Bybit just dropped news about launching a neobank, which is huge because it shows major exchanges are moving way beyond just crypto trading into real banking services.

This tells you the big players see the future in connecting crypto with traditional finance, opening massive opportunities for projects with actual working products instead of empty hype.

The DeepSnitch AI vs Bitcoin Hyper debate intensifies as Bybit’s neobank validates which token categories capture sustained institutional capital.

When exchanges integrate traditional finance, they need security infrastructure protecting users from scams and Layer 2 solutions scaling Bitcoin transactions.

AI analytics vs blockchain ecosystem: Where smart money goes after Bybit’s move

Bybit launching a neobank means exchanges need to compete with real banks now. That requires serious security to stop the rug pulls destroying traders daily, plus infrastructure handling massive transaction volumes when mainstream users flood in.

The AI analytics vs blockchain ecosystem debate comes down to different plays. AI security tokens like DeepSnitch get more valuable as trading volumes explode and scammers get smarter. Layer 2 solutions like Bitcoin Hyper offer scaling but face brutal competition from established players already dominating the space.

When exchanges become banks, security becomes everything because regulators start watching closely, and user protection has to match traditional banking standards. Capital flows into projects with live AI tools catching threats right now instead of infrastructure plays that need years of adoption before they’re actually useful.

Deepsnitch AI vs Bitcoin Hyper comparison

DeepSnitch AI (DSNT): AI security winning the exchange banking race

DeepSnitch AI crushes the DeepSnitch AI vs Bitcoin Hyper debate because it ships working AI security that exchanges like Bybit require as they move into regulated banking.

When platforms bridge crypto and traditional finance, catching malicious contracts and tracking suspicious wallets becomes mandatory infrastructure, not nice-to-have features.

Four live AI agents protect traders today. AuditSnitch scans contracts instantly for vulnerabilities and rug pull code. SnitchScan watches whale movements across Ethereum, BSC, Solana, and every major chain. SnitchFeed delivers breaking crypto news in real time. SnitchGPT analyzes blockchain data, answering trading questions with actionable insights.

The presale crossed $1.3 million with tokens at $0.03755, and it has passed audits from SolidProof and Coinsult with zero critical vulnerabilities.

As exchanges like Bybit expand into traditional banking, security infrastructure becomes mandatory. The AI analytics vs blockchain ecosystem debate heavily favors working security tools over scaling solutions in increasingly regulated environments.

