TLDR

- Bit Digital purchased 31,057 ETH worth $140 million, bringing its total holdings to over 150,000 ETH and making it the sixth-largest Ethereum treasury among public companies.

- The purchase was funded through $150 million in convertible notes priced at a premium to the company’s net asset value, with investors including Kraken Financial, Jump Trading Credit, and Jane Street Capital.

- BlackRock purchased $217.3 million worth of ETH, demonstrating growing institutional confidence in the cryptocurrency.

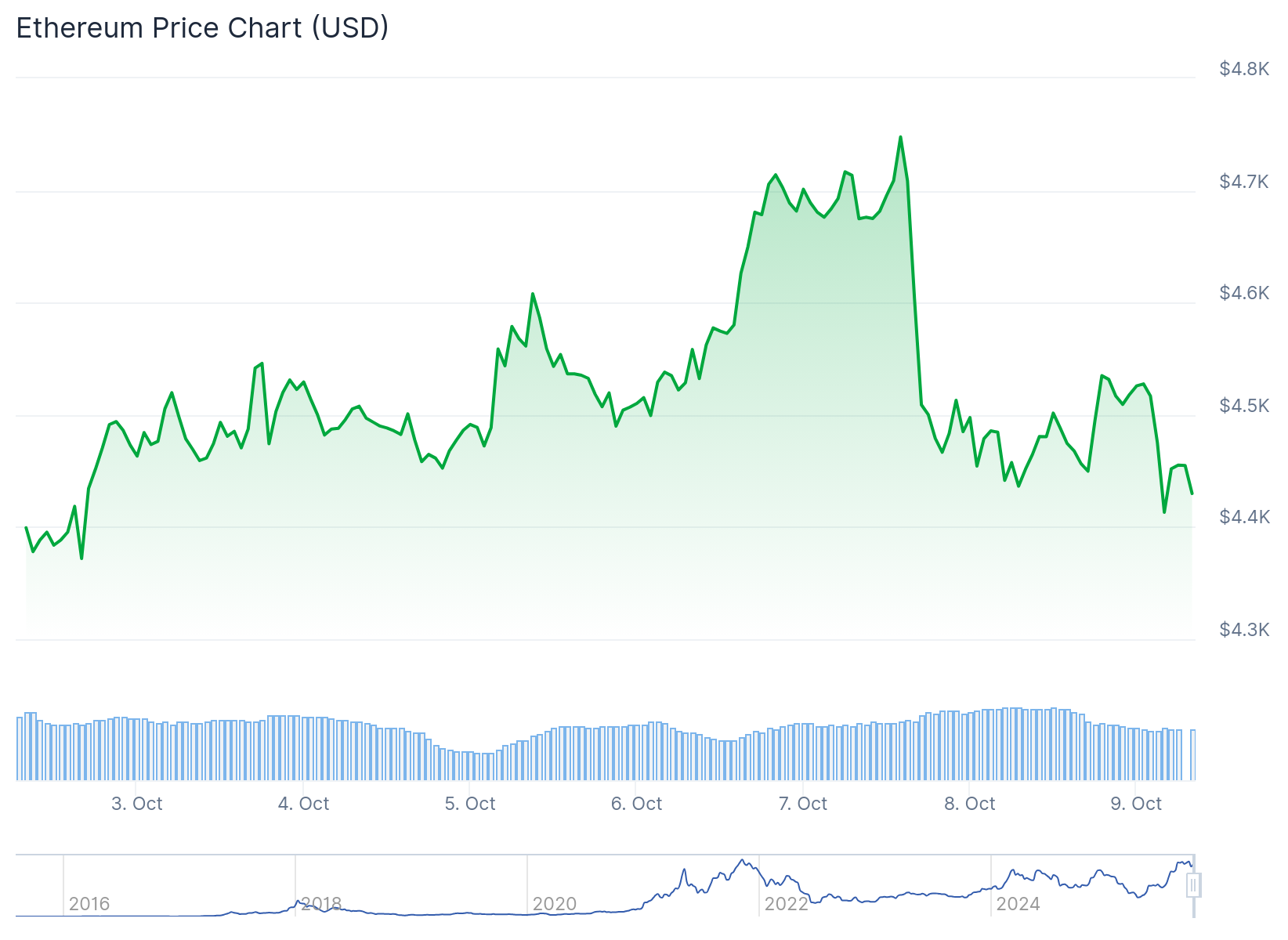

- Ethereum declined 5.73% in 24 hours but maintained a 6.69% weekly gain, with trading volume surging 30.68% to $57.74 billion.

- Analysts predict ETH could surge toward $5,200 if it maintains support above $4,300, with key resistance levels at $4,800 and $5,200.

Ethereum is trading at $4,424.42 after a 5.73% decline in the past 24 hours. The cryptocurrency maintained a 6.69% weekly gain despite the short-term pullback.

The market capitalization stands at $533.54 billion. Trading volume increased 30.68% to $57.74 billion in the last 24 hours.

Bit Digital purchased 31,057 ETH worth $140 million using proceeds from a $150 million convertible notes sale. The purchase brought the company’s total holdings to over 150,244 ETH.

$ETH BUYS: Bit Digital acquired 31,057 Ethereum yesterday, bringing its total holdings to 150,244 ETH.

Are you bullish on ETH? pic.twitter.com/jut8ZgL3r1

— CoinGecko (@coingecko) October 9, 2025

The deal positions Bit Digital as the sixth-largest Ethereum treasury among public companies. The company ranks behind PulseChain Sac, the Ethereum Foundation, The Ether Machine, SharpLink Gaming, and Bitmine Immersion Technologies.

Sam Tabar, CEO of Bit Digital, said the purchase demonstrates the company’s commitment to building shareholder value. The convertible notes were priced at $4.16 per share, representing an 8.2% premium to the company’s mark-to-market net asset value at pricing time.

Institutional Buyers Enter Market

