TLDR

- Chainlink (LINK) is trading at $18.21 and analyst Ali Martinez predicts a potential 300% gain if the token drops to $15 before rallying to $46.31

- The token has formed an inverse head-and-shoulders pattern on technical charts, which typically signals a bullish breakout

- Chainlink’s Strategic LINK Reserves program has accumulated 585,641 tokens worth $10.4 million through buybacks using network revenue

- Whale investors have accumulated over 2.96 million LINK tokens worth $52 million while exchange balances dropped by 21 million tokens

- The SEC is reviewing LINK ETF applications from Grayscale and Bitwise, which could increase demand if approved

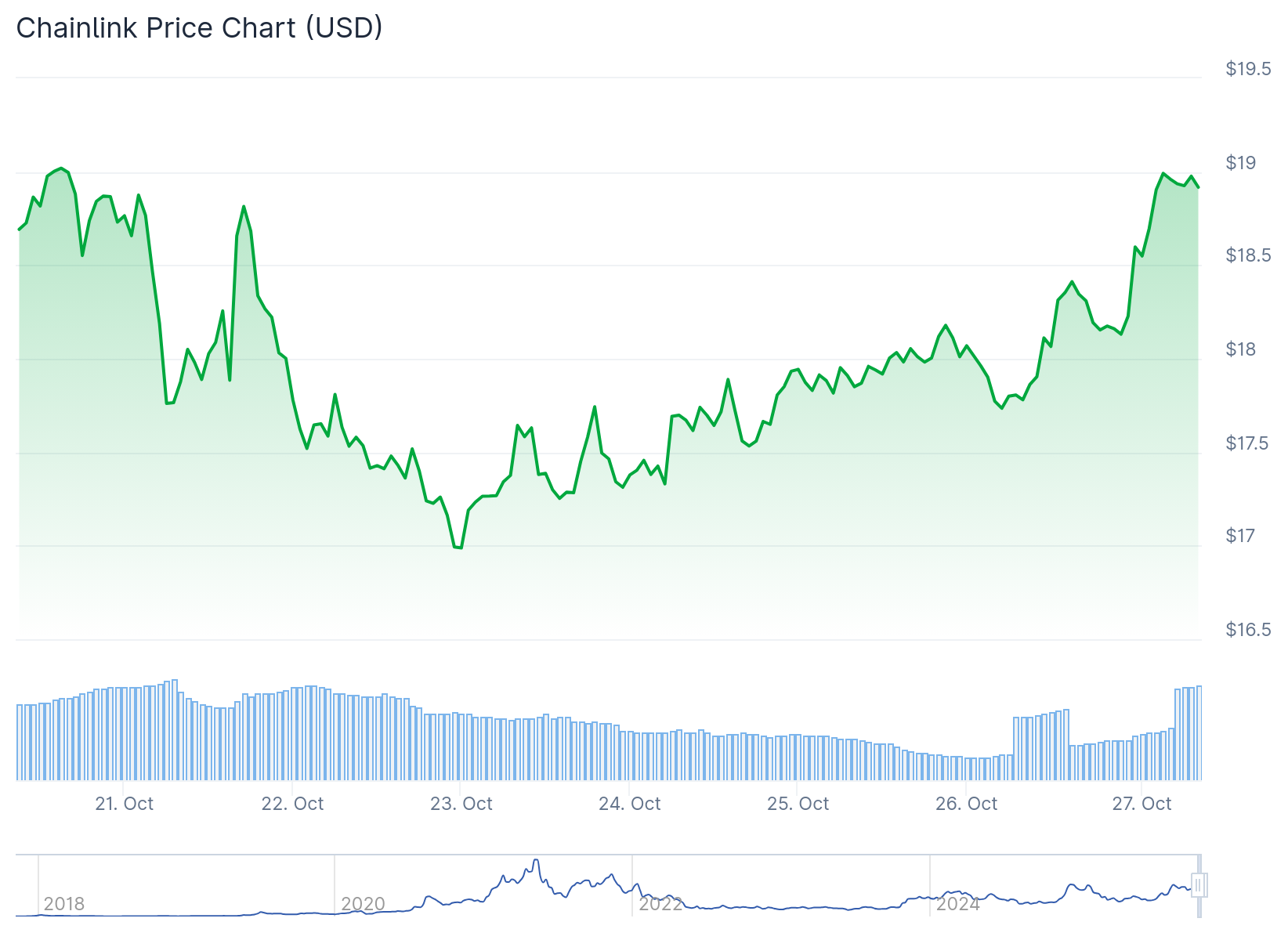

Chainlink is currently trading at $18.21 after gaining 2.41% in the past day. The token has seen a 7.64% increase over the past week.

Market analyst Ali Martinez recently shared a technical analysis suggesting LINK could surge 300% in the coming months. His analysis focuses on an ascending parallel channel that has guided the token’s price action since mid-2023.

Simple plan for Chainlink $LINK:

– Buy the dip at $15.

– Take profits at $46. pic.twitter.com/4O5I0sNr57— Ali (@ali_charts) October 25, 2025

Martinez expects LINK to drop to around $15 before staging a recovery. This price level matches the 0.618 Fibonacci retracement level. The analyst views $15 as a strong buying opportunity for investors.

From that accumulation zone, Martinez projects LINK could climb to $46.31. This target aligns with the 1.272 Fibonacci extension level. The analyst warns that resistance around $20.04 could trigger a brief pullback to $18 before the main rally begins.

Strategic Reserve Program Gains Momentum

Chainlink launched its Strategic LINK Reserves program in early August. The program uses all network revenue to buy back LINK tokens. The developers purchased 63,480 tokens this week alone.

The reserve now holds 585,641 LINK tokens valued at $10.4 million. At the current buying pace, the reserve could exceed $100 million within 12 months. This buyback pressure removes tokens from circulation.

The reserve program aims to improve tokenomics while capitalizing on future price increases. The consistent buying creates ongoing demand in the market.

Technical Indicators Show Bullish Setup