Bitcoin Hyper (HYPER): Layer 2 scaling for Bitcoin ecosystem

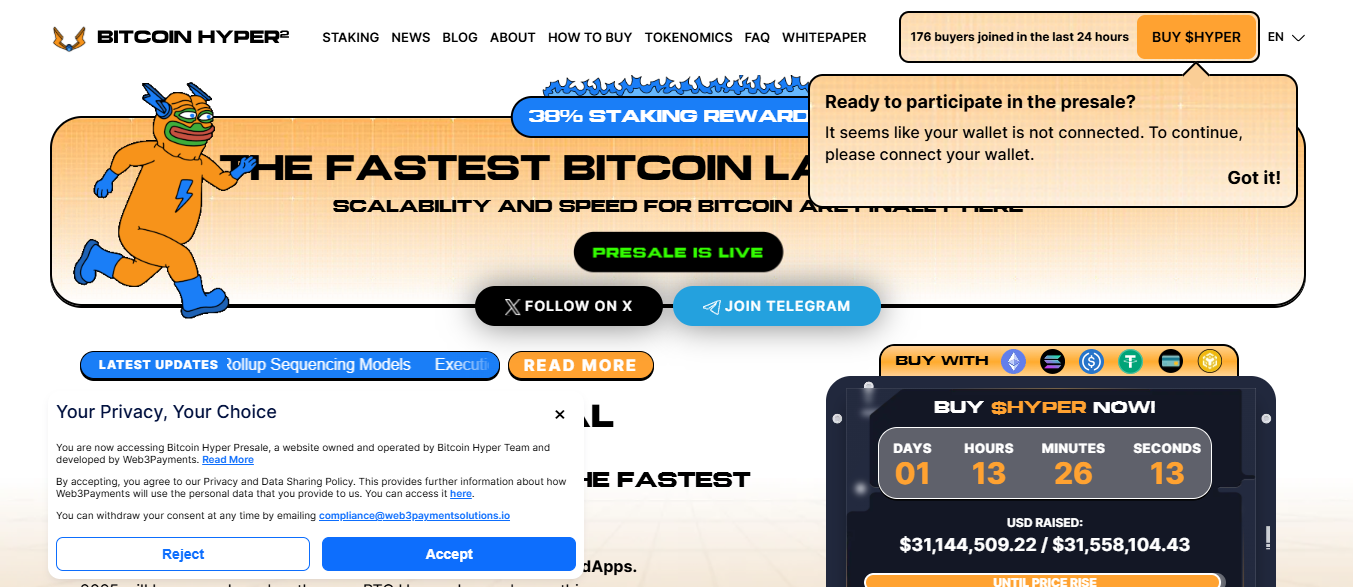

Bitcoin Hyper raised over $31 million, positioning itself as a Layer 2 solution using the Solana Virtual Machine to enable faster Bitcoin transactions. The project targets developers building DeFi applications around Bitcoin’s infrastructure, offering an alternative to established Layer 2 options.

The project offers 49% staking returns, though APY decreases as participation grows. Audits from Coinsult and SpyWolf provide security verification.

However, Bitcoin Layer 2 space faces intense competition from Lightning Network, Stacks, and other established solutions. The DeepSnitch AI vs Bitcoin Hyper comparison reveals HYPER competes in crowded markets while DSNT addresses underserved security needs that become more critical as exchanges expand services.

Dreamcars (DCARS) presale: Real-world asset tokenization

Dreamcars is tokenizing high-end rental cars, including Lamborghinis, Ferraris, and Rolls-Royces, distributing rental income to NFT shareholders. Presale reached 99% funded with real revenue coming from physical car rentals in premium markets like Dubai and Miami.

The RWA approach delivers income regardless of crypto market conditions. As Bybit connects crypto with traditional finance, asset tokenization gains legitimacy by linking blockchain to real-world revenue that regulators recognize and accept.

Presale trades at approximately $0.013 with a launch price expected around $0.03, offering early buyers roughly +130% upside at listing if demand shows up strong.

Conclusion: DeepSnitch AI wins the DeepSnitch AI vs Bitcoin Hyper comparison

Bybit’s neobank proves exchanges need bulletproof security infrastructure to survive in regulated banking. The DeepSnitch AI vs Bitcoin Hyper comparison isn’t even close when you look at what exchanges actually need versus what’s already saturated.

DeepSnitch ships four live AI agents protecting capital today with 300% bonus codes at $0.03755, turning your $10K into potential $6.65M. Bitcoin Hyper offers scaling but fights established Layer 2 giants with billions in TVL. Dreamcars brings RWA exposure as luxury tokenization heats up.

The math is simple. Working AI security at presale prices with 300% multipliers beats crowded scaling plays every time.

Load DSNT at the official DeepSnitch AI website using bonus codes before this window slams shut. Track launch on Telegram and X.

Frequently asked questions

What’s the main difference in DeepSnitch AI vs Bitcoin Hyper?

DeepSnitch AI vs Bitcoin Hyper comes down to working security versus crowded scaling. DeepSnitch ships four live AI agents at $0.03755 with 300% bonuses, turning $30K into $120K tokens. Bitcoin Hyper scales transactions but fights Lightning Network and established Layer 2s for market share

Why does DeepSnitch AI vs Bitcoin Hyper comparison favor $DSNT?

The DeepSnitch AI vs Bitcoin Hyper comparison heavily favors $DSNT because exchanges need security infrastructure for banking services more than any other scaling solution. DeepSnitch offers operational tools with presale multipliers while $HYPER competes in saturated markets.

Which wins for 1000x potential: DeepSnitch AI vs Bitcoin Hyper?

DeepSnitch AI vs Bitcoin Hyper for 1000x gains clearly favors $DSNT. Working AI security at presale prices with 300% bonus codes, quadrupling positions beats scaling infrastructure, competing against established giants. Drop $10K, grab 665,800 tokens with bonuses, hit $6.65M at $10.