TLDR

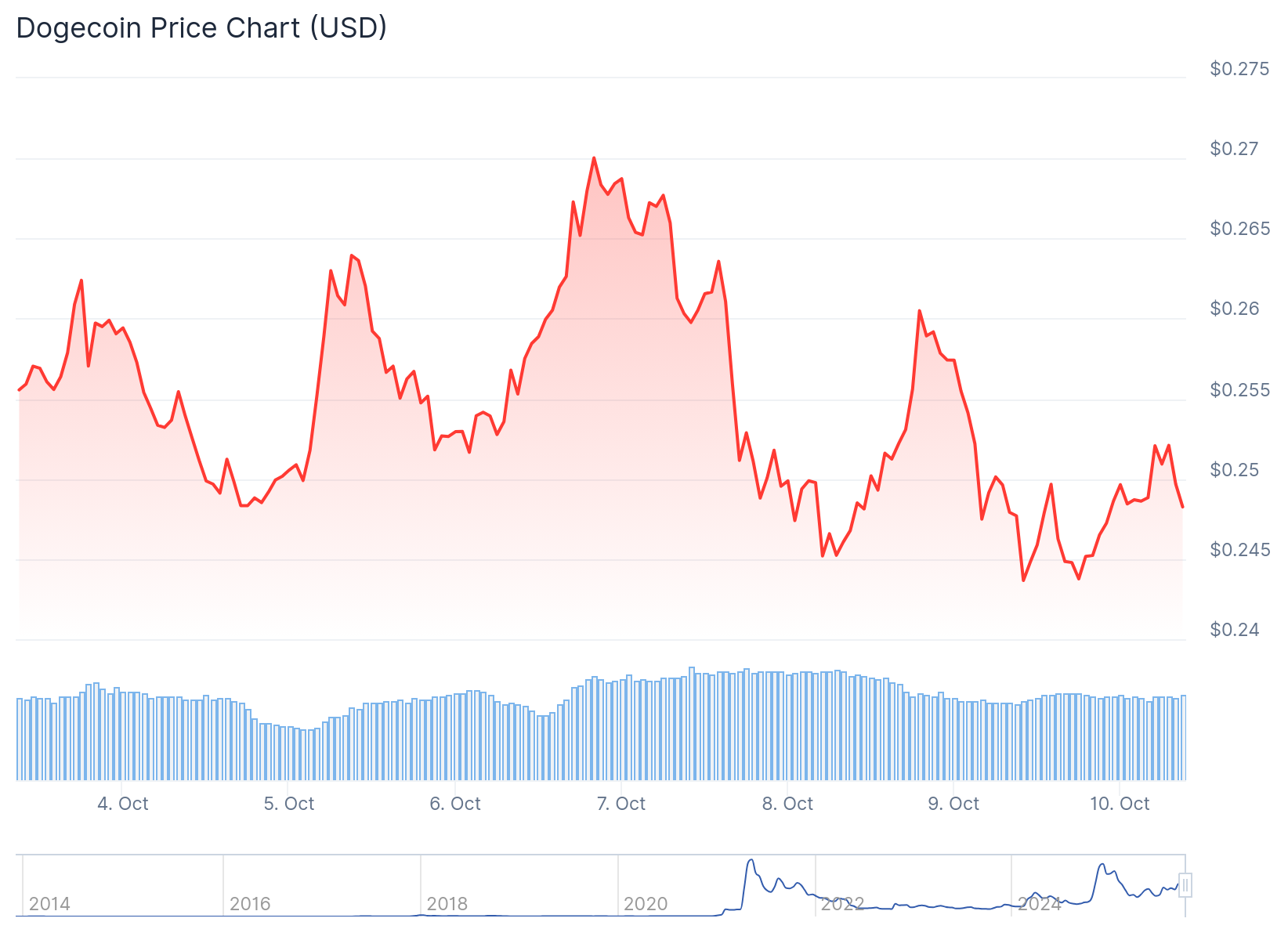

- Dogecoin price currently trades around $0.24 as analysts predict a potential shift from slow-bull phase to parabolic growth phase similar to previous cycle patterns

- Exchange outflows worth $23 million signal whale accumulation and reduced selling pressure, indicating large holders are preparing for potential upward movement

- The 21Shares DOGE ETF was added to the DTCC platform, showing growing institutional interest in Dogecoin-linked investment products

- Technical analysis shows immediate resistance at $0.2540-$0.2550 levels, with bears currently limiting upward momentum

- Long-term price predictions suggest Dogecoin could target the $1 mark if the current pattern continues to hold through the coming year

Dogecoin price is trading at approximately $0.24 as the meme coin enters what analysts describe as a critical phase. Recent on-chain data shows $23 million worth of DOGE leaving exchanges over the past period.

A crypto analyst recently outlined Dogecoin’s long-term chart structure. The analysis indicates the coin moved through distinct growth phases since 2023. Dogecoin spent time in a consolidation phase from mid-2022 to late 2023 with subdued volatility.

$Doge/weekly#Dogecoin has entered the Parabolic phase of this cycle 🔥 pic.twitter.com/Hj3Qko8xiK

— Trader Tardigrade (@TATrader_Alan) October 3, 2025

The coin then shifted into a slow-bull phase during 2024. The weekly chart shows gradual higher lows forming throughout this period. By mid-2025, the structure began showing early signs of exponential growth potential.

The current weekly structure mirrors previous cycle setups that came before explosive breakouts. If this pattern continues, the price could target the $1 mark over the coming year. The analyst’s projection suggests a multi-phase setup toward a parabolic rally.

Whale Activity and Exchange Reserves

The $23 million in exchange outflows represents accumulation activity according to CoinGlass data. Large movements off exchanges typically indicate holders are preparing to hold rather than sell. This behavior becomes more telling when paired with steady on-chain stability.

Whales appear to be positioning for the next major price movement. The pattern resembles previous meme coin rallies that Dogecoin led in past cycles. As other meme coins like Shiba Inu and Pepe consolidate, Dogecoin’s reduced exchange reserves strengthen its market position.

Liquidity leaving exchanges restricts immediate supply available for trading. This dynamic can amplify upward price reactions when demand increases. The outflow trend coincides with recent institutional developments in the Dogecoin market.

Institutional Developments

The 21Shares DOGE ETF received a listing on the DTCC platform recently. This development signals growing institutional interest in meme coin investment products. The ETF listing provides traditional investors with regulated exposure to Dogecoin price movements.

Current Technical Resistance

Dogecoin price started a fresh decline below the $0.2550 zone against the US Dollar. The price dropped below the $0.2540 support level and the 100-hourly simple moving average. A low formed near $0.2413 before the price attempted a recovery wave.

The recovery attempt faced resistance near the $0.2550 level. A bearish trend line is forming with resistance at $0.2540 on the hourly chart. The 50% Fibonacci retracement level of the downward move also acted as resistance.

If the price recovers, immediate resistance sits near $0.2540. The first major resistance level for upward movement is at $0.2550. The next major resistance stands at $0.260.

A close above $0.260 could send the price toward $0.2780. Further gains might push the price to $0.2840 or even $0.2920.

If the price fails to climb above $0.2540, downward movement could continue. Initial support on the downside sits near $0.2475. The next major support level is at $0.240.

The main support zone sits at $0.2320. A break below this level could push the price down to $0.2120 or $0.2050.

The MACD indicator is gaining momentum in the bullish zone on the hourly chart. The RSI sits above the 50 level, indicating neutral to slightly bullish momentum.