Investors participating in the offering included Kraken Financial, Jump Trading Credit, and Jane Street Capital. The company’s estimated mark-to-market net asset value as of late September stood at $3.84 per share.

BlackRock purchased $217.3 million worth of ETH in a separate transaction. The purchase demonstrates growing institutional confidence in Ethereum’s position as a long-term investment.

Tabar stated that Bit Digital plans to continue expanding its ETH holdings while maintaining focus on long-term net asset value growth. The company holds assets backed by $512.7 million in Ethereum and $723.1 million in shares of its majority-owned subsidiary, WhiteFiber Inc.

Reserve companies and ETFs now hold 12.6 million ETH valued at $56.4 billion. This represents over 10.3% of the total supply.

Technical Levels in Focus

Crypto analyst @matthughes13 believes Ethereum is consolidating above $4,350 and preparing for a potential surge. The daily chart shows ETH trading around $4,443.47 while holding the uptrend that began in June.

$ETH looks primed to break into all-time high territory, as it's finally finding stability above the $4,350s. As long as that zone continues to hold as support, ATHs aren't too far away.

5200 is my next target above 🚀#ETH pic.twitter.com/W75iSp4Upj

— The Great Mattsby (@matthughes13) October 7, 2025

Near-term support sits at $4,300. Further support levels exist at $3,850 and $3,600.

Key resistance levels are positioned at $4,800 and $5,200. These levels will determine the next direction for Ethereum’s price movement.

If the price maintains above $4,300, the chart indicates short-term consolidation before a possible breakout toward $5,200. A drop below $3,850 could trigger a steeper correction.

SharpLink Gaming holds 838,730 ETH, making it one of the largest institutional holders. The company began its accumulation strategy on June 2.

Ethereum remains the world’s second-largest crypto treasury asset after Bitcoin. Corporate treasuries hold around 4 million Bitcoin valued at $500 billion.