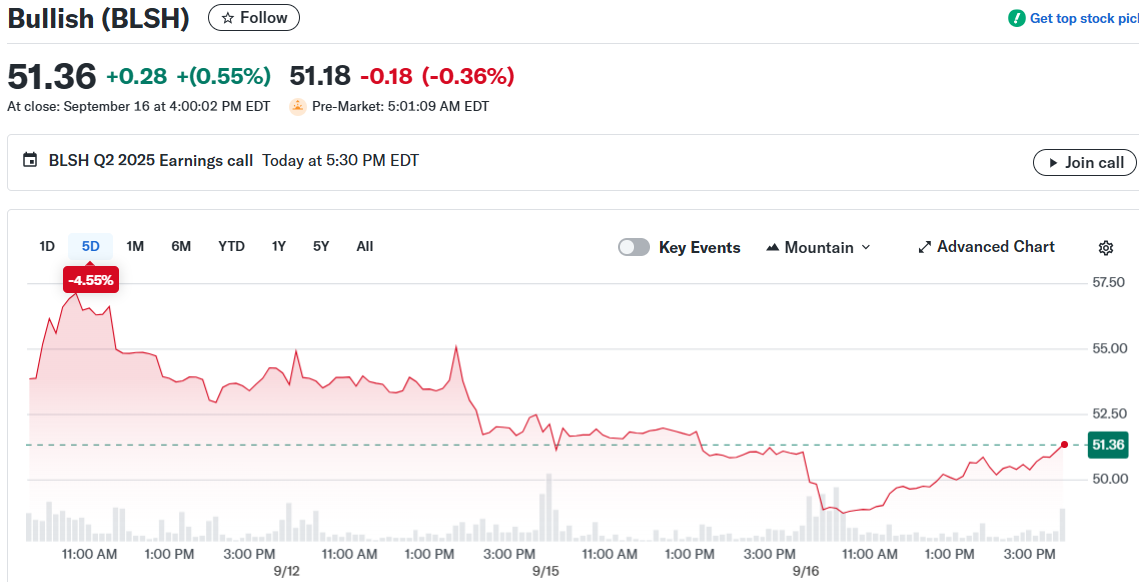

- Bullish stock closed at $51.36 but remains down 24.47% since its NYSE debut last month

- Ark previously bought $172 million worth of Bullish shares during the company’s $1.1 billion IPO week

- Bernstein analysts set a $60 price target and expect Bullish to become the second-largest institutional crypto exchange

Cathie Wood’s Ark Invest continued building its position in crypto exchange Bullish on September 16. The investment firm purchased 161,183 shares worth $8.27 million through two of its exchange-traded funds.

The ARK Innovation ETF (ARKK) acquired 120,609 shares of Bullish stock. The ARK Next Generation Internet ETF (ARKW) bought the remaining 40,574 shares in the same transaction.

The ARKK purchase represents 0.0540% of that fund’s total assets. The ARKW acquisition accounts for 0.0569% of its portfolio holdings.

Bullish shares closed Tuesday at $51.36, gaining 0.55% for the day. The stock has faced headwinds since going public on the New York Stock Exchange last month.

Crypto: Ark Invest Adds $8.3M in Bullish Shares Despite Stock Slide

Cathie Wood’s Ark Invest boosted its stake in crypto exchange Bullish on Tuesday, purchasing $8.27 million worth of shares through its ARKK and ARKW ETFs. The move comes just weeks after Bullish’s $1.1 billion… pic.twitter.com/D81HthsXPP

— BABA CRYPTO (@babacryptoio) September 17, 2025

The crypto exchange’s share price has dropped 24.47% from its debut levels. This decline came despite initial investor enthusiasm for the company’s public offering.

Growing Position in Crypto Exchange

Ark Invest has steadily increased its Bullish holdings since the exchange went public. During the week of Bullish’s initial public offering, Ark purchased approximately $172 million worth of shares.

The investment firm spread these purchases across three different ETFs. This buying activity made Ark one of the largest institutional investors in the newly public crypto exchange.

Bullish completed its market debut through a $1.1 billion IPO process. The company chose the New York Stock Exchange for its public listing.

The exchange operates as an institutional-focused crypto trading platform. It targets professional traders and large-volume cryptocurrency transactions.

Analyst Expectations

Research firm Bernstein published analysis on Bullish earlier this month. The analysts expect the company to become a major player in institutional crypto trading.

Bernstein set an initial price target of $60 per share for Bullish stock. This target suggests potential upside from current trading levels.

The research firm believes Bullish could emerge as the second-largest institutional crypto exchange. This projection depends on the successful launch of the company’s U.S. operations in 2026.

Coinbase currently holds the top position in institutional crypto exchange market share. Bernstein expects Bullish to challenge this leadership position over time.

Additional Investment Activity

Ark Invest made other notable purchases on the same trading day. The firm bought 109,678 shares of Figma Inc. worth approximately $5.9 million.

Figma operates as a digital design technology company. The company went public on July 31 with its own NYSE listing.

Figma disclosed crypto holdings in its IPO filing documents. The company owned $70 million worth of Bitwise bitcoin ETF shares and $30 million in USDC stablecoin with plans to purchase bitcoin.