We recently had the pleasure of sitting down with Dustin Byington, President of Wanchain, at the inaugural Blockchain Connect conference in San Francisco.

Briefly stepping away from the fascinated crowd at the Wanchain booth (we never saw it attendee-less), Byington spoke with us about how he got involved with Wanchain, what excites him about the project, and where he sees the cryptocurrency industry heading over the next few years.

If you’re interested in learning more about Wanchain, be sure to check out our beginner’s guide here.

The Interview

Steven: I’d love to hear you got started with Wanchain – the problem that you saw. I know we talked a little bit about it at the booth. But, I think the whole illiquidity problem is huge in crypto.

Dustin: I started my career at Goldman [Sachs] one year before the financial collapse. I worked there and I graduated from Columbia in 2007, so I saw all of this unfold first-hand.

I left Goldman and went to business school to kick off my entrepreneurial career. I found Bitcoin in 2013 and was aggressively pulled down the rabbit hole by its potential to solve the many of the financial services’ industries systemic problems that I encountered while at GS. I dive-bombed into the space co-founding a number of companies including Satoshi talent, Tendermint, and Stokens Venture Capital.

Jack Lu [Founder of Wanchain, Factom] and met each other in these early days. I had just moved to Austin where Factom was located. In fact, I knew most of the Factom team back before they were Factom when they were NotaryChains. Paul Snow [CEO of Factom] was running the local meet-up in Austin as well as the Texas Bitcoin Conference. And, David Johnston [Chairman of Factom] was doing the Dapps Fund. I’ve been pretty tight with that whole team for a while.

Knowing Jack through all those years, I got curious when he called me and told me he was working on a new project. There are really three things that attracted me to the project.

First, I was drawn to the fact that it was Jack. I’ve always had a lot of respect for him and his work as do many others in Austin. Secondly, I was interested in the project’s connections with China, which is a huge market. Jack was going back and forth to China to do business development while at Factom, and he became one of the most well-connected people in the Chinese blockchain ecosystem.

We say we’re cross-chain, but we’re also cross-culture. We have headquarters in Austin, Singapore, and Beijing. This may prove to be one of our biggest competitive advantages.

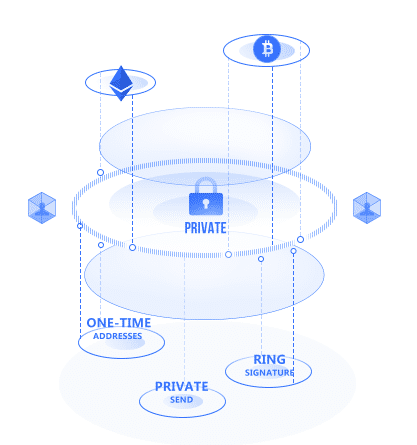

Lastly, Wanchain hits both of the main themes for 2018 – interoperability and privacy. Just last week, we just launched a smart contracting platform with ring-signatures.

Steven: That’s huge.

Dustin: Yeah, no one’s ever done that before. Monero has privacy with CryptoNote, but they use a UTXO (Bitcoin) foundation. No one’s ever done it with an account-based smart contracting platform. There’s a number of things we had to think about when innovating there.

For example, buying GAS leaks your identity. We had to create a stamp system where you pre-pay for GAS and get a stamp. Then, when you issue your transactions, you send the stamp in with it.

Some of the contributions are challenging in and of themselves. We didn’t want to reinvent the wheel if we didn’t have to, so we forked Ethereum. We’re our own blockchain based on the Ethereum codebase.

But, we do want to reciprocate to the ecosystem. We made EIP [Ethereum Improvement Proposal] for the stamp system and sent it back to the Ethereum Foundation to help give back.

We still hold the vast majority of the 120,000 ETH that we raised in October back when the price of ETH was $300. We haven’t diversified out of it yet to show the market that we’re still here to support each other.

We think it’s financially responsible to diversify some of it at some point, but we’ll always be ETH-centric. For example, we’re not going to go sell three-quarters of it for Bitcoin.

