TLDR

- Dogecoin dropped 30% from its July peak of $0.28 to current support at $0.19

- Technical indicators show momentum cooling with RSI below 50 and bearish MACD crossover

- Golden cross pattern from late July remains intact, suggesting long-term uptrend continues

- Futures data shows traders maintaining bullish positions with 3:1 long-short ratios on major exchanges

- Macroeconomic factors including Fed policy and trade tensions create headwinds for risk assets

Dogecoin price has experienced a sharp reversal after reaching a five-month high near $0.28 on July 21. The meme coin has since declined approximately 30% to test crucial support at the $0.19 level.

The recent selloff has brought DOGE below both the 50-day exponential moving average at $0.206 and the 200-day EMA at $0.207. However, buyers have emerged near the $0.19 support zone, preventing further downside movement.

This support level represents a critical juncture for the cryptocurrency. A decisive break below $0.19 on high volume could open the door to additional declines toward $0.17 and potentially $0.15.

These lower targets would represent discounts of 12% to 24% from current levels. Both price points coincide with high liquidity zones that could attract fresh buying interest.

Conversely, a successful defense of the $0.19 support could signal that selling pressure has been absorbed. Such a scenario would likely trigger a rebound toward the 20 EMA around $0.22.

Technical Indicators Show Reset in Progress

The Relative Strength Index has retreated from overbought levels above 80 to below 50, entering bearish territory. This decline reflects the sharp cooling in momentum that has occurred over recent weeks.

The moving average convergence divergence indicator recently flipped bearish, confirming that the previous rally has lost steam. This technical development supports the view that momentum has shifted in the near term.

Despite these bearish signals, the 20-day and 200-day golden cross that formed in late July remains intact. Golden crosses typically indicate that longer-term bullish sentiment persists as long as price holds above the slower moving average.

The primary uptrend for Dogecoin has not been invalidated based on this longer-term perspective. Technical indicators are resetting rather than breaking down completely.

If DOGE maintains the $0.19 support level while indicators reset, a rebound toward the $0.22-$0.24 range becomes the most likely scenario. Breaking above $0.24 resistance could set up a run toward the psychological $0.30 barrier.

Dogecoin Price Prediction

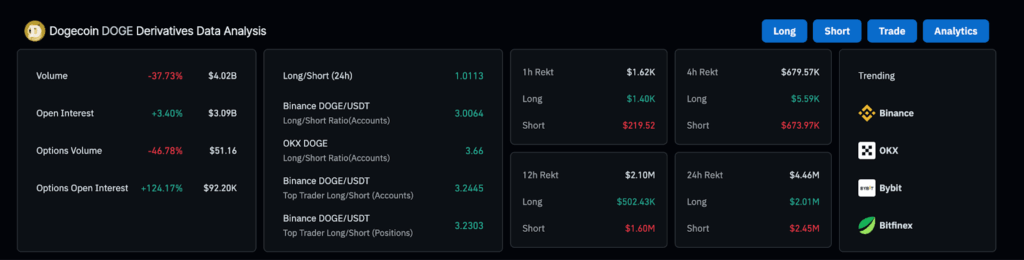

Futures market data provides insight into trader positioning and sentiment. Aggregate Dogecoin futures volume decreased 37% to $4 billion over the past 24 hours during the recent decline.

However, open interest remained relatively stable at around $3 billion. This stability suggests traders are holding positions rather than closing them, indicating continued confidence in the asset.

Long-short ratios on major exchanges paint a bullish picture. Binance shows long accounts outnumbering shorts by a 3:1 ratio, while OKX displays an even stronger 3.6:1 reading.

These metrics demonstrate that despite recent price weakness, larger players continue betting on a rebound. The accumulated buying power from this positioning could drive prices higher if conditions improve.

Macroeconomic factors have created headwinds for risk assets including cryptocurrencies. President Trump introduced new import taxes ranging from 10% to 41% on goods from Canada, India, Brazil, Taiwan, and other nations.

The Federal Reserve maintained its policy rates steady in the latest FOMC meeting. This hawkish stance is expected to continue, leading investors toward safer assets and away from speculative investments like DOGE.

The combination of trade policy uncertainty and monetary policy tightening has pressured crypto markets. These external factors have contributed to the recent selloff across digital assets.

Despite macro challenges, the technical setup and trader positioning suggest potential for recovery. The $0.19 support level will likely determine whether bulls can regain control or further weakness lies ahead.

Current price action around this key level will provide important clues about DOGE’s next directional move. A hold above support combined with improving macro conditions could fuel the next leg higher.