TLDR

- DOGE confirms short-term price reversal but approaches accumulation zone around $0.198-$0.218

- Golden cross formation and double bottom pattern signal bullish momentum building

- Elliott Wave 3 analysis suggests potential target of $0.3763 if current pattern holds

- NUPL and MVRV indicators show DOGE nearing opportunity zone for new buyers

- ETF approval rumors circulating with traders estimating 75% approval chance

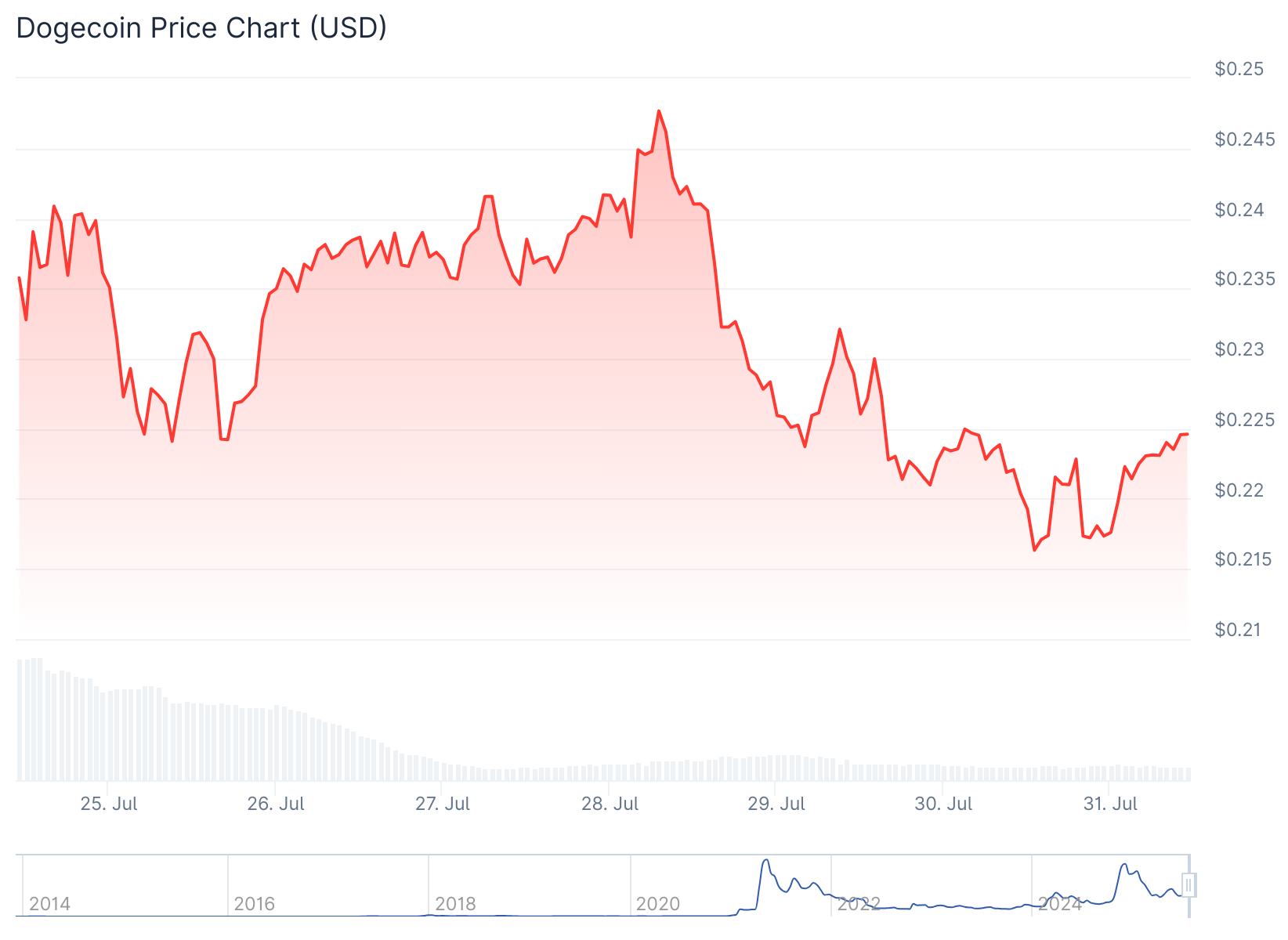

Dogecoin has been experiencing mixed signals as technical indicators point to both short-term weakness and longer-term bullish potential. The cryptocurrency currently trades at $0.220, holding just above key support at $0.218.

Recent price action shows DOGE facing selling pressure after reaching $0.25 levels. This decline appears linked to profit-taking as bullish sentiment reached saturation levels. The retreat represents a natural pullback rather than a complete reversal of momentum.

