TLDR

- Bitcoin led the crypto fund inflows with $931 million in net inflows during the reporting period.

- Total assets under management across all crypto fund products reached $229.652 billion.

- Ethereum recorded its first outflows in five weeks, totaling $168.7 million.

- The United States experienced the most significant regional inflows, totaling $843 million, during the week.

- Germany experienced one of its most significant weekly inflows at $502.1 million, setting a new record.

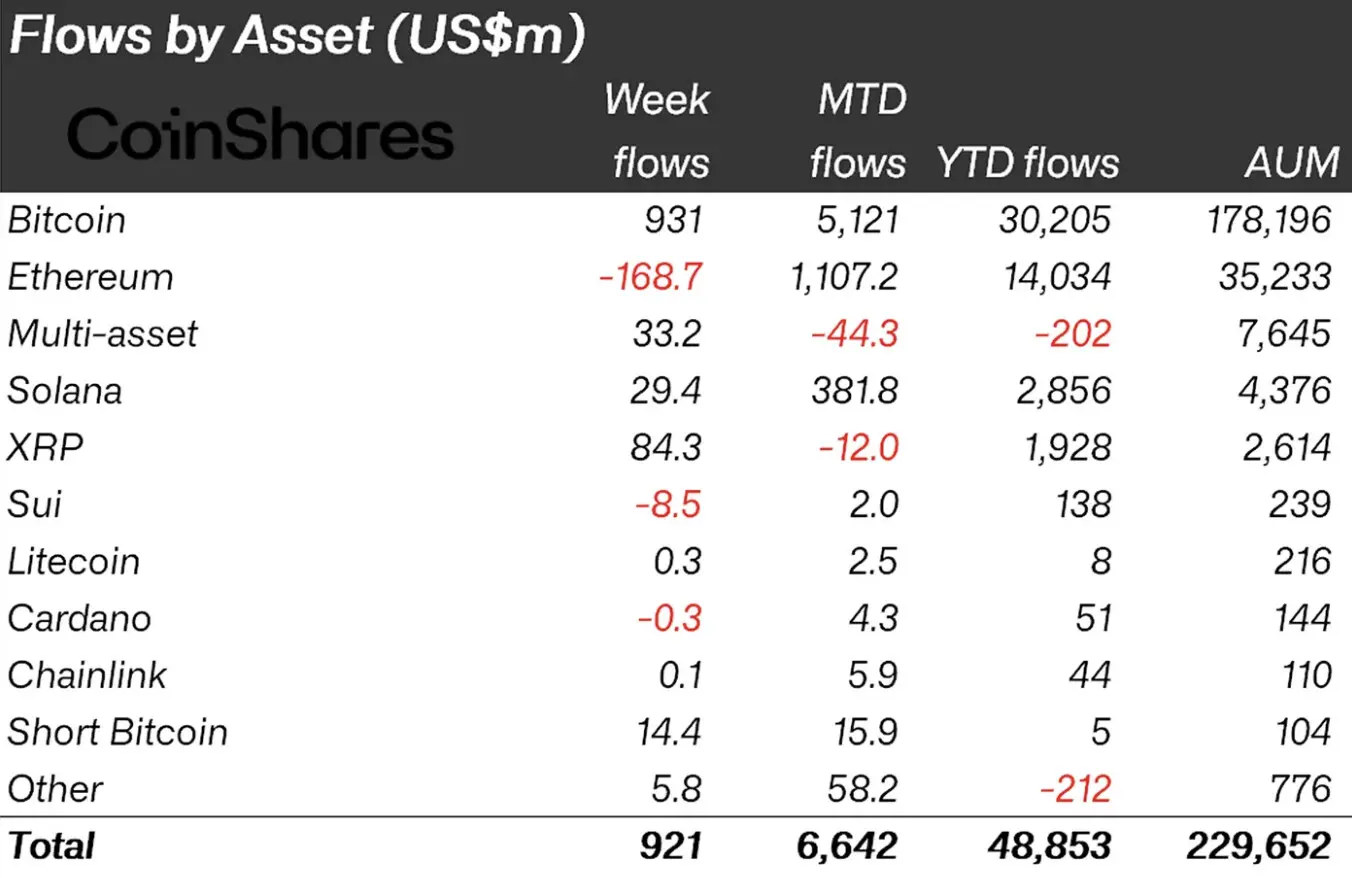

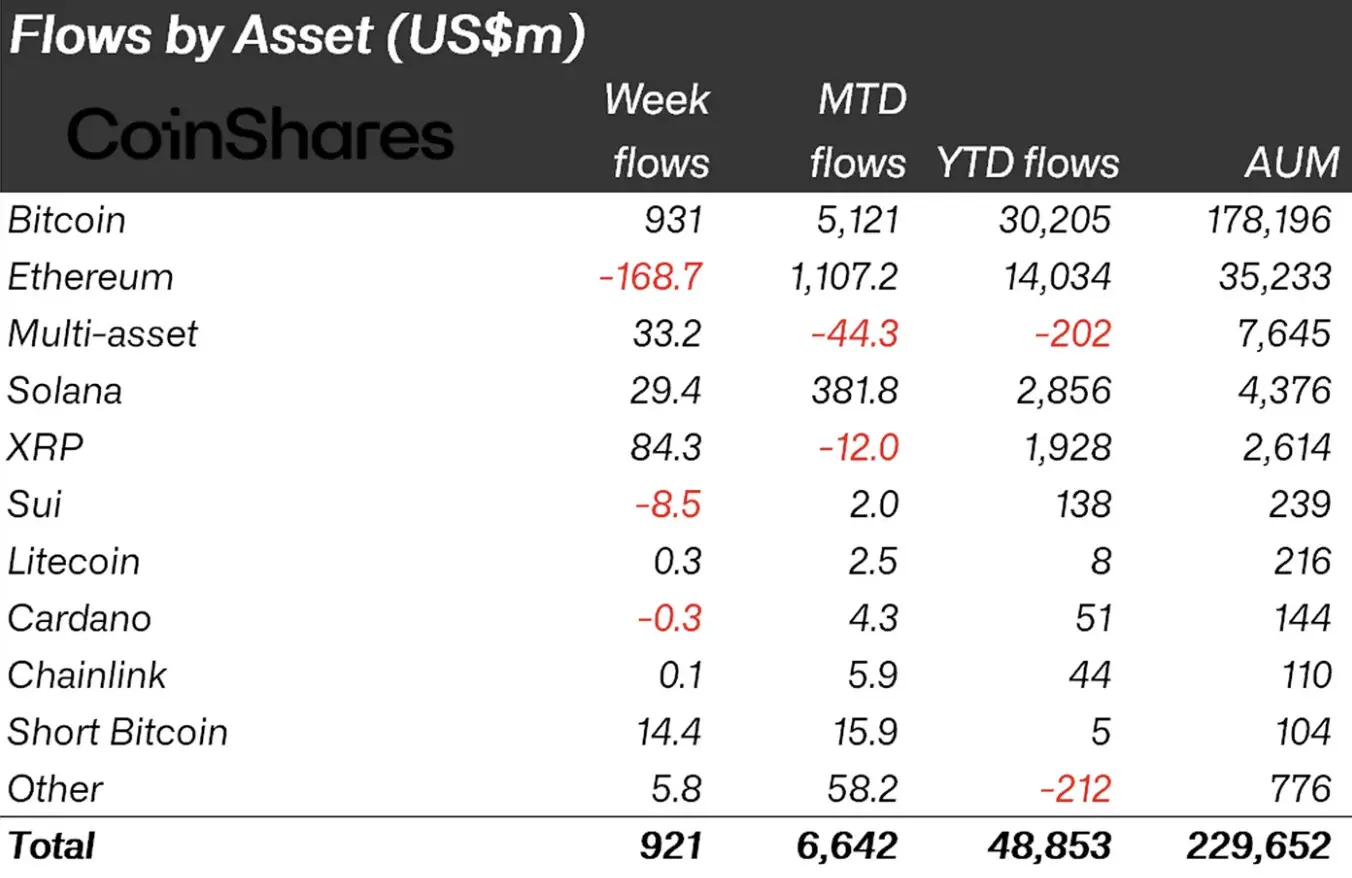

Digital asset investment products attracted $921 million in crypto fund inflows during the recent reporting period. Bitcoin (BTC) dominated the week with $931 million in net inflows, according to CoinShares data from October 24, 2025. Total assets under management across all products reached $ 229.65 billion, as institutional interest remained strong.

