TLDR

- DDC soars 20% after $500M shelf filing to boost Bitcoin treasury plans

- DDC eyes Bitcoin boost with $500M shelf, stock jumps over 20% intraday

- DDC files $500M shelf to fund Bitcoin buys, stock rallies sharply

- DDC stock spikes on $500M SEC filing, Bitcoin becomes core treasury asset

- $500M shelf fuels DDC surge, firm targets Bitcoin as financial backbone

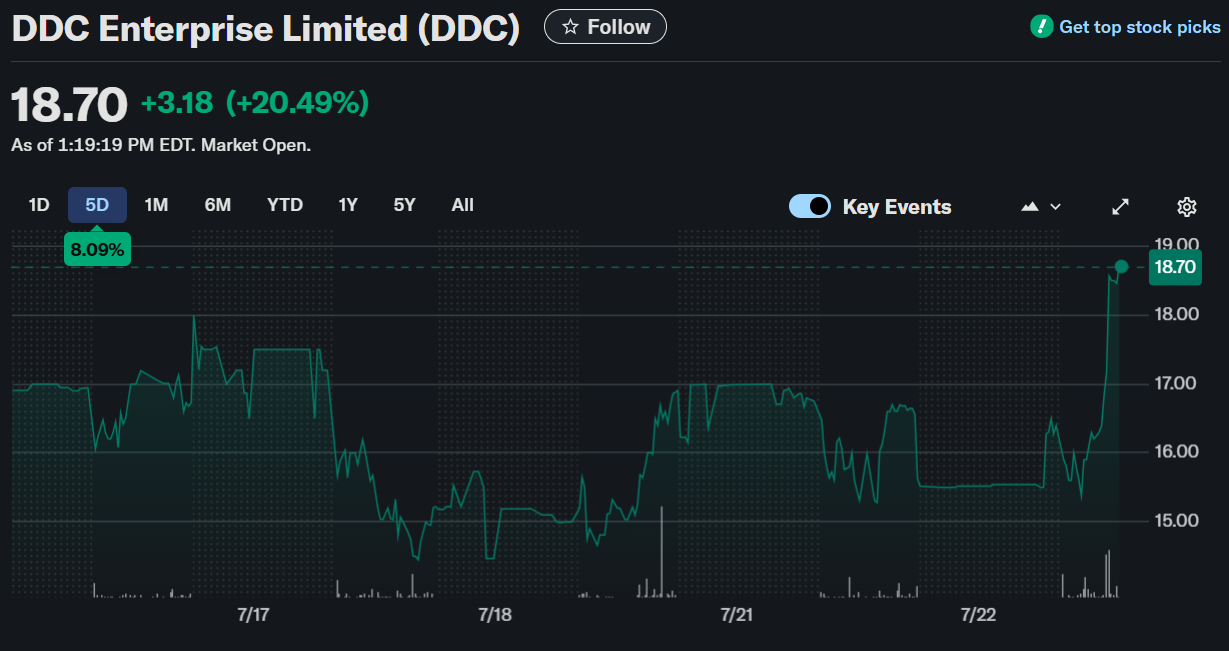

DDC Enterprise Limited (NYSE: DDC) shares surged over 20% to $18.70 intraday following a sharp momentum shift after midday.

The upswing came shortly after the company disclosed the filing of a $500 million universal shelf registration with the SEC. The move signals DDC’s strategic readiness to capitalize on favorable market conditions for expanding its Bitcoin treasury.

$500 Million Shelf Registration Sparks Market Rally

DDC filed a Form F-3 universal shelf registration statement with the SEC, seeking authorization to raise up to $500 million. The filing includes potential offerings of common shares to be sold as needed under favorable conditions. The registration statement is not yet effective, so no securities can be sold until SEC approval is secured. The company can initiate offerings under the registration only through a specific prospectus and supplement filed with the SEC.

The purpose of the shelf registration aligns with DDC’s updated capital strategy, which centers around accelerating its Bitcoin acquisition. The company signals a firm intent to expand its crypto reserve holdings. Future offerings will be determined by market demand, company needs and compliance considerations.

Bitcoin Accumulation Becomes Core Financial Focus

DDC aims to position Bitcoin as a core reserve asset within its broader financial framework, enhancing treasury strength. The company’s plan includes growing one of the largest Bitcoin reserves among public corporations globally. This strategic pivot reflects a broader trend of digital assets integrating into traditional financial infrastructures.

In parallel with its food service operations, DDC has prioritized a dual model combining consumer business with digital asset management. The company believes Bitcoin offers long-term value preservation and potential capital appreciation. Thus, raising funds through the shelf registration supports both liquidity and future crypto acquisitions.

DDC enters a selective group of public companies emphasizing Bitcoin in their corporate treasuries. This bold capital strategy may increase visibility and attract interest from those tracking crypto-related corporate developments. However, any capital raise will depend on market dynamics and applicable securities regulations.

Core Business Continues as Crypto Strategy Expands

While DDC pivots toward Bitcoin, it continues to operate as a global platform for Asian cuisine. The company manages a portfolio of culinary brands across key international markets, focusing on sustainable growth. This ongoing business complements the new financial direction, ensuring a diversified operations model.

The universal shelf registration gives DDC operational flexibility without disrupting its primary food sector services. It can time capital raises to match optimal conditions, balancing expansion and treasury accumulation. As such, the filing enhances both financial agility and strategic execution capability.

DDC’s recent surge illustrates the market’s immediate response to companies leveraging digital assets and traditional business operations. The dual approach sets a precedent for hybrid business models navigating both consumer and crypto domains. Future developments will depend on regulatory clearance and specific offering details.