TLDR

- Over $1.8 billion in crypto positions were liquidated in 24 hours, marking the largest long liquidation event of 2025

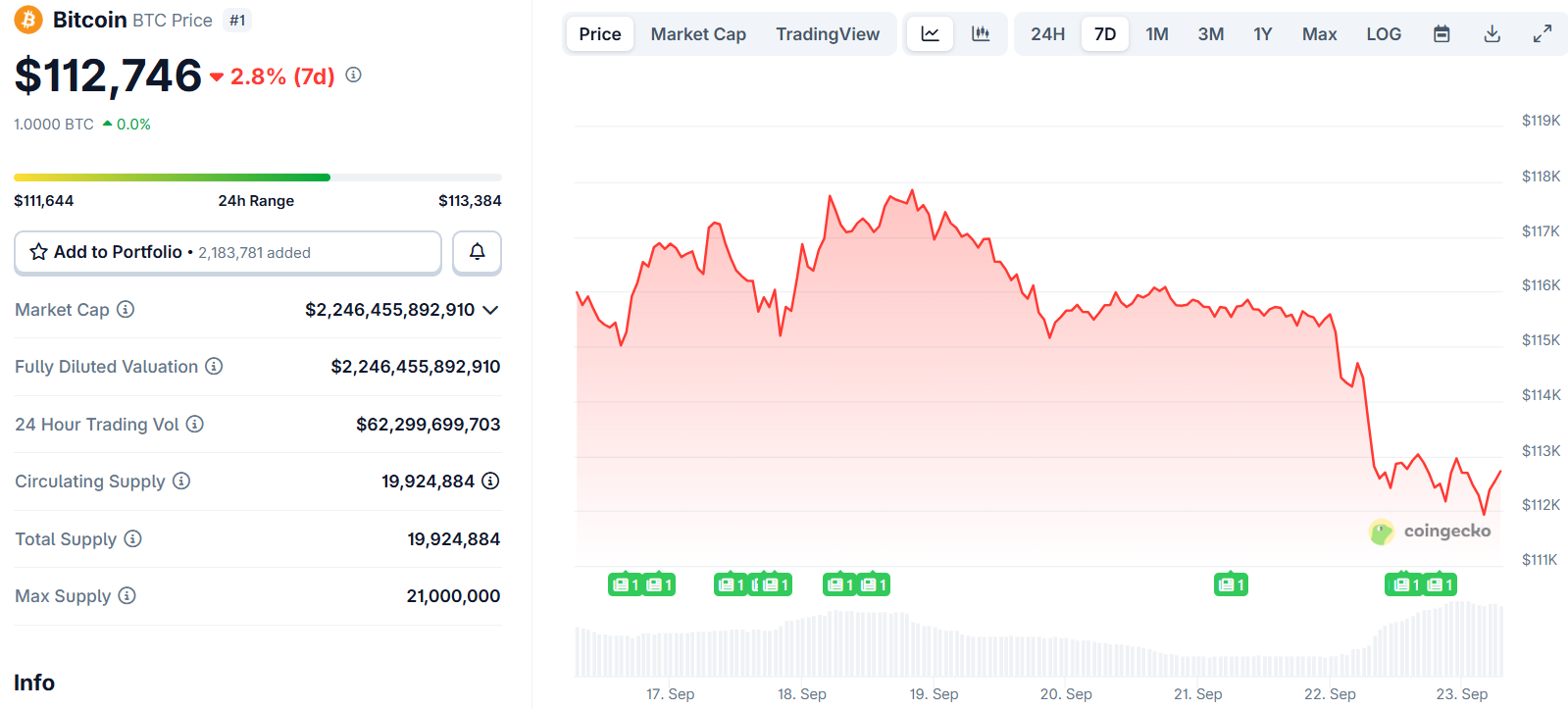

- More than 370,000 traders were liquidated as Bitcoin fell below $112,000 and Ethereum dropped below $4,150

- The crypto market lost over $150 billion in value, falling to $3.95 trillion total market cap

- Options traders are buying puts and pricing in further downside for September despite low implied volatility

- Long-term positioning for the next 3-6 months remains bullish according to options data

Cryptocurrency markets experienced one of their worst days of 2025 on Monday as overleveraged positions triggered a massive liquidation cascade. The selloff wiped out nearly $2 billion in trader positions within 24 hours.

