TLDR

- EOSE stock jumped 15.03% to $14.49 amid a strategic partnership with Unico.

- The alliance focuses on compact and efficient power conversion systems.

- Unico will supply DC-to-DC converters for Eos’s Z3 zinc battery systems.

- Both firms manufacture in the U.S., aligning with federal clean energy goals.

- EOSE stock is up 362.78% YoY and 198.05% year-to-date, outperforming the S&P 500.

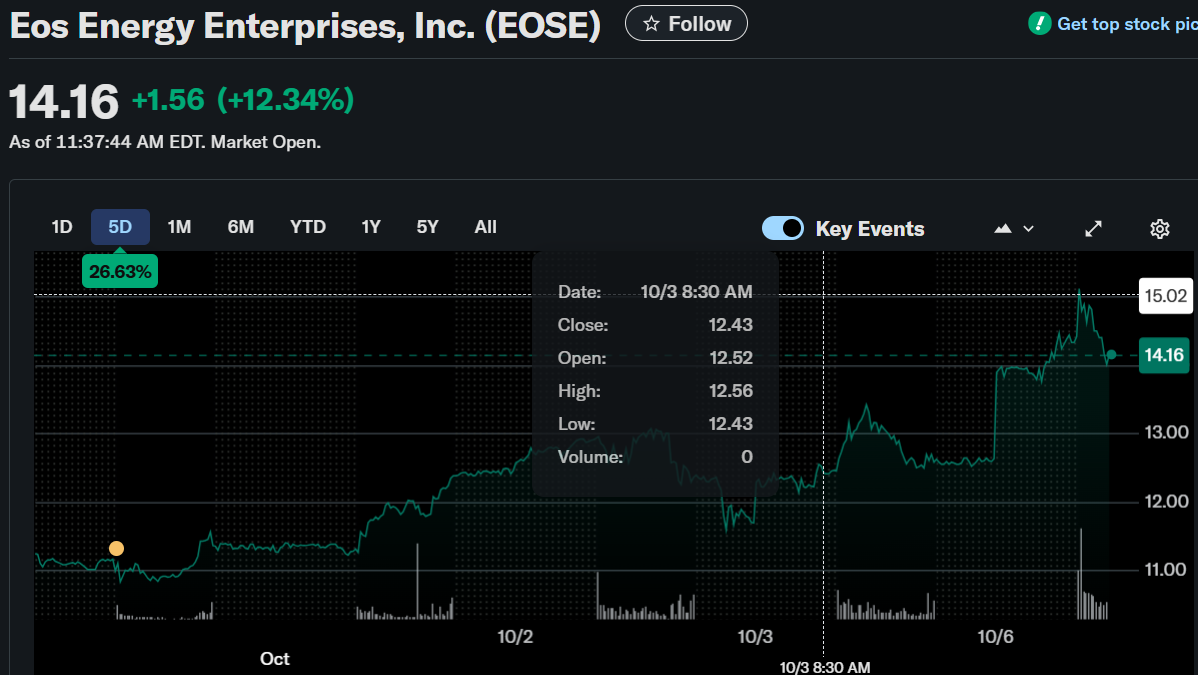

Eos Energy Enterprises Inc. (NASDAQ: EOSE) stock climbed 15.03% to $14.49 as of 10:40 AM EDT after announcing a new multi-year strategic partnership with Unico.

Eos Energy Enterprises, Inc. (EOSE)

The collaboration aims to deliver compact and efficient power conversion solutions for the energy storage market, a key component of grid modernization in the U.S.

Unico, a leader in high-performance power electronics, will supply Eos with DC-to-DC converters over the next five years. These converters will be integrated into Eos’s Z3 Znyth™ aqueous zinc battery systems, designed to improve efficiency and deliver more available energy to end users.

Enhanced Performance Through Joint Innovation

The new partnership combines Unico’s engineered power electronics with Eos’s proprietary battery technology. According to Unico CEO Mike Canada, this collaboration strengthens the performance and sustainability of energy storage systems by enhancing power density and efficiency through high-speed switching controls and advanced algorithms.

Eos’s Senior Vice President of Storage Systems Engineering, Pranesh Rao, said the partnership integrates Eos’s DawnOS controls and analytics platform with Unico’s systems, resulting in one of the safest and most scalable energy storage offerings available.

Supporting U.S. Clean Energy Goals

Both Eos and Unico design and manufacture their products domestically, aligning with U.S. clean energy and domestic sourcing incentives. The partnership reinforces the government’s efforts to strengthen American energy independence and manufacturing leadership.

Eos’s energy storage systems use Znyth™ chemistry, which relies on non-precious, abundant materials rather than lithium. This provides a non-flammable, stable, and scalable alternative for long-duration applications ranging from utility-scale to microgrid projects.

Market Outlook and Financial Performance

The collaboration comes amid renewed investor optimism around Eos Energy. The stock has gained 362.78% over the past year and 198.05% year-to-date, significantly outperforming the S&P 500, which rose 16.97% and 14.38%, respectively, over the same periods.

Over the past three years, EOSE has delivered a massive 704.72% return, underscoring strong long-term performance compared to the S&P 500’s 79.66%. While the five-year return stands at 44.42%, the company’s recent developments could extend this growth trajectory.

The strategic partnership with Unico is expected to drive continued innovation and cost efficiency, supporting Eos’s vision of sustainable energy storage leadership. With demand rising for long-duration storage solutions, investors are closely watching how this alliance strengthens Eos’s position in the rapidly expanding energy transition market.