TLDR

- Dogecoin formed a hammer candlestick pattern near $0.19 support level, signaling potential bullish reversal

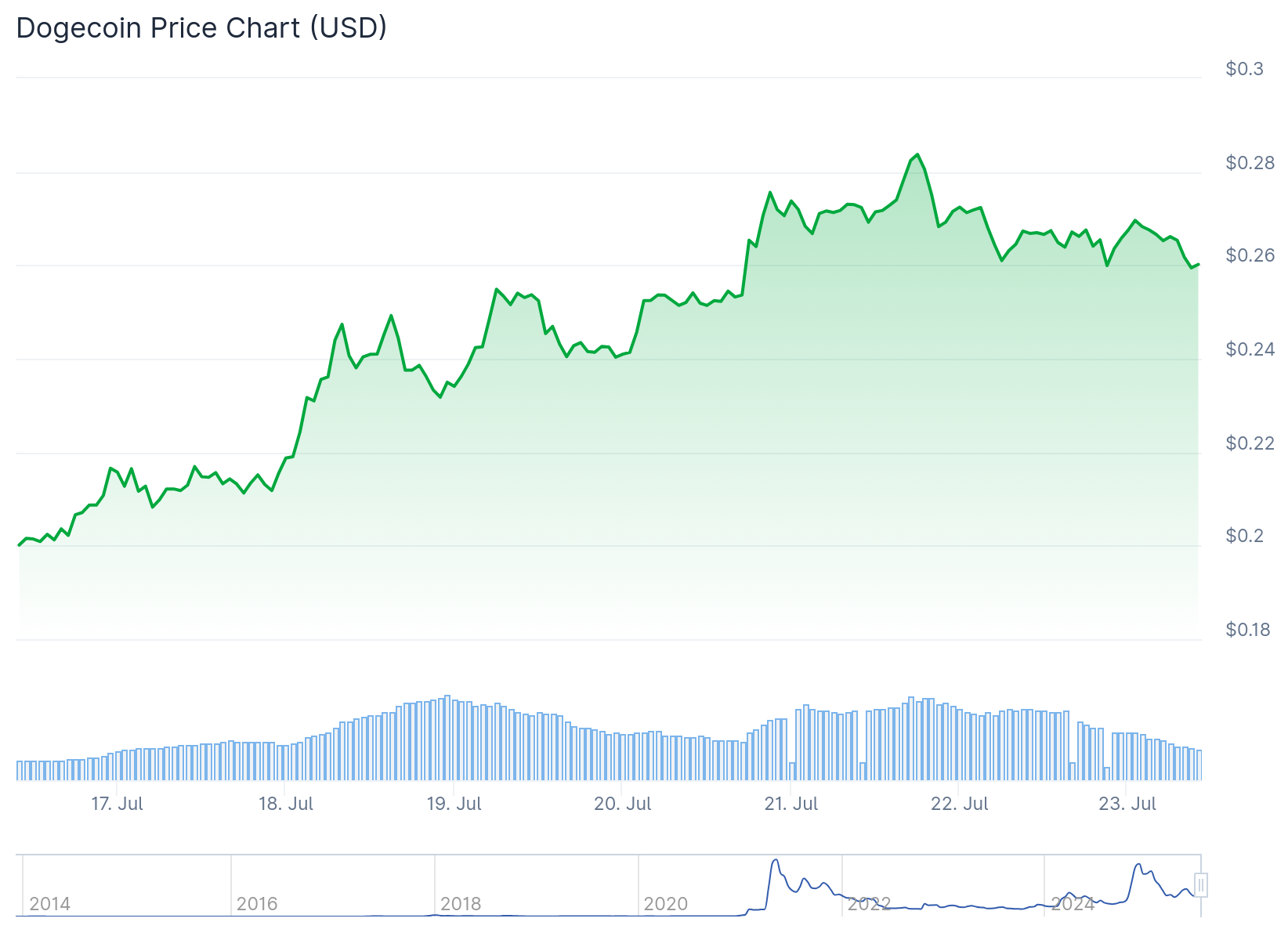

- DOGE price broke above $0.20 resistance after rallying 77% in July and 17% over seven days

