TLDR

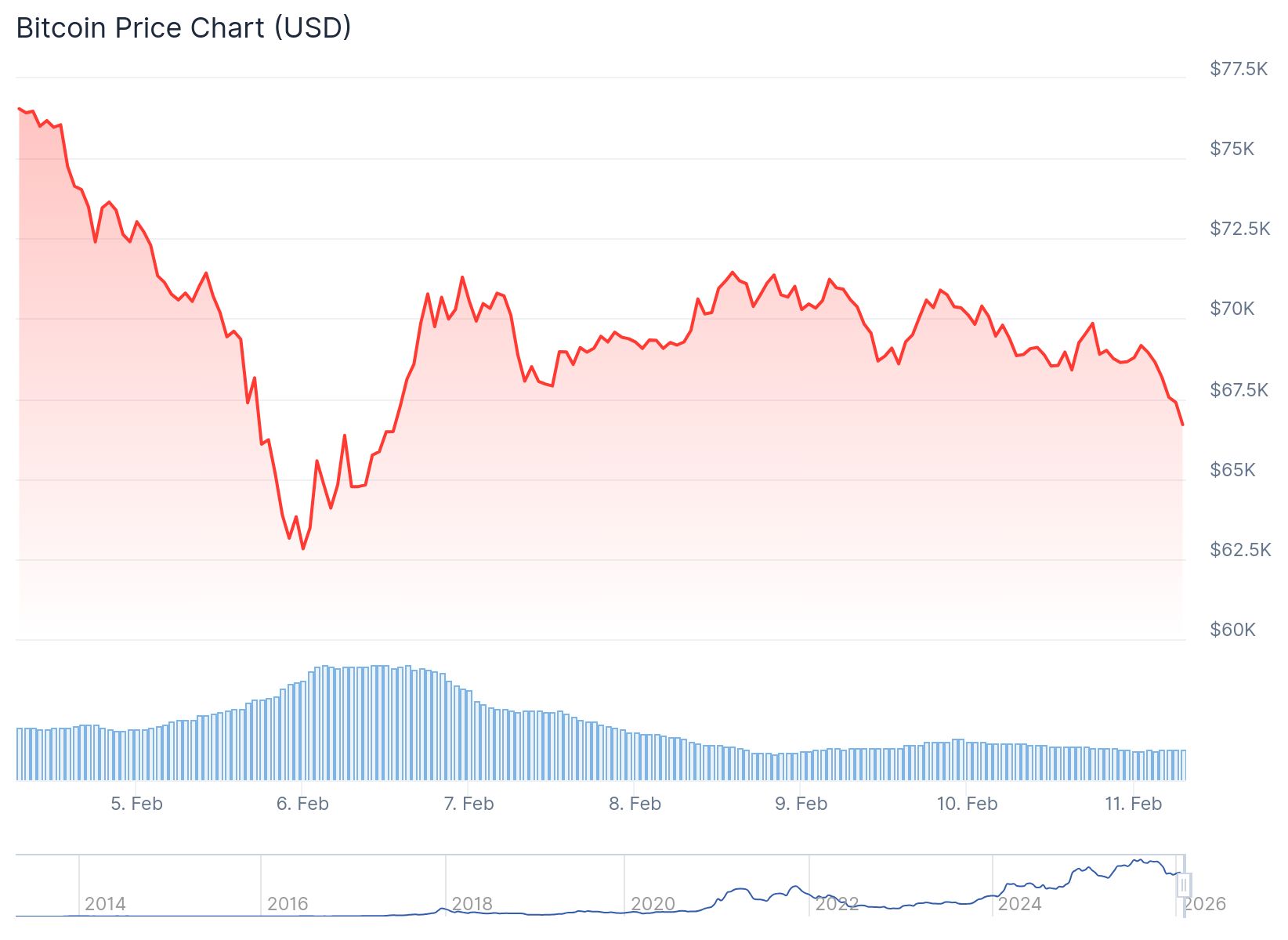

- Bitcoin trades in high-60,000s, down 2% and nearly 30% below year-ago levels as crypto markets search for a bottom