The four-hour chart reveals an inverse head-and-shoulders pattern. The head formed at $15.63 with a slanted neckline. This pattern typically precedes upward price movement.

The True Strength Index moved from minus 46 on October 11 to neutral. The Relative Strength Index now sits slightly above 50. Both indicators show improving momentum.

LINK has crossed above its 25-period Exponential Moving Average. A bullish divergence pattern has also formed. These technical signals support the case for higher prices.

The pattern suggests a move toward $25, which represents a 42% gain from current levels. This matches the high point from September 13.

Whale Activity Increases

Large investors have accumulated over 2.96 million LINK tokens worth $52 million. Data from Nansen tracks this whale buying activity over recent weeks. Experienced traders often signal confidence through large purchases.

Whales keep accumulating $LINK.

39 new wallets have withdrawn 9.94M $LINK($188M) from #Binance since the 1011 market crash.https://t.co/N4RfX2npyl pic.twitter.com/aZcl3uYlZJ

— Lookonchain (@lookonchain) October 27, 2025

Exchange balances have dropped from 284 million tokens in September to 263 million currently. This represents 21 million tokens worth $357 million leaving exchanges. Tokens moving off exchanges typically indicates buying and holding rather than selling.

Lower exchange reserves reduce available supply for trading. Combined with whale accumulation, this creates upward price pressure.

Ecosystem Partnerships and ETF Applications

The US government recently selected Chainlink as its oracle platform for on-chain data. The network also partnered with S&P Global for its Stablecoin Stability Assessments program.

Major companies including Swift, JPMorgan, Coinbase, and Treehouse use Chainlink technology. These partnerships generate revenue that funds the strategic reserve program.

The SEC is reviewing ETF applications from Grayscale and Bitwise for LINK-based funds. ETF approval would provide a regulated investment vehicle for institutional investors. This could drive increased demand similar to Bitcoin ETF launches.

LINK maintains a market cap of $12.35 billion, making it the twelfth largest cryptocurrency. Daily trading volume stands at $366 million, down 43.38% from the previous day. The token remains down 11.05% over the past month despite recent gains.