Steven: In a way, I feel like Ethereum is its own form of diversification because there’s so much built on top of it.

Colin: It’s its own gold standard now. The whole idea that Bitcoin is the store of value – Ethereum is showing us that it’s not necessarily the case. There isn’t only one standard. As much as Charlie Lee would probably cringe at this, I don’t know if Litecoin is the silver to Bitcoin’s gold as much as Ethereum at this point.

Dustin: You’re right. People have this money token thesis. They say, “Oh, I don’t invest in Ethereum because it’s not a money token.” That’s misguided. Money is a function of trust. People that trust programmable money, Vitalik, and all the work that the Ethereum team has done, choose to store their money in Ethereum.

They say it’s trustless, but that’s not true. It still is built on trust, but people trust different things. Some people really trust decentralization and the Bitcoin core developers, so they store their wealth in Bitcoin. Other people trust Charlie Lee and store their wealth in Litecoin.

Privacy and Trust

Colin: What is Wanchain going to do in terms of being a little more to make your protocol even more trustless and even more private?

Dustin: We see privacy as a fundamental building block of financial infrastructure. If we send each other [money] on Wells Fargo Surepay or something similar, that’s not public information. The same can be said when buying stocks, bonds, or treasury bills as well. You’re not going to broadcast those transactions to the world and make it immutable for anybody see.

So, we see privacy as a building block. Long-term privacy is probably going to be so fundamental that it becomes a feature. Right now, Wanchain’s privacy is novel, but privacy is so important that all these chains will find a way of adopting it.

We use privacy to support our goal of rebuilding the financial services industry. Our objective here is to create a Turing complete smart contract platform that’s private and holds all of the world’s digital assets. Then, the banks become applications that sit on top of it.

When we digitized photographs, we soon thereafter digitized the camera. The camera became an app. Banks will become apps that run on digital assets.

That’s why we say we’re rebuilding finance. We’re not focused on cutting costs from two banks who are sending money back-and-forth. We’re not interested in saying, “Hey, how can I work to help them save the bottom line.”

We do think there’s a place for banks to play in this ecosystem, though, particularly around custody. Custody – that’s a bank’s primary job. They hold your cash for you because you don’t want a million dollars in your mattress. A lot of people don’t want to have a million dollars even on a Ledger Nano S in their safety deposit box. It still keeps them up at night.

If you don’t want to use a decentralized exchange and keep custody of your own assets you give custody to someone who’s regulated, insured, and trusted. But you don’t give custody to a centralized exchange that is unregulated, uninsured, and run by anonymous devs like is being done today. I think in just a year or two we’ll look back at these days with total amazement that more damage wasn’t done by centralized, uninsured, and unregulated exchanges.

Steven: You trust other people almost more than you trust yourself with something like that.

Dustin: Yeah, a lot of people do. Everyone has different trust models and those models are personal. Some people trust technology. Some people trust banks.

We think putting digital assets as the foundation is the path forward. That will scale and create a lot of efficiencies. Just putting blockchain technology on top of the existing system isn’t enough.

Thoughts on the Cryptocurrency Industry

Steven: I’ve got to ask: Is it WANNchain or WAHNchain?

Dustin: WANN (Like FAN). Wan means ‘many’ or ten thousand in Chinese. WAN also stands for Wide Area Network – connecting all the networks.

Steven: Out of all the areas Wanchain is covering, what use-cases make you the most excited?

Dustin: We talk about what exists already. You’ve got exchanges, lending, and payments. They all still exist in the world. You can put more of these transactions on-chain to make them more trusted and audible, but that’s not enough.

To me, much of these efforts are still like newyorktimes.com. The business model still hasn’t changed. Once we create the right environment and the right platform for permissionless innovation, people will create these financial versions of Facebook. Things I can’t even dream up right now.

I don’t know how long that’ll take, especially in this environment where the world’s innovators are so tightly connected. But, it might happen a lot faster than we think.

Steven: 10-15 years?

Dustin: Oh, no.

