Cardano hit two milestones this month. CME launched regulated ADA futures alongside BTC and ETH, and Wanchain delivered $130 million in cross chain volume.

The cardano price prediction gets more interesting as institutional access deepens, but from $0.25 to $1 requires the hard fork, Midnight, and CME demand to align over months.

While you hold ADA, Pepeto with $7.5M raised is the 300x exchange presale delivering returns the cardano price prediction needs a full cycle to produce.

CoinDesk reported CME Group launched regulated ADA futures, placing Cardano alongside Bitcoin and Ethereum on the world’s top derivatives exchange, while CoinMarketCap confirmed Wanchain delivered $130 million in cross chain volume to Cardano with net inflows exceeding $80 million.

The cardano price prediction improves with every access point, but presale entries capture returns ADA at $10 billion needs years to deliver.

Cardano Price Prediction and the 300x Exchange Presale That Moves While ADA Waits for Catalysts

Pepeto: The Project That the Cardano Price Prediction Cannot Match

As CME launches ADA futures and Wanchain bridges $130 million in volume, investor attention is splitting between the cardano price prediction and the exchange presale that raised $7.5M during the exact consolidation ADA traders are living through right now.

Pepeto is a platform designed to give everyday traders access to unified exchange tools across Ethereum, BNB Chain, and Solana. The cross chain bridge routes assets instantly. The zero tax engine keeps every trade whole. The risk scoring system catches risky contracts before your capital commits. The SolidProof audit backs every line of code, and the cofounder of the Pepe ecosystem who built a token to $7 billion leads the development.

The 300x math requires only the listing valuation exchange tokens with real infrastructure routinely achieve. Over $7.5M raised during consolidation while the cardano price prediction crowd waits for Protocol Version 11, and the difference is that Pepeto delivers returns through exchange infrastructure that works regardless of whether the hard fork ships on time or Midnight reaches mainnet.

The 209% APY staking compounds for wallets already positioned. CME adding ADA futures confirms institutional interest in Cardano, but the cardano price prediction targets $1 which requires months and multiple catalysts. The exchange presale with the $7 billion cofounder and a Binance listing approaching does not need CME futures or Wanchain bridges to go live, because the listing happens on its own timeline, and by the time the cardano price prediction crowd celebrates $0.34, the presale entry at six decimal zeros will have already repriced permanently for the wallets that moved during the silence.

Cardano Price Prediction: ADA at $0.25 With $1 Realistic if Hard Fork and Midnight Deliver