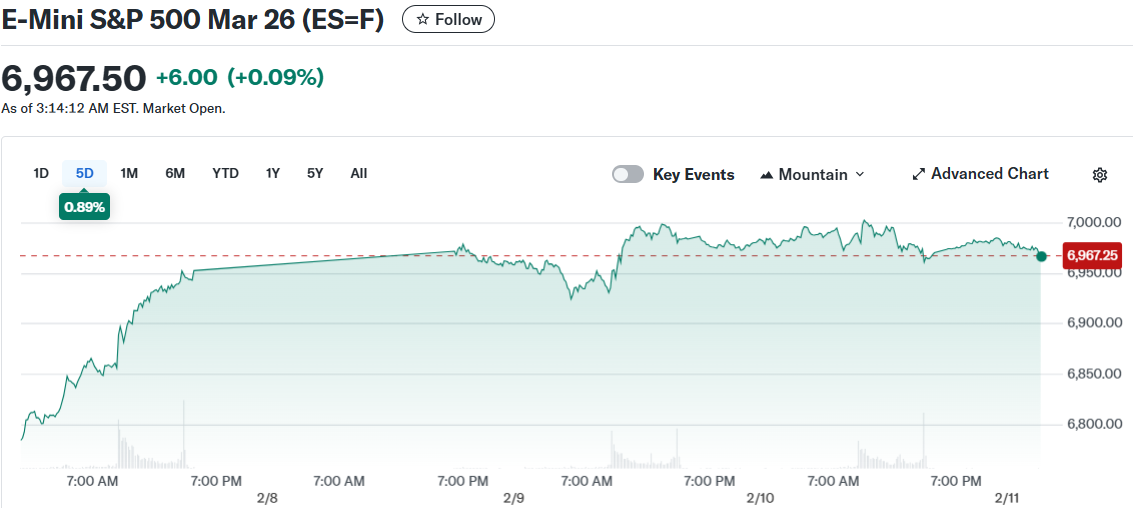

- US stock futures rise slightly ahead of delayed January jobs report, with economists expecting 68,000 new jobs added

- Stalled digital asset legislation in Washington keeps institutional investors cautious despite pro-crypto Trump administration stance

- South Korean exchange Bithumb reports 40-billion-won transaction error due to system flaws, raising infrastructure concerns

- S&P 500 fell 0.3% while Dow hit third consecutive record close as markets react to flat December consumer spending data

US stock futures climbed in overnight trading as investors prepared for a delayed January employment report. At the same time, Bitcoin continued searching for support in the high-60,000s amid growing caution across crypto markets.

Futures tied to the S&P 500 gained 0.2% while Nasdaq 100 futures added 0.2%. Dow Jones Industrial Average futures rose roughly 0.1%. The moves came after the Dow posted its third straight record close during Tuesday’s regular session.

Bitcoin traded down approximately 2% from the previous day, hovering just below the $67,000 level. The leading cryptocurrency has fallen nearly 30% from its price one year ago. Analysts describe the current environment as the early stages of a bottoming process, with shallow bounces and declining trading volumes.

The total cryptocurrency market cap declined for a second consecutive day. Smaller altcoins underperformed as traders moved capital into Bitcoin and stablecoins. Sentiment indicators remain in “extreme fear” territory, showing that investors have reduced risk but not enough to trigger a reversal.

Jobs Report Takes Center Stage

Market participants focused on the January nonfarm payrolls report from the Bureau of Labor Statistics. The report’s release was delayed by last month’s partial government shutdown. Economists surveyed by Bloomberg project a median gain of about 68,000 jobs, with the unemployment rate expected to hold at 4.4%.

Trump’s trade counselor Peter Navarro told Fox News that “We have to revise our expectations down significantly for what a monthly job number should look like”. The comments suggest the administration is preparing for a weak reading.

During Tuesday’s regular trading session, the S&P 500 dropped 0.3% on concerns about artificial intelligence impacting financial services. Investment platform Altruist Corp. launched a new AI-driven tax planning tool, pressuring shares of several financial firms. The Nasdaq Composite fell about 0.6%, while the Dow rose 0.1% to another record.

Consumer spending data released Tuesday showed flat growth in December. The reading fell short of expectations for a 0.4% monthly increase. The weak consumer data added to market concerns ahead of the jobs report.

Regulatory Uncertainty Weighs on Crypto

A White House-backed effort to advance comprehensive digital asset legislation stalled again this month. A high-profile meeting failed to produce compromise on market structure and stablecoin rules. The lack of progress comes despite a more crypto-friendly Trump administration and new SEC leadership that has discussed an “innovation exemption” for token projects.

Without finalized regulatory text, large institutional investors continue treating US crypto rules as uncertain. Regulatory pressure has eased, but the absence of a clear framework keeps major institutional capital on the sidelines. This dynamic limits near-term upside for digital assets.

Exchange Issues Add to Crypto Concerns

South Korean exchange Bithumb disclosed that internal system flaws caused a 40-billion-won transaction error. The exchange described the incident as a technical mistake rather than a hack. However, the episode reminded traders of infrastructure risks at centralized trading venues.

The Bithumb error briefly pressured Korean trading pairs but showed no signs of broader contagion. The incident reinforced demand for higher-quality exchanges, stronger proof-of-reserves protocols, and self-custody solutions. It also provided regulators with fresh examples to support arguments for tighter oversight of exchange operations.

Traders are now watching whether Bitcoin can stabilize in the $65,000-to-$70,000 range. A sustained hold in that band could enable a gradual recovery led by Bitcoin and large-cap cryptocurrencies. A break below that range would support the view that the post-ETF cycle has more downside ahead.