TLDR

- The US government shutdown entered its sixth day on Monday with no funding deal reached between Congress members

- The SEC is operating with extremely limited staff under modified conditions, stalling crypto ETF applications and exemptive relief work

- The CFTC is also operating with restrictions and only one commissioner serving as acting chair

- Betting platforms show users predict the shutdown will last more than 15 days, with some speculation it could extend beyond 25 days

- With the SEC effectively closed, crypto policy focus shifts to the Federal Reserve, OCC, and FDIC, which can operate during shutdowns

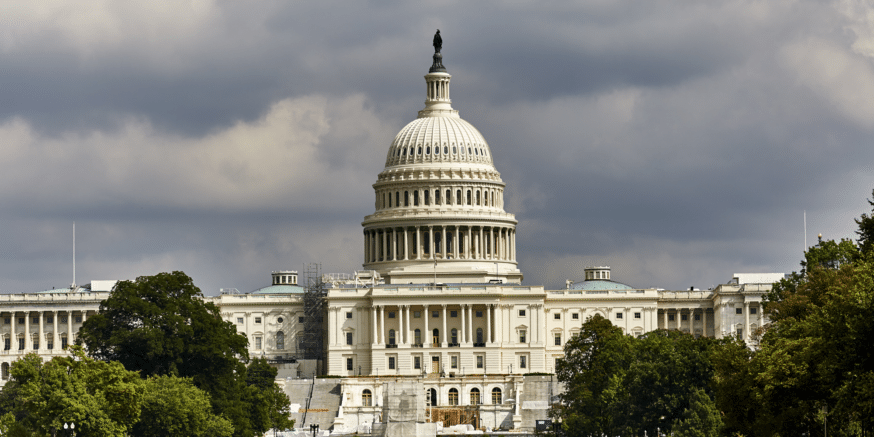

The US government shutdown that began on September 30 continues to impact federal agencies including the Securities and Exchange Commission and Commodity Futures Trading Commission. Congress failed to pass a stopgap funding measure last week, leading to employee furloughs and restricted operations.

🚨BREAKING:

U.S. GOVERNMENT SHUTDOWN IS FORECASTED TO LAST 3 WEEKS

GIGA BULLISH FOR CRYPTO pic.twitter.com/jL7u8GspuB

— symbiote (@cryptosymbiiote) October 5, 2025

The Senate scheduled a vote on a continuing resolution for 5:30 pm ET on Monday. At the time of reporting, it remained unclear whether the measure had enough support to pass.

The budget standoff centers on healthcare policy. Democrats are demanding that any spending bill reverse cuts from a July budget measure.

The SEC announced it would operate under modified conditions with an extremely limited number of staff members. This restriction affects the agency’s ability to review crypto exchange-traded fund applications that were expected to receive approval soon.

The CFTC faces similar operational challenges. The agency currently has only one commissioner serving as acting chair and is operating with limited staff.

Impact on Crypto Industry

TD Cowen’s Washington Research Group said the shutdown puts crypto policy work on ice. The SEC had been exploring exemptive relief for new crypto products and digital asset companies offering tokenized equities.

Jaret Seiberg from TD Cowen stated the agency cannot resume work on crypto policy changes until the government receives funding. The delay extends beyond just the shutdown days, as staff will need time to resume projects after returning.

The shutdown also prevents the Senate from considering bills to establish a digital asset market structure. President Donald Trump cannot nominate replacements for CFTC commissioners during this period.

The White House withdrew the nomination of Brian Quintenz as CFTC chair last week. Reports indicated pushback came from Gemini co-founders Cameron and Tyler Winklevoss, who are Trump donors.

Przemysław Kral, CEO of crypto exchange Zondacrypto, said the shutdown can damage the crypto industry by disrupting the SEC and CFTC. He noted their reduced operational capacity risks stalling innovation and reducing investor confidence.

Predictions and Alternative Pathways

Betting platforms show users expect a lengthy shutdown. Kalshi users gave a 69% chance of the shutdown lasting more than 15 days and 41% for more than 25 days.

Polymarket traders now see a 72% chance that the U.S. government shutdown will last more than 10 days… pic.twitter.com/CKdveT0xxx

— Crypto Rover (@rovercrc) October 6, 2025

Polymarket users assigned a 24% chance the current shutdown would become the longest in US history. The platform showed a 72% chance it would end after October 15.

Trump holds the record for the longest shutdown at 35 days during his first term. That shutdown occurred over his push to build a US-Mexico border wall.

With the SEC effectively closed, TD Cowen said crypto policy will shift to other regulators. The Federal Reserve, Office of the Comptroller of the Currency, and Federal Deposit Insurance Corporation can continue operations during shutdowns.

These agencies will handle matters related to banks issuing stablecoins, serving as custodians for crypto assets, and developing payment systems using tokenization. The CFTC remains operational with restrictions despite having only one acting commissioner.