Steven: Even quicker?

Dustin: Oh, dude, yeah! I think in 2-3 years, we’re going to see some real innovation in the financial service industry that’s based upon these digital assets. It’s hard to know what that will be, but it’s coming.

Colin: A lot of people doubt – based on its volatility, based on the transaction problems that we’ve seen – that cryptocurrencies will be used as an actual, viable currency going forward. Do you think those naysayers are wrong?

Dustin: Absolutely. I think the world will be run on digital assets. I’m betting my career on that actually. But, it might be the case that we have digital tokens that are similar to U.S. fiat.

I also think that we’ll start seeing more stable coins. The wealthier you are, the more volatility you can handle. The current financial services industry can’t economically support two billion people. It’s not that they don’t want to. It’s that the system is so broken and so expensive to operate that it doesn’t make economic sense for them to service those people.

One of our missions is to build a system that’s much more efficient in order to service the unbanked. Because they’re also some of the world’s poorest people, we need to additionally reduce the volatility.

A lot of people in this space, we’re so crazy. We soak up the volatility.

But the rest of the world doesn’t operate like that. To get payments operational, we need to smooth some of that out. The rails built on a digital asset infrastructure are much more efficient than the current debt-based ones.

[thrive_leads id=’5219′]

Wanchain Roadmap

Steven: What’re next steps for Wanchain? You’ve got the main net out now – that’s the hardest challenge right there.

Dustin: Coin swap is happening. People can now swap their ERC20s for the protocol tokens [Wancoin] (you can make the swap here.) After that, exchanges will most likely be picking it up in the coming weeks.

We’re also starting to do ICOs on Wanchain. The goal is three really high-quality ICOs in the next couple months. Because we’re a fork of Ethereum, we can do token issuance.

Our next big milestone is Wanchain 2.0. 2.0 is when some of the real magic starts happening- we start doing cross-chain swaps. This isn’t a pipedream. We’ve laid out how we’re going to do this in our whitepaper. Implementation is always hard, especially with cross-chain, but we have 40 engineers in the Beijing office. Many of them are PhDs from Peking University which is the Harvard of the East. We’re working on these challenging problems, but we’re confident we can solve them.

Steven: I heard you talking with someone else at the booth about waiting on [implementing] the Proof-of-Stake model until Ethereum sets what they’re going to do. Are you guys going to continue to do that if they decide to make another big change?

Dustin: That’s the plan: don’t reinvent anything we don’t have to. We’re hoping, and confident, that they can solve some of the scaling issues. As they do, we’ll incorporate them into our blockchain.

Steven: It seems like they will.

Dustin: We’re pretty confident. We went to DevCon, and we came out of there thinking, “These guys got it.”

Steven: That’s great to hear.

Dustin: Someone has to figure out Proof-of-Stake. This whole industry doesn’t work on Proof-of-Work. It only works well for one player [Bitcoin]. If we’re going to do digital gold, and that’s it, then Proof-of-Work is fine. But, we all want a lot more than that.

Colin: Would you say that interoperability is your focus, or are there other benefits that you’re focusing on more?

Dustin: Right now, we’re in this age of the blockchain intranet. There’s no global network that’s been created yet. Our goal is to create that global network.

But to do that, you need to be able to connect with many, or hopefully, all of the chains. You need to be able to get to that scale in a permissionless way. One of the advantages of our approach is that chains don’t need any software upgrade. We can hook into chains and work with them without them having to approve us. They can’t stop us from connecting to their chain.

That’s one of the advantages of the secure multi-party compute and the way that we’ve architected it. You just need public/private keys, and most every chain has those.

With that, the goal is to create a global internet. We would’ve gone with the tagline ‘Internet of Blockchains’ but a bunch of other projects already had that. That’s our mission, though: blockchain interoperability.

Thank You

A huge thank you to Dustin for taking the time to speak with us. He was running around non-stop at the conference, so we’re grateful to have been able to grab him for a few minutes to learn more about one of blockchain’s most exciting projects and the influential team member behind it.