TLDR

- Ethena (ENA) jumped 13% to $0.622 with trading volume increasing 28% to $1.14 billion

- Futures market activity heated up with Open Interest rising 17.47% and derivatives volume climbing 46.24%

- Buy-Sell Delta turned positive at $4.63 million after a week of negative sentiment

- Major token unlock of 171.85 million tokens worth $103 million scheduled for August 6th

- Price targets $0.68-$0.70 if current momentum continues with support at $0.55

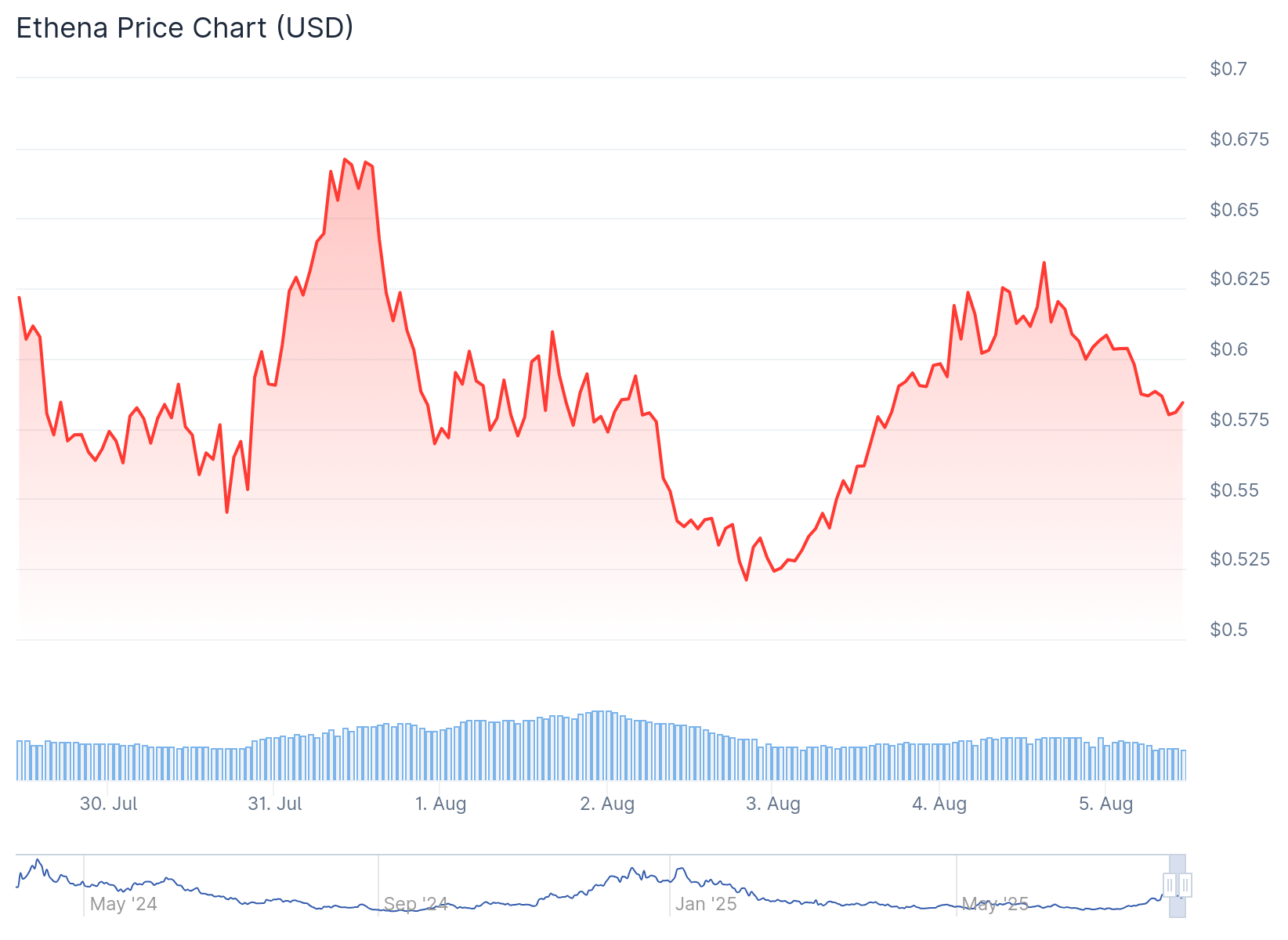

Ethena (ENA) price rallied strongly on August 5th, gaining 13.17% to reach $0.622. The cryptocurrency hit a local high of $0.628 during the trading session.

Trading volume surged 28% to $1.14 billion, indicating renewed investor interest. The price action came after ENA successfully held the $0.51 support level.

Market sentiment shifted from negative to positive over the past 24 hours. Buy volume reached $46.99 million compared to sell volume of $42.3 million, creating a positive Buy-Sell Delta of $4.63 million.

This marked a reversal from the previous week when ENA recorded negative sentiment. The shift suggests investors are accumulating the cryptocurrency at current price levels.

Exchange data shows coins moving off trading platforms. Spot netflow remained negative for eight consecutive days, with the most recent reading at -$123,000.

When cryptocurrencies flow off exchanges, it typically indicates holders plan to store them long-term rather than trade actively.

Futures Market Activity Increases

Derivatives trading activity increased across multiple metrics. Open Interest jumped 17.47% to $1.14 billion during the 24-hour period.

Derivatives volume climbed even higher, rising 46.24% to $3.5 billion. The combination of rising Open Interest and volume suggests traders are taking new positions.

The Long/Short Ratio reached 1.0008 across all exchanges. On Binance specifically, the ratio was more skewed toward long positions.

No chill for $ENA, really strong recovery. Pushing again for the downtrend resistance bullish reversal 👌 pic.twitter.com/R8B6YIFARC

— Crypto Rand (@crypto_rand) August 4, 2025

Among Binance accounts, the Long/Short Ratio hit 1.95. Top traders on the platform showed an even higher ratio of 2.09.

These ratios indicate most market participants expect ENA price to continue rising. Traders are positioning for upward price movement rather than declines.

Technical indicators support the bullish sentiment. The Stochastic RSI rose to 18 from 5 after making a bullish crossover.

Chaikin Money Flow has stayed in positive territory for 48 hours. This indicator measures money flowing into versus out of the cryptocurrency.

Token Unlock Scheduled for August 6th

ENA faces a major supply event on August 6th. The project will unlock 171.85 million tokens worth approximately $103 million at current prices.

The unlock represents about 2.70% of ENA’s total market cap. This ranks as one of the largest token unlocks in recent months.

Despite the approaching unlock, ENA price has remained resilient. The cryptocurrency has gained over 140% in the past month.

Historical data shows ENA typically performs well in the seven days following token unlocks. However, none of the previous unlocks matched the size of this upcoming event.

Ethena Labs recently crossed $10 billion in Total Value Locked (TVL). The growth stems largely from USDe offering an 11% annual percentage yield.

ENA reached a new all-time high market cap of $3.83 billion. The previous peak occurred in January 2025 at $3.7 billion.

Price targets depend on whether current buying momentum continues. If demand holds, ENA could retest $0.68 and potentially reach $0.70.

Should buying pressure fade, the cryptocurrency may find support around $0.55. The RSI cooled from overbought levels above 75, providing room for further gains.

Current price action shows ENA trading above the 5, 10, and 20-day moving averages, confirming the short-term bullish trend remains intact.