TLDR

- Ark Invest bought $21.2 million worth of Bullish shares and $16.2 million worth of Robinhood shares on Tuesday

- This marks the third consecutive day Ark has purchased Robinhood stock, following $14 million and $9 million buys

- Ark Innovation ETF now holds over 1.1 million Bullish shares valued at approximately $73.85 million

- Both Bullish and Robinhood stocks fell on Tuesday, dropping 6.1% and 6.5% respectively

- Crypto-related stocks tumbled across the board, with Coinbase down 5.82% and Galaxy Digital losing 10.06%

Cathie Wood’s Ark Invest purchased $37.4 million worth of crypto-related stocks on Tuesday, adding to its growing positions in both Bullish and Robinhood Markets. The investment firm bought $21.2 million in Bullish shares and $16.2 million in Robinhood stock through its ARK Innovation ETF.

The Tuesday purchase added 356,346 Bullish shares to Ark’s holdings at $59.51 per share. The ARK Innovation ETF now holds 1,165,397 Bullish shares with a total value of roughly $73.85 million.

This latest Bullish investment builds on Ark’s earlier allocation of more than 2.5 million shares across three ETFs. The firm made this initial purchase on Bullish’s first day of trading, creating a position then valued at over $170 million.

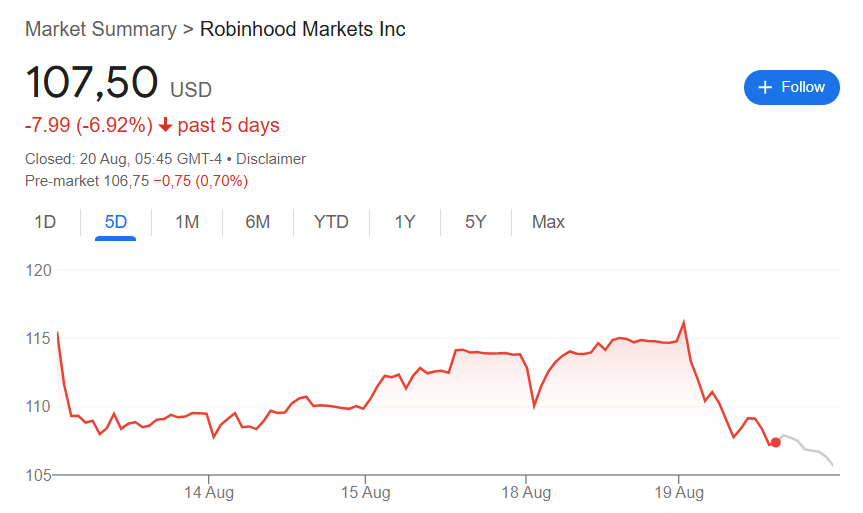

Robinhood has become one of Ark’s most consistent crypto-adjacent investments. The firm purchased 150,908 Robinhood shares on Tuesday at $107.50 per share, marking the third straight trading day of purchases.

Consecutive Days of Investment

Ark previously bought $14 million worth of Robinhood shares on Monday and $9 million on Friday. This pattern shows sustained interest in the trading platform despite market volatility.

The purchases came during a difficult day for crypto-related stocks. Bullish closed down 6.09% at $59.51 and dropped another 3.24% in after-hours trading according to Yahoo Finance data.

Robinhood fell 6.54% to $107.50 during regular trading hours. The stock declined a further 1.23% after the market close.

Other crypto stocks also faced selling pressure on Tuesday. Coinbase Global dropped 5.82% while Galaxy Digital lost 10.06% of its value.

Broader Market Weakness

MicroStrategy fell 7.43% and Circle slipped 4.49%. The weakness in crypto stocks came as the broader Nasdaq Composite declined 1.46% on Tuesday.

Bullish operates as a crypto exchange and is the parent company of CoinDesk. The company made its debut on the New York Stock Exchange recently, attracting immediate attention from institutional investors like Ark.

Robinhood has expanded its crypto offerings in recent years, making it an attractive investment for funds seeking exposure to digital assets. The platform allows users to trade both traditional stocks and cryptocurrencies.

Ark’s continued purchases suggest confidence in both companies despite short-term price declines. The investment firm has built substantial positions in both stocks over recent trading sessions.

The Tuesday purchases occurred as crypto markets faced broader headwinds. Bitcoin and other digital assets have experienced volatility in recent weeks, affecting related equity investments.