TLDR

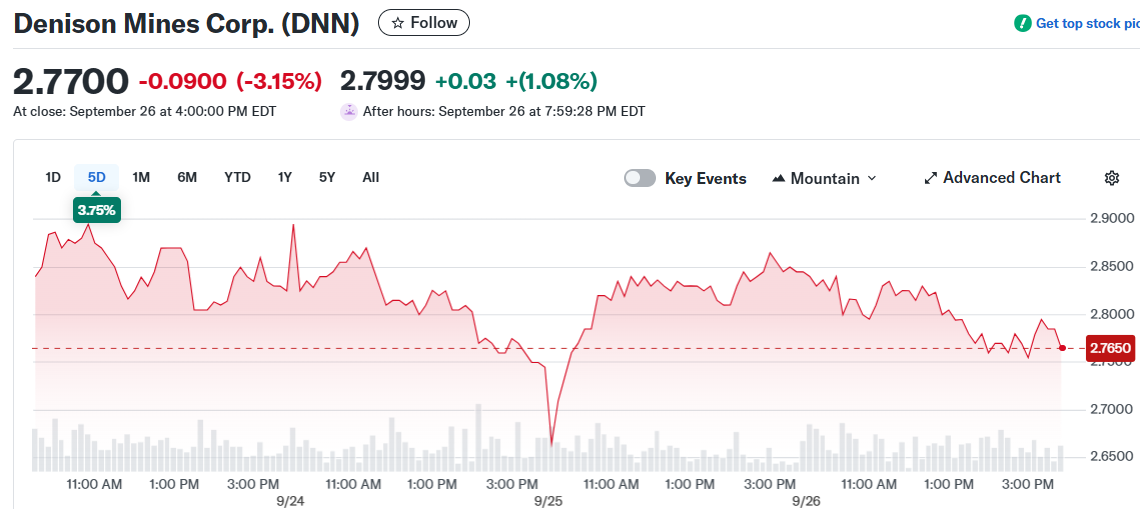

- Denison Mines (DNN) stock jumped 6% last week closing at $2.77

- Five analysts give the stock a consensus “Buy” rating with average price target of $2.75

- Company raised $345 million in convertible notes to develop Phoenix uranium mine in Saskatchewan

- Institutional ownership increased to 36.74% with several hedge funds raising stakes

- Recent tech investments by Nvidia, Alibaba, and OpenAI boosted uranium sector optimism

Denison Mines shares climbed 6% last week, closing at $2.77 as investors piled into uranium stocks. The Canadian uranium developer saw heavy trading volume with 97 million shares changing hands on Thursday.

The stock surge comes after technology companies announced major investments that boosted confidence in the nuclear power sector. Nvidia Corp., Alibaba Group, and OpenAI revealed billion-dollar commitments earlier this week that strengthened expectations for nuclear energy demand.

Denison Mines operates in Canada’s uranium-rich Athabasca Basin region. The company’s uranium products fuel nuclear power plants that supply electricity to energy-hungry AI data centers.

Strong Analyst Support

Wall Street analysts remain bullish on Denison Mines prospects. Five analysts covering the stock maintain “Buy” ratings with an average price target of $2.75.

TD Securities, Scotiabank, Raymond James Financial, and National Bankshares all rate the stock “outperform” or equivalent. Desjardins recently upgraded shares to “moderate buy” in mid-August.

The consensus rating reflects confidence in uranium market fundamentals. Nuclear power demand continues growing as countries seek clean energy alternatives.

Institutional Interest Growing

Hedge funds and institutional investors have been increasing their Denison Mines positions. Institutional ownership now stands at 36.74% of outstanding shares.

MMCAP International boosted its stake by 36.4% in the first quarter. The fund now holds 23.9 million shares worth over $31 million.

Balyasny Asset Management purchased a new $8 million position during the second quarter. BW Gestao de Investimentos also took a new $5.3 million stake.

Vident Advisory raised its holding by 41.9% to 9.8 million shares. Connor Clark & Lunn Investment Management increased its position by 35.4% to 8.9 million shares.

Funding Mine Development

Denison Mines completed a $345 million convertible notes offering last month. The 2031 notes provide capital for developing the company’s Phoenix In-Situ Recovery uranium mine.

The Phoenix project sits in northern Saskatchewan within the prolific Athabasca Basin. This region produces some of the world’s highest-grade uranium ore.

In-situ recovery mining extracts uranium without traditional underground excavation. The process pumps solutions through ore bodies to dissolve uranium for surface recovery.

The remaining funds from the convertible notes will support future investment decisions. Management maintains flexibility for additional growth opportunities.

Market Performance

Denison Mines stock has traded between $1.08 and $2.95 over the past 52 weeks. The shares opened Friday at $2.86 with a market capitalization of $2.56 billion.

The stock’s fifty-day moving average sits at $2.27. Its two-hundred-day moving average stands at $1.79.

Denison Mines carries a beta of 1.38, indicating higher volatility than the broader market. The company currently trades at a price-to-earnings ratio of -47.67.

The Wheeler River uranium project covers approximately 300,000 hectares in the Athabasca Basin region. This flagship property anchors the company’s development pipeline in northern Saskatchewan.