TLDR

- Ether held on crypto exchanges dropped from 12.31 million tokens in July to 8.15 million as holders continue staking

- The Ethereum validator entry queue shows 3.6 million ETH waiting to be staked with a 63-day wait time

- NYSE-listed company BitMine has staked 2.5 million ETH, representing about 61% of its total holdings

- Total staked Ether has grown to over 36 million tokens, roughly 29% of supply

- Four staking wallets withdrew over 26,000 tokens from Binance as some stakers appear to be accumulating more

Ether held on cryptocurrency exchanges has been declining over the past six months while the token’s price remains relatively stable. Data from Santiment shows exchange holdings peaked at 12.31 million tokens in July before dropping to 8.15 million.

🤑 Ethereum's amount of non-empty wallets on the network has now ballooned to over 175.5M, a record among among all cryptocurrencies. As staking continues to be of strong interest, especially while markets move sideways, exchange supply will continue to shrink as well. pic.twitter.com/sbDzmoRRS5

— Santiment (@santimentfeed) January 27, 2026

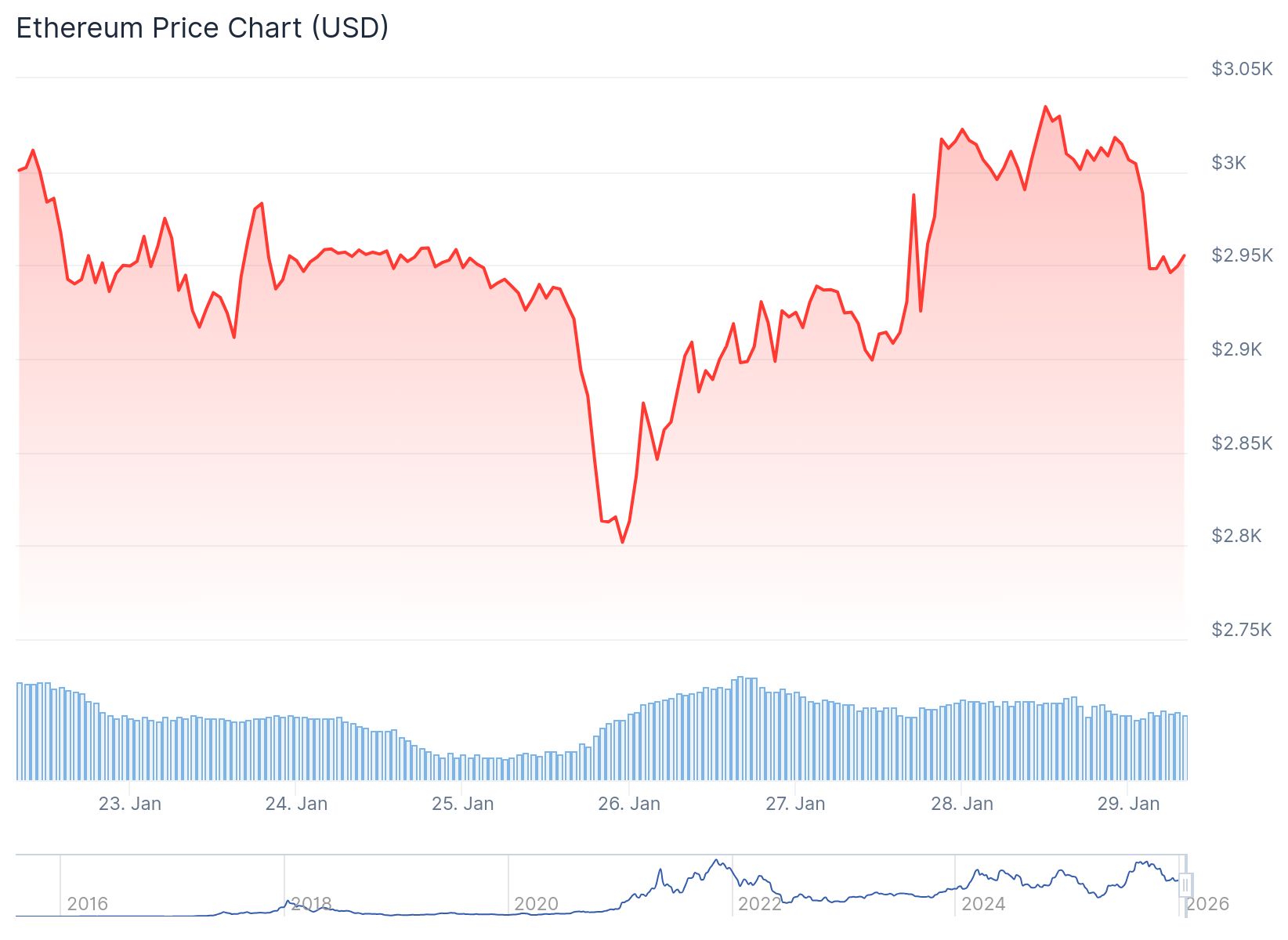

The decrease comes as more holders move their ETH into staking. Ether has traded between $2,801 and $3,034 over the last seven days.

Santiment analysts expect the trend to continue as long as price movements stay muted. The blockchain explorer Ethereum Validator Queue reports the entry queue is near capacity with 3.6 million tokens lined up for staking.

The current wait time for new validators stands at 63 days. This compares to just 44,448 tokens waiting to exit with an 18-hour wait.

Growing Staking Participation

The Ethereum network limits how many validators can enter and exit staking per epoch to maintain network stability. Total staked Ether now exceeds 36 million tokens.

This represents roughly 29% of the circulating supply. The figure has increased from 35 million tokens in June.

Ethereum operates as a proof-of-stake network requiring validators to stake tokens to help secure the blockchain. Unstaking often signals validators want to free up Ether for potential sales.

Staking typically indicates confidence in the asset since tokens must remain locked up. NYSE-listed company BitMine has been expanding its staking position.

Tom Lee(@fundstrat)'s #Bitmine staked another 209,504 $ETH($610M) today.

In total, #Bitmine has staked 2,218,771 $ETH($6.52B), over 52% of its total holdings.https://t.co/P684j5YQaG pic.twitter.com/TsIk5f0x6e

— Lookonchain (@lookonchain) January 27, 2026

Data analytics firm Lookonchain reported BitMine staked another 250,912 Ether recently. The company now has more than 2.5 million tokens staked.

This accounts for about 61% of its total holdings. BitMine started staking its treasury in December with a transfer of 74,880 Ether.

Accumulation Activity Continues

Some staking wallets appear to be accumulating more tokens. Lookonchain identified four staking wallets that withdrew over 26,000 tokens from Binance on Tuesday.

Bitfinex $ETH long positions have reached a 7-month high.

Whales seem to be getting interested in Ethereum again. pic.twitter.com/BhgJSbbzOi

— Ted (@TedPillows) January 28, 2026

The trading volume for Ether on CoinMarketCap reached around $23.54 billion on Thursday. This marked a decrease from more than $27 billion the previous day.

BitMine controls roughly 3.5% of ETH’s circulating supply through its holdings. The company has staked 2.2 million ETH in total.

The average cost basis for BitMine’s ETH holdings sits at $2,839. With ETH trading near $2,900, the company maintains a narrow profit margin on its position.