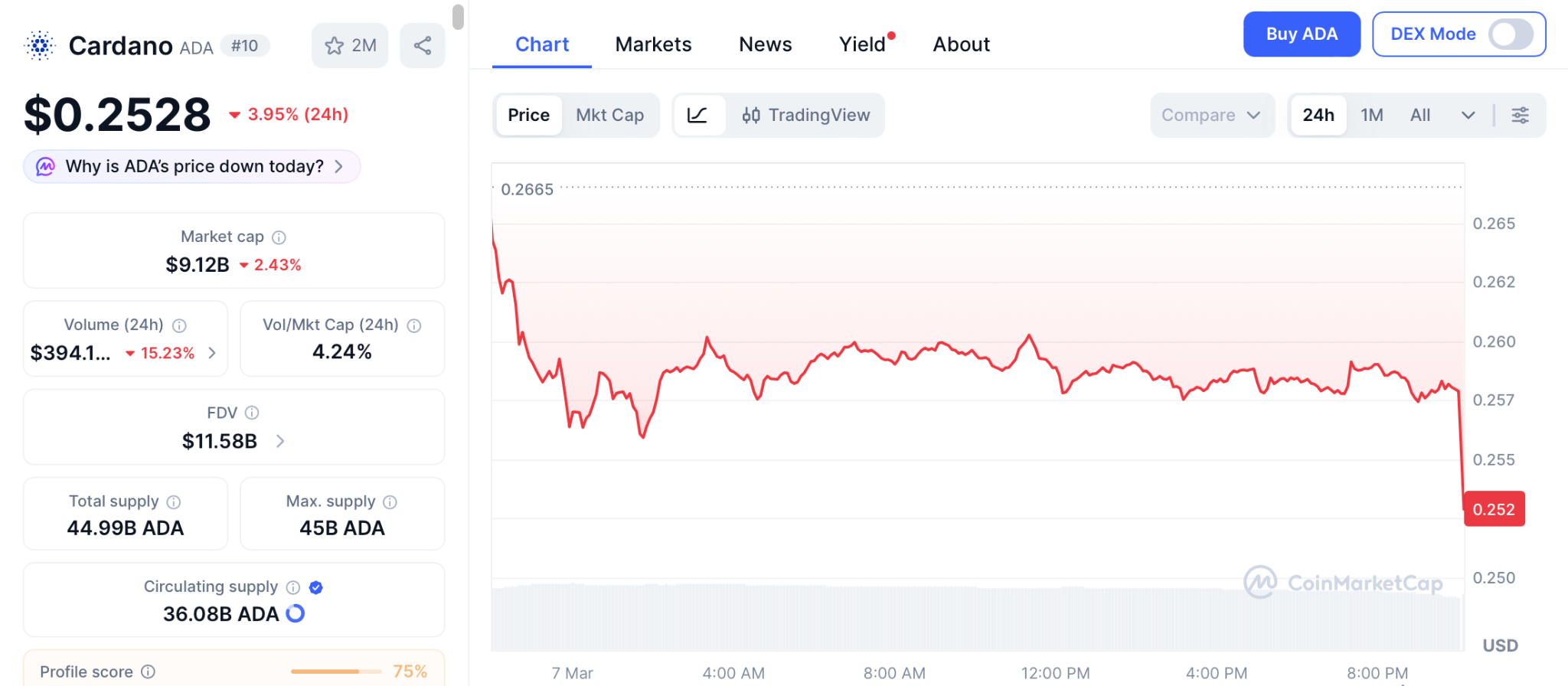

ADA trades at $0.25 with 59% of supply staked according to CoinMarketCap. Whales accumulated 454 million ADA in two months according to Santiment.

Protocol Version 11 targets March with Plutus upgrades, while Midnight aims for late March mainnet.The cardano price prediction targets $0.34 if $0.30 breaks, with $1 possible in H2 2026. Even $1 is 270% requiring patience, while presale entries deliver faster multiples.

SUI Holds $0.98 as Bulls Defend Support Inside a Falling Wedge Pattern

SUI trades near $0.98 after bouncing from $0.88, with buyers defending the $0.82 to $0.88 zone. The falling wedge pattern suggests reversal, but SUI needs $1.05 to confirm.

The cardano price prediction conversation confirms large caps in consolidation offer patience plays, not 300x presale returns.

The Bottom Line

Pepeto holders earn $57 per day at 209% APY while ADA holders sit at $0.25 waiting for CME futures and the hard fork, with minimal yield to cushion the wait.

The cardano price prediction targets $1 which is 270% requiring everything to align, while Pepeto’s presale to listing gap delivers on a timeline CME does not control.

The $7 billion cofounder builds the exchange, the audit is done, and every quiet day compounds while ADA stakers earn 3% watching the market sideways. Visit the Pepeto official website and enter the presale before the hard fork arrives and the entry that was available during the waiting becomes the most expensive hesitation of this cycle.

Click To Visit Pepeto Website To Enter The Presale

FAQs

What is the cardano price prediction for 2026?

The cardano price prediction targets $1 in H2 2026 if Protocol v11 and Midnight deliver, but Pepeto at presale pricing with 300x exchange infrastructure offers faster returns. Visit the Pepeto official website.

Why did CME launch ADA futures?

CME added ADA to its institutional derivatives alongside BTC and ETH, deepening liquidity, while presale entries like Pepeto deliver the returns ADA at $10 billion needs years to produce.

Is Cardano dead or waiting?

Cardano is not dead, CME futures and Wanchain volume confirm real growth, but the cardano price prediction needs patience while Pepeto’s presale to listing math works during consolidation.