TLDR

- BlackRock’s Ethereum ETF (ETHA) recorded its largest single-day inflow of 80,768 ETH ($363 million) on September 15, 2025

- Trading volume surged to $1.5 billion after a week of heavy outflows totaling $787 million between September 5-12

- ETH price fell 2.5% despite the ETF recovery, showing short-term selling pressure

- Historical data shows Ethereum often rises after FOMC meetings, with the next Fed meeting scheduled for September 17

- Rate cuts are expected at tomorrow’s meeting, which could make crypto investments more attractive to institutional investors

BlackRock’s Ethereum ETF has made headlines with record-breaking inflows. The fund attracted 80,768 ETH worth approximately $363 million on September 15, 2025.

This represents the largest single-day intake for the fund in 30 days. Trading volume jumped to $1.5 billion, showing renewed institutional interest.

The surge comes after a difficult period for the ETF. Between September 5 and 12, the fund experienced net outflows of $787 million.

This contributed to broader selling pressure across digital asset markets during that week. The recent recovery builds on last week’s positive momentum across spot Ethereum funds.

Last week saw collective net inflows of $638 million across all Ethereum ETFs. Fidelity’s FETH led with $381 million in fresh capital during this period.

BlackRock’s ETHA contributed $165 million last week. Grayscale’s ETHE and Bitwise’s ETHW also added steady amounts to their holdings.

By September 12, Ethereum ETFs collectively managed $30.35 billion in assets. BlackRock holds the largest portion with $17.25 billion under management.

This represents roughly 3% of Ethereum’s total market capitalization. The firm previously rotated capital from ETH into Bitcoin investments.

Fed Meeting Could Impact Price Action

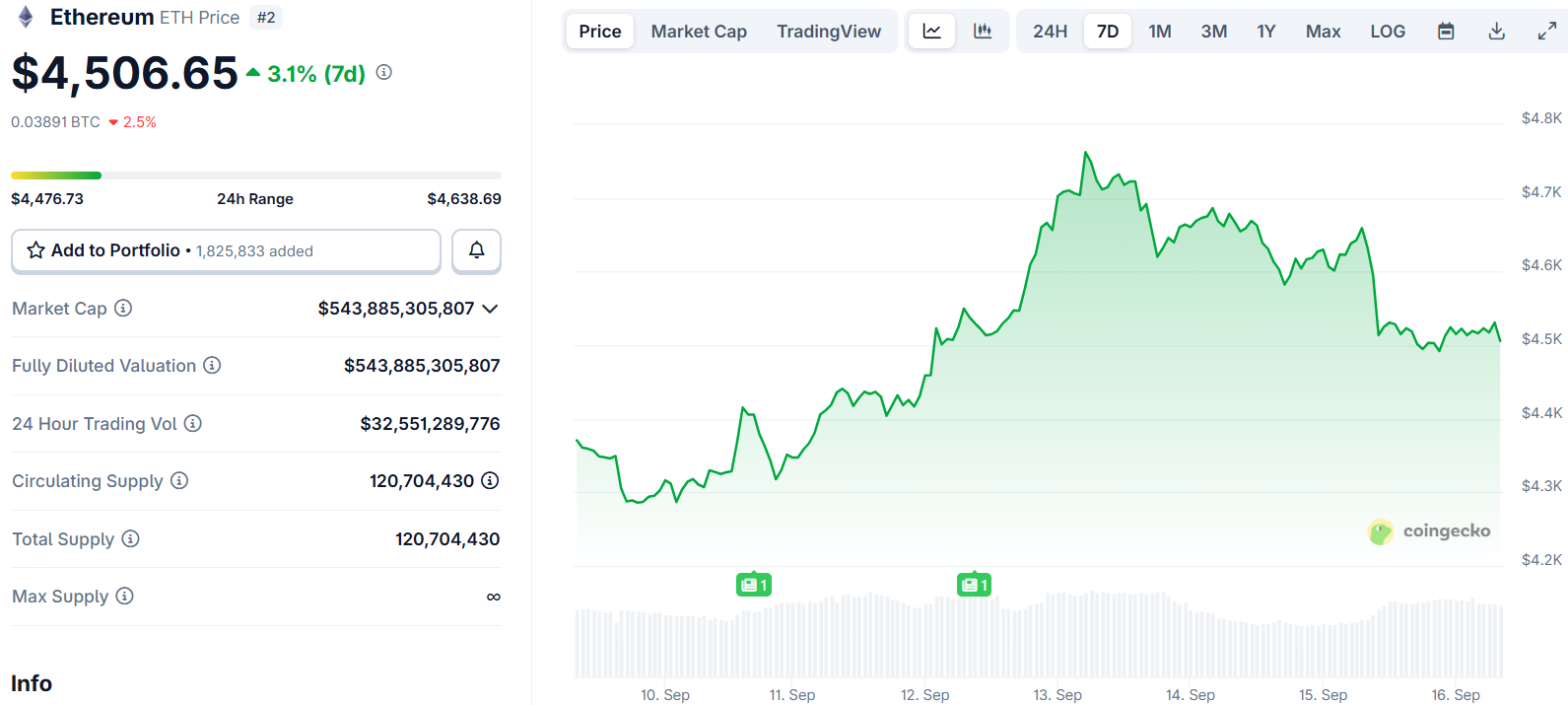

Despite ETF recovery, ETH’s price performance has been weak. The token fell 2.5% over the past day, underperforming the broader crypto market.

Technical indicators suggest consolidation may continue in the near term. The MACD histogram shows waning bullish momentum while RSI remains near neutral levels.

Historical patterns show Ethereum often rises after Federal Reserve meetings. The next FOMC meeting is scheduled for September 17, 2025.

Rate cuts are expected at tomorrow’s meeting. Lower interest rates typically make borrowing cheaper and push investors toward riskier assets like cryptocurrencies.

Network Fundamentals Remain Strong

Ethereum’s network continues showing strength beyond price movements. The network’s total stablecoin supply recently reached a record $166 billion.

This growth demonstrates Ethereum’s continued importance as DeFi infrastructure. The milestone occurred even during periods of price volatility.

BlackRock is also exploring tokenizing ETFs on blockchain infrastructure. Reports suggest the firm is examining ways to bring exchange-traded products on-chain.

These developments could include products tied to real-world assets. The moves show institutional confidence in blockchain technology adoption.

Crypto analysts point to the historical trend of Ethereum price increases following Fed meetings. Market sentiment appears bullish heading into tomorrow’s announcement.

ETHEREUM PUMPED AFTER THE LAST 3 FOMC MEETINGS.

NEXT FED MEETING IS TOMORROW, RATE CUTS EXPECTED. pic.twitter.com/Nx64Ph2GJ5

— Crypto Rover (@rovercrc) September 16, 2025

Some traders are already positioning for potential upward movement. However, other factors including Bitcoin performance and regulatory news could influence outcomes.

The current trading environment shows mixed signals for Ethereum. Strong ETF inflows contrast with recent price weakness and technical consolidation patterns.

BlackRock’s record 80,768 ETH inflow on September 15 occurred alongside expectations for Fed rate cuts at tomorrow’s FOMC meeting.