More than 370,000 traders saw their positions liquidated, totaling $1.8 billion in losses according to CoinGlass data. The liquidations primarily affected long positions betting on higher prices for Bitcoin and Ethereum.

Bitcoin fell below $112,000 on Coinbase while Ethereum dropped under $4,150 during the rout. The decline represented Ethereum’s biggest pullback since mid-August and pushed Bitcoin down 9.5% from its all-time high.

The broader crypto market capitalization shed over $150 billion in value, dropping to a two-week low of $3.95 trillion. Altcoins faced widespread selling pressure alongside the major cryptocurrencies.

Ethereum positions saw the heaviest liquidations at over $500 million, more than double the liquidations for Bitcoin long positions. This imbalance caught the attention of market observers who pointed to excessive altcoin leverage as a key factor.

Real Vision founder Raoul Pal described the pattern as typical market behavior. He explained that traders often get overleveraged ahead of expected breakouts, leading to liquidations when the initial attempt fails.

Same thing happens all the time… the crypto market is focused on a big breakout, gets levered long ahead of it, it fails at first attempt so everyone gets liquidated… only then does the actual breakout occur, leaving everyone sidelined.

— Raoul Pal (@RaoulGMI) September 22, 2025

Technical Factors Drive Selling Pressure

Market analysts attributed the selloff to technical rather than fundamental factors. The liquidations followed a familiar pattern seen in previous market corrections throughout 2025.

Similar liquidation events occurred in late February, early April, and early August when spot markets lost hundreds of billions in value over short periods. CoinGlass confirmed Monday’s event as the largest long liquidation of the year.

Researcher “Bull Theory” blamed excessive altcoin leverage compared to Bitcoin for triggering the cascade. The imbalance created conditions where one sharp downward move could trigger widespread liquidations across multiple assets.

Nassar Achkar from CoinW exchange suggested the flush-out represented a near-term adjustment rather than a fundamental shift in the bull market trend. He pointed to supportive monetary policy as a continued tailwind for risk assets like Bitcoin.

Options Traders Position for More Downside

Despite the scale of Monday’s liquidations, options market data shows muted implied volatility according to GreeksLive chief researcher Adam Chu. However, put-buying activity increased after the crash as traders positioned for further declines.

Sean Dawson from options platform Derive noted heightened demand for put options as fears of continued downward price action worried the market. This activity suggests traders are pricing in additional near-term weakness.

Max Shannon from Bitwise Europe observed that one-week and one-month put-call delta skew reached its highest level since early August. The metric indicates increased put-buying for downside protection among options traders.

The bearish positioning may reflect “sell-the-news” dynamics following the Federal Reserve’s quarter-point rate cut on September 17. Traditional assets like the S&P 500 and gold have outperformed crypto since the Fed’s dovish Jackson Hole comments in late August.

Potential Support Levels Ahead

IG market analyst Tony Sycamore suggested Bitcoin could test support around $105,000 to $100,000, including the 200-day moving average at $103,700. He viewed a potential dip to these levels as a healthy correction that could flush out weaker positions.

The current correction remains relatively shallow compared to previous bull market pullbacks. Bitcoin had only corrected 13% in early September from its August peak, with the current drop from all-time highs standing at 9.5%.

Bitcoin has fallen in eight of the past 13 September months but remains up approximately 4% for the current month. Historical data shows the cryptocurrency typically performs better in October.

Despite near-term bearishness, options positioning for the next three to six months remains bullish according to multiple analysts. Market makers are net short gamma in Ethereum, which could force spot purchases if prices move against their positions.

The liquidation event appears to have found temporary support levels as major cryptocurrencies stabilized following Monday’s decline.