TLDR

- Coinbase stock fell 7% Thursday, marking its eighth straight losing session to reach May 2025 levels at $195

- Spot crypto trading volumes dropped from $1.7 trillion last year to $900 billion in January 2026

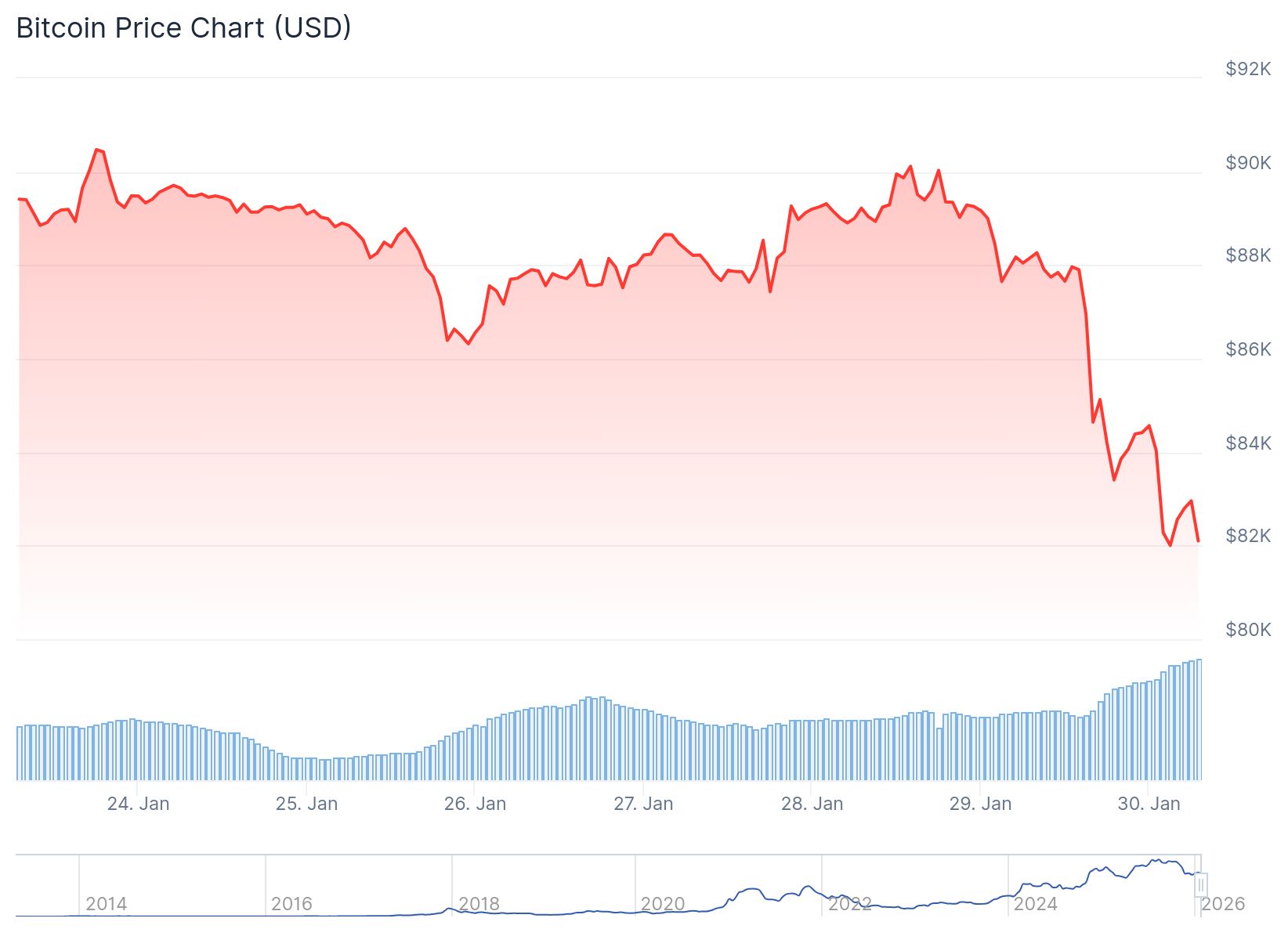

- Bitcoin fell 6% to below $82,000 while Ethereum dropped to $2,816

- Bitcoin miners pivoting to AI infrastructure like Hut 8 and IREN posted year-to-date gains despite Thursday’s selloff

- Strategy and BitMine stocks both fell nearly 10% as their crypto holdings lost value

Crypto-related stocks fell sharply on Thursday as bitcoin dropped 6% to below $82,000. The decline affected major exchanges and treasury companies across the sector.

Coinbase, the largest publicly traded crypto company, dropped 7% to $195 on Thursday. This marked the eighth consecutive day of losses for the exchange. The stock hasn’t traded at these levels since May 2025.

Competing exchanges also took losses. Gemini fell 8% on Thursday and is down 21% for the year. Bullish and Circle have declined 16% and 20% respectively in 2026.

Trading Volume Drops by Half

Spot crypto trading volumes fell dramatically in January. Data from TheTie shows volumes reached just $900 billion compared to $1.7 trillion a year earlier. The 47% decline reflects reduced market activity and cautious investor behavior.

Eric He from crypto exchange LBank said bitcoin has been stuck around $85,000. He noted that rising geopolitical tensions are making investors more cautious. The hesitation is showing up across different asset classes.

He pointed out that while stocks and commodities are moving higher, crypto remains in a wait-and-see phase. Analysts will monitor trading volumes and macroeconomic data heading into February.

Bitcoin treasury companies also suffered losses. Strategy stock fell nearly 10% to $143.19, its lowest level since September 2024. The company holds 712,647 BTC worth approximately $60 billion at current prices.

Strategy added to its holdings on Monday by purchasing $267 million worth of bitcoin. The company is co-founded by chairman Michael Saylor, a vocal bitcoin advocate.

AI-Focused Miners Outperform

Bitcoin miners that shifted to AI infrastructure posted gains despite Thursday’s decline. Companies like Hut 8, IREN, CleanSpark, and Cipher Mining all show positive returns for the year. These firms are using their energy and computing resources to serve the AI sector.

Galaxy Digital also outperformed in 2026 despite Thursday’s losses. The crypto merchant bank recently received approval from Texas grid operator ERCOT for data center expansion.

BitMine Immersion Technologies dropped nearly 10% to $26.70. The Ethereum treasury company holds approximately $11.9 billion worth of ETH, representing 3.5% of total supply. BitMine purchased $116 million worth of ETH at the start of this week.

Ethereum fell 6.6% to $2,816 on Thursday. Users on prediction market Myriad increased odds that Ethereum will hit $2,500 before reaching $4,000, raising probability from 65% to over 75%.

The U.S. Senate blocked a continuing resolution to prevent a partial government shutdown on Thursday afternoon. Lawmakers have until Saturday to reach an agreement. Microsoft’s stock decline also fueled concerns about a potential AI bubble.

Bitcoin recovered slightly from its daily low of $83,407 to trade at $84,416. The price remains above the late November low when it briefly dropped below $83,000.