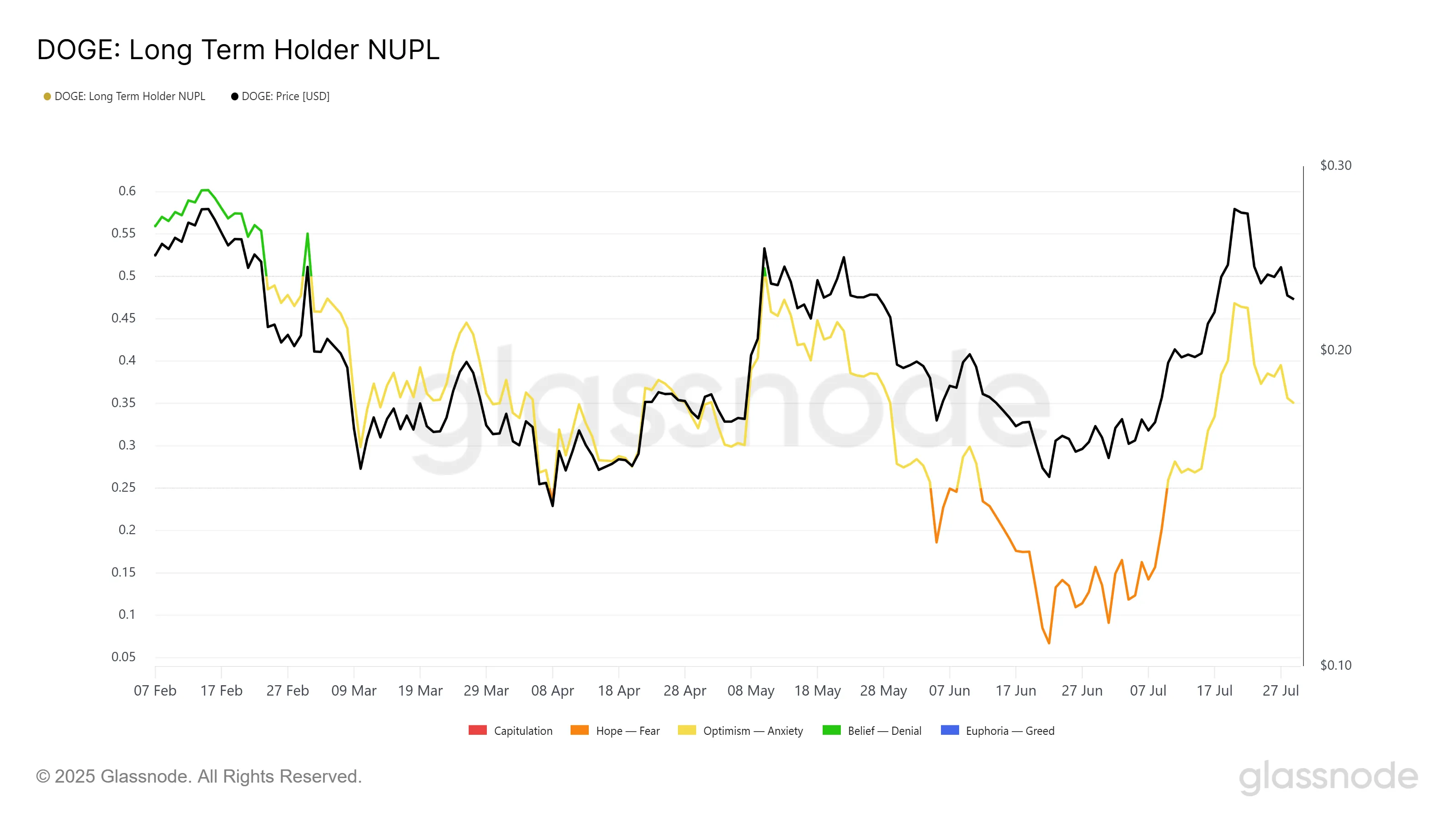

The Net Unrealized Profit/Loss indicator reveals uncertainty among long-term holders. Unlike previous rallies, DOGE crossed the 0.5 NUPL threshold earlier than expected. This early shift suggests rising skepticism as prices increased, triggering the current selling pressure.

Market Value to Realized Value data shows recent buyers facing a 2.4% loss on 30-day positions. This metric indicates DOGE approaching the opportunity zone, which typically occurs when MVRV ratios fall between -9% and -20%. Historical data suggests this zone often marks accumulation periods.

Technical Pattern Analysis

Chart analysis reveals a golden cross formation where short-term moving averages crossed above long-term ones. This pattern typically signals upward momentum building in the market. The setup coincides with a confirmed double bottom around $0.15 levels.

Wave pattern analysis suggests DOGE completed Wave 1 around $0.25 before pulling back to $0.22 in Wave 2. Current positioning indicates the potential start of Elliott Wave 3, historically the strongest phase of the cycle.

If Dogecoin price breaks below $0.218 support, the next target sits at $0.198. This level would push the cryptocurrency deeper into accumulation territory. Such a move could trigger renewed buying interest from value-focused investors.

Conversely, if selling pressure subsides, DOGE could bounce from current support toward $0.241. This move would invalidate bearish scenarios and potentially signal the beginning of a new upward trend.

Wave 3 Projections

Elliott Wave theory suggests Wave 3 typically represents the longest and strongest movement in the cycle. Current analysis points to $0.3763 as the primary target if this wave structure develops as expected.

Extended projections indicate Wave 5 could potentially reach $0.45-$0.50 levels if momentum continues building. These targets depend on sustained buying pressure and broader market conditions remaining favorable.

ETF speculation has emerged as a potential catalyst for DOGE price movement. Some market participants estimate a 75% probability of regulatory approval for a Dogecoin exchange-traded fund. Such approval could bring institutional capital flows into the cryptocurrency market.

Current price action suggests DOGE sits at a critical juncture between continued decline toward accumulation levels or the start of a new bullish phase targeting higher resistance areas.