- Technical analysts identify cup-and-handle breakout pattern with potential 165% price increase target

- Bit Origin Ltd announced $500 million funding round to build Dogecoin treasury for long-term adoption

- Next resistance target sits at $0.357 level, with broader projections reaching $0.43 to $0.70 range

Dogecoin price action has captured trader attention as the meme coin breaks through key resistance levels. The cryptocurrency traded above $0.20 after forming bullish technical patterns on daily charts.

DOGE produced a hammer candlestick formation near the $0.192 level following an intraday low of $0.185. This pattern typically signals potential trend reversals when formed at support areas.

The hammer formation occurred at horizontal support that has served as a local bottom during previous consolidation periods. Trading volume increased during this formation, strengthening the reversal signal interpretation.

Dogecoin price rallied over 5% in 24 hours and gained approximately 17% over seven days. The price moved from $0.17 to above $0.20, breaking through resistance that had contained previous breakout attempts.

At press time, DOGE traded around $0.203, establishing itself above the formerly resistant $0.20 level. This breakout followed extended sideways movement and multiple failed attempts to breach this zone.

Technical Pattern Breakouts Drive Momentum

Technical analysts identified a falling wedge pattern breakout that began developing in early June. The breakout occurred at the $0.175 level and confirmed above $0.20.

Falling wedge patterns typically indicate bullish continuation within broader uptrends. The projected target from this pattern measures approximately $0.43 based on the wedge’s widest point.

This target zone aligns with resistance levels recorded in mid-2021 and earlier in 2024. Intermediate zones of interest include the $0.25 to $0.30 range based on historical price and volume interactions.

A separate cup-and-handle pattern breakout has emerged on daily charts. Analysts suggest this formation could produce a 165% price increase, potentially driving DOGE toward $0.70 under favorable conditions.

The Money Flow Index reached 89.12, indicating increased buying activity. The Aroon Up indicator sits at 100%, reinforcing bullish sentiment through consistent higher highs.

Institutional Backing Supports Price Action

Bit Origin Ltd announced a $500 million funding round dedicated to building a Dogecoin treasury. The company plans to use this capital for long-term adoption support and market liquidity enhancement.

Bit Origin ( $BTOG ) is raising $500M to build a $DOGE reserve, with $15M already secured for its first buys.

With 3 Spot DOGE ETFs (Grayscale, REX-Osprey, Bitwise) pending, institutions are eyeing DOGE as a treasury asset.

What are your targets for Dogecoin for this bull run? pic.twitter.com/hyI3x1Xj5Z

— Wise Advice (@wiseadvicesumit) July 17, 2025

The funding will support a “multi-phase DOGE monetization strategy” according to company statements. This development could establish Dogecoin beyond its meme coin origins within the broader cryptocurrency market.

DOGE cleared resistance near $0.25 that had maintained consolidation since March. Following this breakout, analysts target $0.33 in the near term, with $0.357 representing the next key resistance level.

Technical charts show DOGE price forming higher highs and higher lows within an ascending parallel channel. This formation suggests a stable uptrend pattern with consistent directional movement.

On-chain data reveals rising Dogecoin Liveliness metrics, indicating long-term holders are beginning to sell positions. However, short-term investors appear to be driving the current surge despite this distribution.

The combination of retail interest and institutional backing creates conditions for continued price appreciation. Trading volume has increased alongside the technical breakouts, supporting the bullish momentum.

DOGE faces immediate challenges at the $0.357 resistance zone, which has historically proven difficult to overcome. Volume patterns and technical indicators suggest a breakout remains possible in coming sessions.

Failure to maintain current levels could result in retracement to the $0.21-$0.17 support range. This zone may provide buying opportunities for traders anticipating continuation toward $0.41 or higher targets.

Dogecoin was trading around $0.26, down 2.78% in the last 24 hours at press time.