TLDR

- Q3 2025 profit rose 16% to $3.8 billion, despite a $726 million loss from the Banamex stake sale.

- Adjusted EPS came in at $2.24, topping analyst estimates of $1.90, with revenue up 9% to $22.1 billion.

- All five divisions, Markets, Banking, Services, Wealth, and US Retail, reported record third-quarter revenue.

- Investment banking revenue jumped 34%, while markets revenue surged 15% to $5.6 billion.

- CEO Jane Fraser highlighted progress on AI automation, BlackRock partnership, and plans to exceed $84 billion FY revenue.

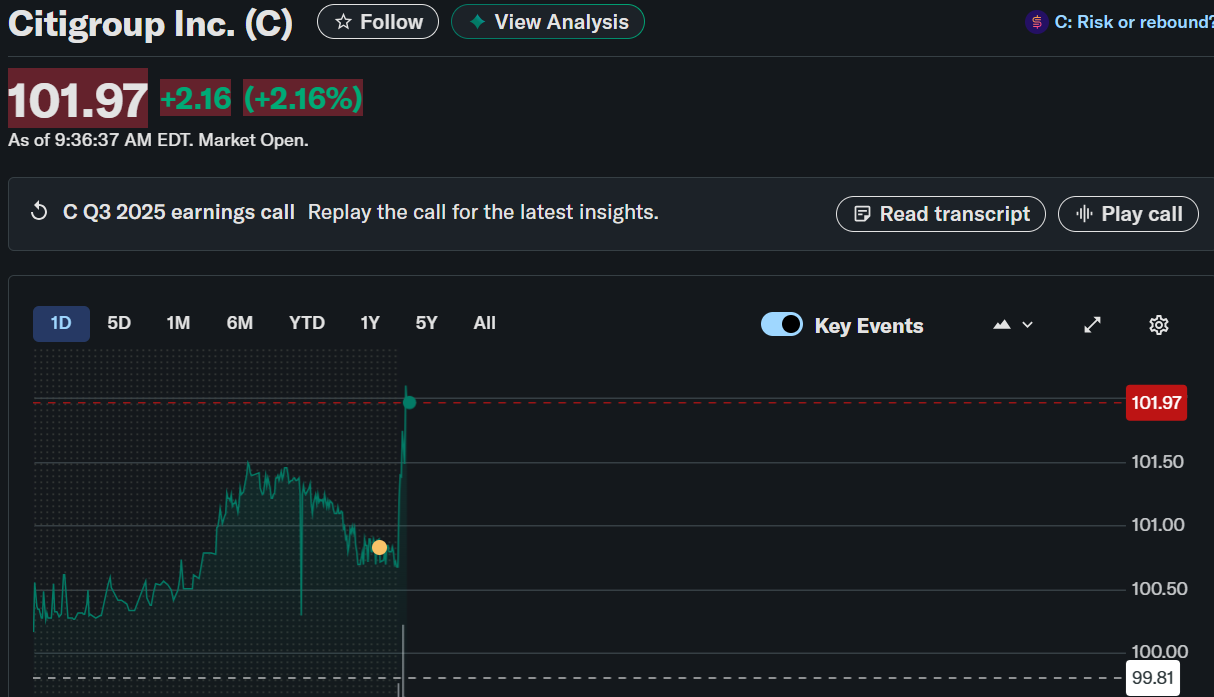

Citigroup Inc. (C) stock surged sharply to $101.97, up 2.16% in early trading following its Q3 2025 earnings call,

The bank reported a 16% profit increase, driven by record revenue across all divisions, even as it booked a $726 million loss from the sale of its Banamex stake.

Strong Quarter Across All Divisions

Net income climbed to $3.8 billion, or $1.86 per share, while adjusted earnings excluding the Banamex loss stood at $4.5 billion, or $2.24 per share, beating expectations of $1.90. Revenue rose 9% year-over-year to $22.1 billion, with record results in Markets, Banking, Services, Wealth, and U.S. Personal Banking.

Citigroup, $C, Q3-25. Results:

📊 Adj. EPS: $2.24 🟢

💰 Revenue: $22.09B 🟢

📈 Net Income: $3.75B

🔎 Strong performance in U.S. Personal Banking and Markets segments helped offset restructuring-related impacts in Legacy Franchises. pic.twitter.com/j8m91d06lf— EarningsTime (@Earnings_Time) October 14, 2025

CEO Jane Fraser credited the bank’s transformation strategy and resilient global economy for the strong quarter. “Every business had record third-quarter revenue and improved returns,” Fraser said. She added that the firm’s restructuring has positioned Citi for sustainable growth, supported by robust consumer spending and renewed capital markets activity.

Revenue Drivers and Segment Performance

Citigroup’s banking division revenue surged 34%, boosted by stronger dealmaking and capital markets activity. Investment banking fees rose 17%, with notable contributions from advisory, M&A, and underwriting. The bank benefited from a rebound in mega-deals amid optimism over U.S. rate cuts and lighter regulation.

Markets revenue increased 15% to $5.6 billion, driven by solid performance in equities and fixed income. Services revenue rose 7%, with assets under custody and administration (AUCA) up 13% to nearly $30 trillion. Wealth revenues grew 8%, as client investment assets jumped 14%, while U.S. Personal Banking achieved its 12th consecutive quarter of positive operating leverage, generating a record $5.3 billion in revenue.

Strategic Initiatives and Outlook

Citigroup advanced its Banamex divestiture, marking a major milestone in simplifying its global operations. Fraser emphasized the significance of the sale, noting progress toward full deconsolidation. The bank also announced a new partnership with BlackRock to manage $80 billion in client assets, aligning with its open-architecture wealth strategy.

Citi’s adoption of artificial intelligence remains central to its operational transformation. Nearly 180,000 employees in 83 countries are now using proprietary AI tools, recording 7 million uses this year. AI-driven code reviews have surpassed 1 million, significantly improving developer productivity.

CFO Mark Mason reported that Citigroup repurchased $5 billion in shares during the quarter, $1 billion above guidance, and ended Q3 with a CET1 ratio of 13.2%. The bank expects capital requirements to ease next year as the Basel III endgame concludes, providing flexibility for further buybacks.

Financial Metrics and Market Performance

Citigroup’s return on tangible common equity (ROTCE) was 8.6%, or 9.7% excluding the Banamex loss, slightly below its 2026 target range of 10%–11%. The firm reiterated confidence in surpassing its $84 billion full-year revenue target, driven by broad-based strength and cost discipline.

Citigroup’s stock has gained 44.91% year-to-date and 55.89% over the past year, outperforming the S&P 500’s 13.39%. Its three-year return stands at 159%, with a five-year gain of 179.16%, reflecting sustained investor confidence.

With its AI integration, renewed dealmaking strength, and accelerating cost efficiency, Citigroup is positioned for continued momentum into 2026, even amid regulatory and macroeconomic headwinds.