TLDR

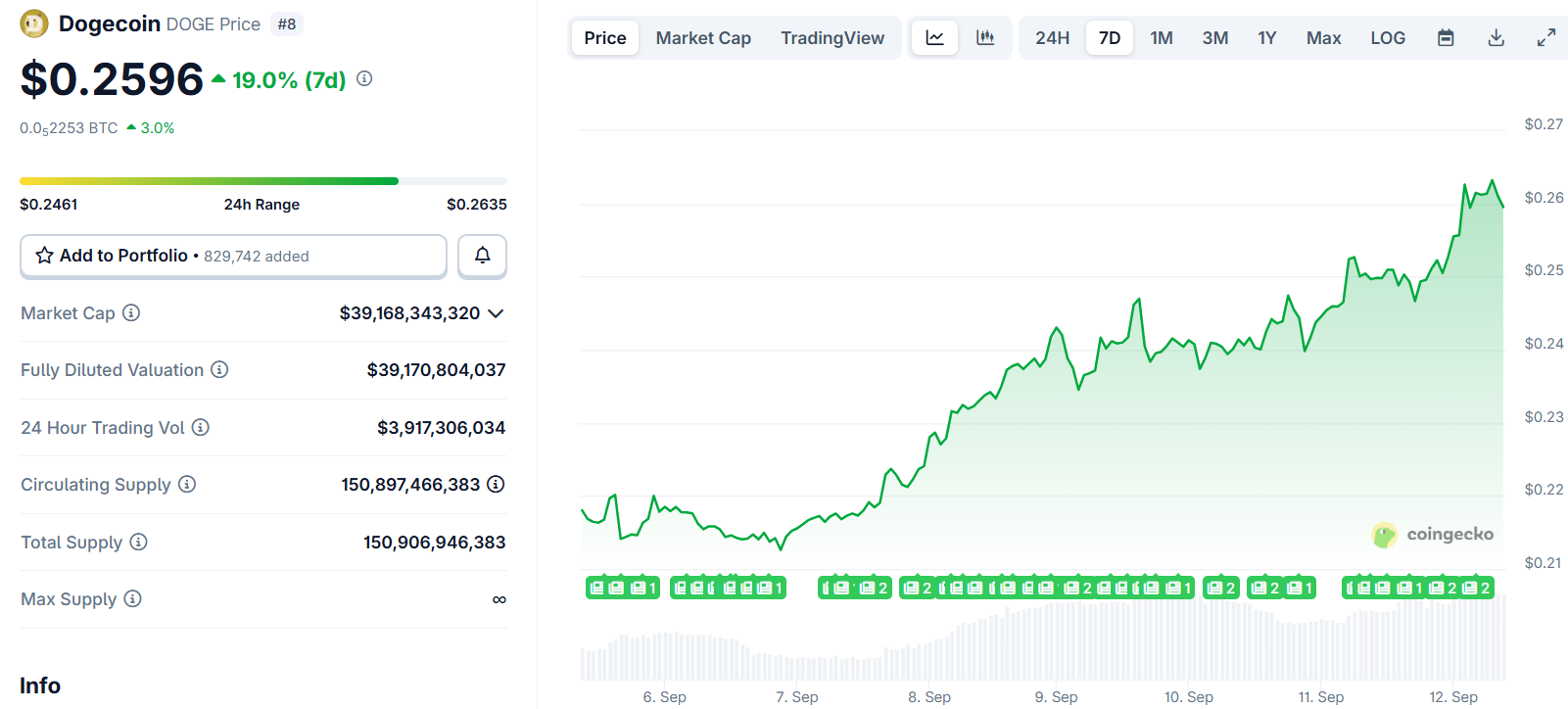

- Dogecoin price surged 20% in one week to $0.2543, reaching its highest level since August 13

- Rex-Osprey’s Dogecoin ETF (DOJE) launches Friday, September 12, marking the first US meme coin ETF

- CleanCore Solutions holds over 500 million DOGE worth $125 million as official treasury company

- Technical analysts target $0.50 if DOGE breaks above $0.29 resistance with strong volume

- Futures open interest reached $4.6 billion as derivatives activity increased ahead of ETF launch

Dogecoin price jumped to $0.2543 this week, marking a 20% gain over seven days. This represents the highest price level for the meme coin since August 13.

The rally comes as Rex-Osprey prepares to launch the first US Dogecoin ETF on Friday, September 12. The fund will trade under the ticker DOJE.

CleanCore Solutions now holds more than 500 million DOGE tokens valued at $125 million. The company positions itself as Dogecoin’s official treasury partner.

Marco Margiotta, CIO of CleanCore and CEO of House of Doge, explained their strategy. “Holding over 500 million Dogecoin reflects our speed and scale in treasury strategy,” he said.

The firm works with the Dogecoin Foundation’s commercial branch called House of Doge. Their goal is making Dogecoin a top reserve asset.

ETF Launch Creates New Access Point

Rex-Osprey’s ETF cleared the SEC’s 75-day review window. The fund aims to give retail and institutional investors easier access to Dogecoin exposure.

Bloomberg ETF analyst Eric Balchunas noted the structural differences from Bitcoin and Ethereum ETFs. However, he said the effect remains similar in providing mainstream access.

The ETF launch follows a cooler August Producer Price Index reading. Several analysts now expect rate cuts at next week’s FOMC meeting.

Macro relief helped sentiment across higher beta assets like cryptocurrencies. Lower inflation expectations reduced fears of tighter financial conditions.

Despite the recent gains, Dogecoin remains far below its 2021 peak of $0.73. Among top 10 cryptocurrencies by market cap, Dogecoin is the only token that hasn’t set new highs in the past year.

Technical Analysis Points Higher

Crypto analyst Ali Martinez identified a key resistance level at $0.29. He said a clear break above this level with strong volume could target $0.50.

Dogecoin $DOGE next move: break $0.29 and we could be looking at a run to $0.50. pic.twitter.com/sdqThyH6U4

— Ali (@ali_charts) September 10, 2025

Short-term charts show a bullish pennant pattern after the sharp advance. This formation often resolves in the direction of the prior trend.

The setup points to a measured objective near $0.275 on continuation. Traders calculate this by applying the prior flagpole’s height to the breakout point.

DOGE futures open interest reached $4.6 billion according to Coinglass data. This increase in derivatives activity shows growing trader interest.

Volume acts as the key confirmation tool for any breakout above $0.29. Sustained turnover above recent averages would help confirm the move.

Immediate support sits near last week’s swing low around $0.21. Initial resistance overlaps the $0.29 level that Martinez highlighted.

$Doge/2-hour#Dogecoin LTF bullish pennant has performed well.

After a breakout, a retest at the apex occurred, followed by trend continuation.

The pattern will complete when it reaches the short-term target of $0.275 🚀 https://t.co/4eoOE3FXHV pic.twitter.com/MfqrwrWr51— Trader Tardigrade (@TATrader_Alan) September 11, 2025

On prediction market Myriad, users price a 66.6% probability that Dogecoin hits $0.30. They assign lower probability to a drop to $0.15.

Cross-asset correlations with equities also strengthened during recent sessions. This helped improve breadth across large tokens.

The Rex-Osprey ETF launch on Friday represents the next key catalyst for price movement. Event risk often raises volatility around listing days.