Market sentiment improved after the US released lower-than-expected consumer price index data on Friday. This development restored expectations for potential interest rate cuts later this year. Consequently, investors increased their allocations to digital asset products across multiple regions and providers.

Bitcoin products absorbed the majority of positive market sentiment during the reporting period. The leading cryptocurrency recorded $931 million in weekly crypto fund inflows, surpassing the total for all products. Month-to-date flows reached $5.121 billion, while year-to-date inflows totaled $30.205 billion for Bitcoin products.

Bitcoin Maintains Dominance Despite Year-Over-Year Decline

Assets under management for Bitcoin products reached $178.196 billion during the reporting period. The weekly inflows pushed cumulative flows to $9.4 billion since the Federal Reserve began cutting rates. However, the year-to-date figure of $30.2 billion lags behind the $41.6 billion recorded during the same period last year.

iShares ETFs recorded $235 million in weekly inflows to its Bitcoin crypto funds through its US-based products. The provider’s month-to-date flows reached $5.049 billion, while year-to-date inflows totaled $38.687 billion. Assets under management for iShares stood at $104.851 billion, making it the largest provider.

Fidelity Wise Origin Bitcoin Fund attracted $52 million in weekly inflows during the reporting period. The fund’s month-to-date total reached $320 million, and year-to-date inflows stood at $885 million. Meanwhile, Grayscale Investments experienced $118 million in weekly outflows, bringing the month-to-date total to a negative $598 million.

Grayscale recorded year-to-date outflows of $2.370 billion despite maintaining $32.654 billion in assets under management. The contrasting performance between providers highlights shifting investor preferences within the Bitcoin product landscape. Competition among providers intensified as institutional investors sought lower-fee options for exposure to Bitcoin.

Ethereum Records First Outflows in Five Weeks

Ethereum products experienced their first negative crypto fund inflows in five weeks, with a total of $168.7 million in outflows. The asset saw consistent daily outflows throughout the entire reporting period. Month-to-date flows remained positive at $1.107 billion, while year-to-date inflows reached $14.034 billion.

Total assets under management for Ethereum products stood at $35.233 billion after the weekly outflows. The reversal ended five consecutive weeks of positive flows into Ethereum investment products. Data showed that leveraged Ethereum products continued to attract specific investor segments despite broader outflows.

Multi-asset products recorded $33.2 million in weekly crypto fund inflows but faced month-to-date outflows of $44.3 million. Year-to-date, these products experienced negative flows of $202 million with assets under management totaling $7.645 billion. The mixed performance reflected uncertain investor sentiment toward diversified digital asset exposure.

US Leads Crypto Fund Inflows with $843M

The United States led regional crypto fund inflows with $843 million during the reporting period. Month-to-date flows for US products reached $6.393 billion, while year-to-date inflows totaled $45.498 billion. Assets under management for US-based products totaled $160.896 billion, representing the most significant regional allocation.

Germany recorded one of its most significant weekly crypto fund inflows on record at $502.1 million. The country’s month-to-date flows totaled $561.1 million, and year-to-date inflows reached $2.301 billion. German investors’ assets under management in digital asset products stood at $7.447 billion.

Switzerland experienced significant outflows of $358.9 million for the week, reversing recent positive trends. Month-to-date negative flows reached $229.2 million, though year-to-date inflows remained positive at $602 million. Canada saw weekly outflows of $10.0 million but maintained positive month-to-date flows of $33.3 million.

Solana products attracted $29.4 million in weekly crypto fund inflows, bringing month-to-date flows to $381.8 million. Year-to-date inflows for Solana reached $2.856 billion with assets under management totaling $4.376 billion. XRP investment products recorded $84.3 million in weekly inflows despite month-to-date outflows of $12.0 million.