TLDR

- Cipher Mining signed a 10-year AI hosting contract with Google-backed Fluidstack worth approximately $3 billion, starting October 2026

- The deal covers 168MW of computing power at Cipher’s Barber Lake facility, marking the company’s first entry into AI infrastructure

- Cipher raised $1.1 billion through zero-coupon convertible notes due in 2031, avoiding equity dilution while retaining 100% ownership of Barber Lake

- Google received 5.4% pro forma equity ownership and warrants for approximately 24 million Cipher shares as part of the financing arrangement

- Three analysts raised price targets: H.C. Wainwright to $17, Rosenblatt to $14, and Keefe, Bruyette & Woods to $13, with Canaccord Genuity increasing to $16

Cipher Mining announced its first high-performance computing co-location contract with Fluidstack, an AI cloud platform developer backed by Google. The 10-year agreement brings approximately $3 billion in contracted revenue to the bitcoin mining company.

The deal involves 168MW of computing power at Cipher’s Barber Lake facility. Operations will begin in October 2026. Google is supporting the project with $1.4 billion in financing.

To fund the development, Cipher raised $1.1 billion through convertible senior notes due in 2031. The notes carry a zero percent coupon rate. The offering was increased from the initially planned $800 million.

Initial purchasers have an option to buy an additional $200 million in notes. This financing structure allows Cipher to retain complete ownership of Barber Lake. Management had previously considered selling a stake in the project to reduce debt.

Google acquired warrants to purchase roughly 24 million Cipher shares. This gives Google a 5.4% pro forma equity ownership stake in the company. The arrangement provides both financing and a strategic partnership.

The announcement triggered multiple analyst upgrades. H.C. Wainwright’s Mike Colonnese raised his price target to $17 per share from $7.50. Chris Brendler of Rosenblatt increased his target to $14 from $9.

Analyst Response

Bill Papanastasiou of Keefe, Bruyette & Woods doubled his fair value assessment to $13 per share from $6.50. Canaccord Genuity raised its target to $16 from $12. All analysts maintained buy ratings on the stock.

The upgrades cited the deal as validation of demand in the large-scale AI compute market. Analysts noted Cipher’s stronger position for future capital raising. The company’s share price gains over recent months provided better currency for fundraising.

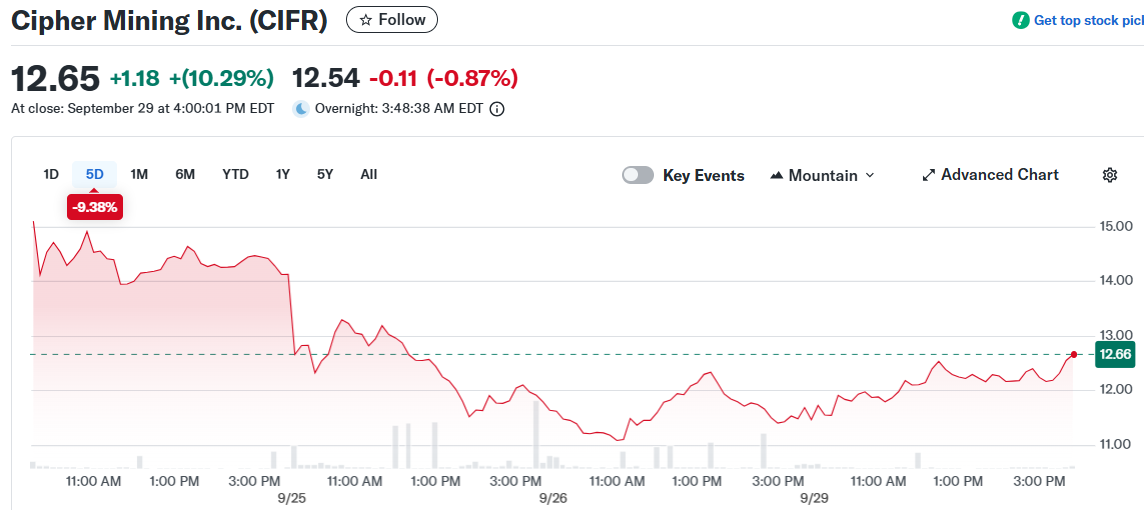

Cipher Mining’s stock rose more than 10% on Monday following the announcements. Bitcoin also contributed to the rally, rising 3% in the preceding 24 hours. The benchmark S&P 500 index gained 0.3% during the same trading session.

Future Growth Potential

The Fluidstack agreement doesn’t cover Cipher’s entire Barber Lake capacity. This leaves room for additional AI hosting contracts at the facility. Keefe, Bruyette & Woods found it unusual that Fluidstack didn’t secure all available capacity or negotiate expansion options.

Cipher operates a 2.6 gigawatt development pipeline beyond Barber Lake. Other energized sites like Odessa and the ramping Black Pearl could also attract AI co-location deals. The partial agreement at Barber Lake suggests other opportunities remain available.

The company joins other bitcoin miners pivoting to AI infrastructure. This trend reflects growing demand for computing power in artificial intelligence applications. Cipher’s stock reached around $11.60 per share in early trading following the analyst upgrades.